7 Ways To Improve Customer Loyalty | A Guide For Businesses

Cultivating customer loyalty is an essential part of making your business a succ...

All businesses must choose to classify their employees according to a salary vs. hourly pay structure. From an operational perspective, the choice can have a dramatic effect on your business’s bottom line.

The federal government has made some stipulations regarding what jobs are considered salary vs. hourly, but, for the most part, your business can decide for itself how it wants to classify its team members.

Which should you choose?

In this article, the workforce management experts at Sling tell you everything you need to know to make the right choice for your business so that your team members are engaged and everything runs smoothly.

Most of the laws that apply to the salary vs. hourly choice come from the federal government and boil down to two classifications: exempt and non-exempt.

We’ll discuss what those classifications are later on in this article. But, first, we’ll address the origin of the salary vs. hourly laws and where the exempt vs. non-exempt status comes from — the Fair Labor Standards Act (FLSA).

In the early part of the 1900s, businesses had complete control over their employees’ schedules, wages, working conditions, and a whole host of other variables.

If they wanted you to work ten hours per day, seven days a week, you either had to do it or quit and find another job.

Then, in 1938, the federal government enacted the Fair Labor Standards Act (FLSA) to set limits and standards on the way businesses managed their employees.

According to 29 U.S. Code § 202(a), Congress enacted the FLSA to eliminate:

“…Labor standards detrimental to the maintenance of the minimum standard of living necessary for health, efficiency, and general well-being of workers,” and to prevent these substandard labor conditions from being used as an “unfair method of competition” against reputable employers.

The biggest changes to come with the FLSA were 1) the federal minimum wage, and 2) the maximum number of hours employers could require their employees to work each week.

Instead of that maximum number being up to the whims of the business, the government set the limit at 40 hours per week (e.g., eight hours per day, five days per week).

If an employee works more than 40 hours per week, the business then has to pay them extra compensation at 1.5 times their regular pay rate. This higher pay rate for hours over 40 came to be known as overtime.

While the FLSA addressed and codified significant variables in the employer/employee relationship — the 40-hour workweek, minimum wage, and overtime just to name a few — it still provided some freedom for the businesses themselves.

That freedom came in the form of a choice: whether to classify their employees as FLSA exempt or FLSA non-exempt.

As the name suggests, exempt employees are not covered by the mandates of the FLSA that apply to the 40-hour workweek and the overtime requirement.

More specifically, an FLSA-exempt employee in a private business is one who meets the following criteria:

Because these employees receive a salary (meaning they are paid a flat amount whether they work 40 hours or not), exempt employees do not qualify for overtime.

With this in mind, we can make the following equivalency that will help you understand the salary vs. hourly pay information later on in this article: an exempt employee is a salaried employee.

According to the Fair Labor Standards Act, a non-exempt employee in a private business is one who meets the following criteria:

Because non-exempt employees are typically paid by the hour (meaning they clock in and clock out every day) — and are often paid less than FLSA-exempt employees — non-exempt employees qualify for overtime.

Whether you hire full-time or part-time employees, if you classify them as non-exempt, you have to pay them at least minimum wage, and, if they work more than 40 hours a week, you have to pay them overtime.

As we did in the previous section, we can make the following equivalency that will help you understand the salary vs. hourly pay information later on in this article: a non-exempt employee is an hourly employee.

At first glance, salary vs. hourly (or, exempt vs. non-exempt) pay structures may seem straightforward, but with federally mandated exceptions and exemptions, things can get complicated very quickly.

It’s essential that ownership, management, and everyone in your human resources department understand the differences between the two classifications so that you can make the right choice for each job position and the business as a whole.

When it comes to salary vs. hourly employees, a salaried employee is one that receives a set total compensation each year (e.g., $50,000 per year).

Depending on the payroll schedule your business uses, you’ll pay a salaried employee a fraction of their total compensation each payday.

For example, if your business pays team members every two weeks and a salaried employee works 48 out of the 52 weeks each year (with no sick days or inclement weather delays), your business owes that team member $2,083.33 per pay period.

As a general rule, salaried employees are not eligible for overtime, but your business can include this provision in a team member’s contract if they meet certain requirements.

For example, your business may stipulate that a team member receives overtime if they work more than 50 hours in a single workweek.

While this is uncommon for salaried employees, your business may use it as a type of fringe benefit to attract and retain high-performing employees.

Because salaried employees (who are FLSA exempt) don’t qualify for overtime, some businesses elect to offer comp time instead.

Comp time is the practice of providing “payment” for overtime hours in the form of time off instead of overtime pay.

If a salaried employee works 48 hours in one week, your business may choose to give the employee eight hours off during the next pay period as compensation for the extra hours they worked.

That said, nowhere is it written that a business has to offer comp time to exempt employees. The choice is solely up to the employer.

It’s also worth noting that, if administered incorrectly and to the wrong classification of employee, comp time may be illegal. We’ll discuss this further in the What is an hourly employee? section.

If in doubt, consult with an attorney who is familiar with your industry and the location in which it operates.

Most salaried positions also come with other employee benefits, such as health insurance, 401k, paid time off, and anything else your business wants to include.

These benefits help your HR department recruit high-potential employees that make your business run better.

Time tracking for the salaried/exempt employee is much simpler than it is for the hourly/non-exempt employee (as we’ll discuss in the What is an hourly employee? section).

For salaried employees, time tracking often comes down to recording when they start working on a task, job, or project, and when they stop working on that task, job, or project.

While salaried employees don’t necessarily have to clock in and out at the beginning and end of the workday, the data gathered from tracking time on task gives you an accurate picture of the total hours they spend on the job.

For example, on Monday, Tony uses your task management software to indicate that he starts working on Project A at 8:10 a.m. and stops two hours later at 10:10 a.m.

He then starts working on Project B and continues with it until he “clocks out” for lunch at 12:10 p.m.

In the afternoon, he works on Project C from 1:30 p.m. to 5:30 p.m. and then doesn’t work on any more projects that day.

From this string of data, you can calculate that Tony worked a total of eight hours (8:10 a.m. to 12:10 p.m. and 1:30 p.m. to 5:30 p.m.) that day.

Common examples of salaried employees include:

Just because the employees in your business don’t fall into the categories in this list doesn’t mean that you have to pay them hourly. You can choose to make any position salary or hourly depending on what’s right for your team and your business.

When it comes to salary vs. hourly, an hourly employee is one that receives compensation based on the total number of hours they work during a specific pay period. This is usually expressed as a dollar-per-hour figure (e.g., $12 per hour).

Depending on the payroll schedule your business uses, you’ll pay an hourly employee for the exact number of hours they worked between the last payday and the most current.

For example, if your business pays hourly team members every two weeks and an employee who makes $12 per hour worked a total of 78 hours in that period, you would pay them $936 ($12 per hour x 78 hours) before taxes and withholdings.

According to federal law, hourly employees are entitled to receive overtime for any time over 40 hours they work each week. Overtime is typically set at one-and-a-half times the employee’s hourly rate (some businesses offer more).

So if an employee works 41 hours in a given week, you would pay them the regular $12-per-hour rate for the first 40 hours, and $18 per hour for the additional 60 minutes.

Overtime pay adds up quickly and can seriously impact your bottom line if you don’t keep it under tight control.

We recommend putting language in your employee handbook that makes it mandatory for all employees to get permission from their supervisor before working any overtime.

Because hourly employees (who are FLSA non-exempt) qualify for overtime, they do not qualify for comp time.

In fact, the federal government views comp time as a way for businesses to get around paying hourly employees overtime for any hours they work beyond their regular schedule.

Why is this an issue? Because paying overtime is much more expensive than allowing an employee to take time off.

In some cases, overtime amounts to thousands, or even tens of thousands, of dollars per employee that your business may not have budgeted for.

To avoid paying those extra thousands of dollars, your business may choose to offer comp time instead.

But, according to the federal government, that would be “taking advantage” of hourly employees for the betterment of the business — one of the very situations the FLSA was created to prevent.

The federal government has, therefore, made it illegal to give hourly/non-exempt employees comp time in any shape or form.

To make sure you’re making the right choice for your team, talk to a lawyer about how comp time does or does not apply to your business.

Most hourly employees do not receive benefits like their salaried counterparts.

Your business, though, can include perks such as vacation days, sick leave, and paid holidays if it makes sense to do so.

As we mentioned earlier in this article, time tracking for hourly/non-exempt employees is significantly simpler than it is for salaried/exempt employees — at least in theory.

The minimum information your business needs to calculate payroll for an hourly employee is the time they start work in the morning and the time they stop work in the evening.

In the simplest form, their time card would look something like this (Option A):

If you don’t pay for their lunch break, their time card might look something like this (Option B):

Things get even more complicated if you ask your employees to record time on task as well.

In that case, you’ll have even more ins and outs sandwiched between the time they start work in the morning and the time they end work in the evening.

Most businesses don’t need that much detail for their hourly employees, so they choose to use Option A or Option B shown above.

Common examples of salaried employees include:

As we mentioned in the salaried employee section, you can choose salary vs. hourly for any of its employees as long as it makes sense for your business. You can even change from one pay structure to the other after hiring if the individual team member agrees.

For example, if you hired a full-time employee on an hourly contract, but, because of the nature of the job, they typically stay 15 minutes past their regular eight hours (with their supervisor’s permission), every four days you’ll need to pay them an hour of overtime.

That can add up to four to five hours of overtime each month and almost 60 hours of overtime each year.

Using the $12-per-hour example already discussed, all overtime is paid at $18 per hour. So five hours of overtime per month is $90 — and close to $1,000 per year.

It might be better for your business to switch to a salary pay structure for that employee in order to cut down on the overtime expense.

From the business’s perspective, the pros of salaried employees include:

Deciding whether to hire part-time vs. full-time employees and pay them salary vs. hourly is important for your business. Equally important is what software you use to manage, organize, and optimize your workforce.

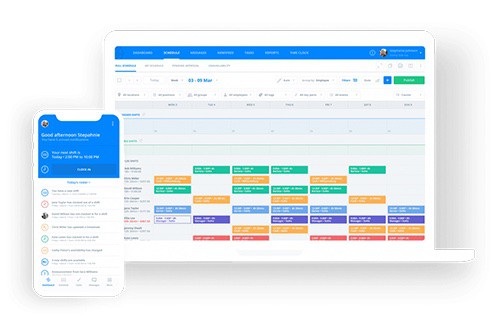

The Sling app is the best choice to help you manage all aspects of the salary vs. hourly pay structure. First and foremost, Sling gives you unprecedented control over your scheduling process.

With the cloud-based tools that Sling offers, you can implement employee self-scheduling and quickly and easily build staff rotas one month, two months, even six months or more in advance.

And with the built-in artificial intelligence, Sling automatically reminds you of requested time off, double bookings, and overtime hours so you can finalize the schedule in less time and with less effort.

Sling also acts as a time clock for your business so you can accurately track when your team members work.

Because Sling works on a variety of devices, you can set up a central terminal or allow your employees to clock in and out right from their mobile devices.

And with Sling’s powerful geofencing feature, you can prevent early clock-ins, missed clock-outs, and time theft with the touch of a button.

Sling even lets you optimize labor costs by setting salary vs. hourly wages per employee or position so you can see how much each shift will cost your business.

You can also keep track of your labor budget and receive alerts when you’re about to exceed those numbers.

All of this — and much more — will help you save money and increase profits regardless of whether you choose a salary vs. hourly pay structure for your team.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.