Restaurant Payroll: The Ultimate Guide For Business Owners

Restaurant payroll is one of the largest expenses your business will have to abs...

You can’t manage what you don’t measure. That’s why payroll reports are such a crucial part of controlling your labor expenses, overhead costs, and profit margin.

In this article, the management experts at Sling answer your questions and tell you everything you need to know to optimize labor costs, stay on budget, and manage your business better.

At the most basic, payroll reports are documents (hard copy and digital) in which you conduct calculations with regard to:

Really, you can create payroll reports to give you insight on any aspect of your employees’ labor, including:

That said, there are several standard payroll reports required by local, state, and federal governments that every business manager needs to understand. We’ll discuss those in another section. First, let’s discuss the timing of your payroll reports.

The first four payroll report options in this section are tied to your business’s payroll schedule (i.e., when you distribute paychecks).

You can produce payroll reports as often as you’d like, but the size and structure of your business may make reporting too frequently more work than it’s worth.

Many businesses produce their own customized payroll reports every week. This helps them get an accurate picture of one of their biggest expenses and keep that expense under control.

As we mentioned above, a weekly payroll report is usually tied to a weekly payroll schedule. In this arrangement, you pay your employees every week for work done the previous week and then compile a report for that same week.

Businesses using a weekly payroll payment and report schedule usually distribute checks on Friday for the last full week worked (Monday through Sunday), and then crunch the numbers for the record.

For example, if employee A worked 40 hours during the pay period November 1, 2021, through November 7, 2021, you would process their hours worked during the following week, hand out their check on Friday, November 12, 2021, and compile a payroll report for 11/01 through 11/07.

Other businesses produce in-house payroll reports every two weeks, four weeks, or eight weeks. It all depends on what you need to keep your business running smoothly.

The term “biweekly” is a bit confusing at first because it has two different definitions.

A biweekly payroll schedule and report could mean distributing and calculating everything every two weeks. But it can also mean calculating everything twice a week.

When it comes to your payroll reports and the schedule on which you distribute paychecks, biweekly always means every two weeks. The amount of work that would go into distributing paychecks and producing reports twice a week would be unrealistic for most businesses.

When it comes to a biweekly pay and reporting period, most businesses choose every other Friday (e.g., September 10, 2021, and September 24, 2021).

Since each month doesn’t always have four full weeks, there will be two months every year with a third pay period. With a biweekly payroll system, you’ll distribute 26 paychecks over the course of one year.

A semi-monthly reporting schedule means you pay your employees and produce reports twice per month. Unlike biweekly, the semi-monthly system has nothing to do with the number of weeks in a month.

You simply choose two days — roughly equally spaced (e.g., the 15th and the 30th) — process the timesheets prior to those days, pass out checks, and run the numbers for your reports.

With a semi-monthly schedule, you’ll distribute 24 paychecks and 24 reports (2 paydays x 12 months) over the course of one year.

In a monthly payroll report schedule, you generate data for the work your employees performed during the past 30 days.

Because of processing time (typically a week), you may process numbers for time worked over three weeks of the current month (e.g., November) and one week of the previous month (e.g., October).

You could also run the reports at the end of the first week in the following month. In that case, your employees would work October 1 through October 30, you would process the reports during the first week in November, and reports would be sent out on Friday, November 5.

With a monthly payroll schedule, you’ll create 12 payroll reports over the course of one year.

Every three months, the IRS (and most state governments) requires that you submit certain payroll reports. These often have to do with income, Social Security, wages, workers’ compensation, unemployment, and Medicare taxes.

You’re also required to produce and submit several payroll reports at the end of each year. These reports are necessary to accurately complete your federal, state, and local business taxes.

As we mentioned earlier, you can create your own customized in-house payroll reports to examine any aspect of labor costs.

You can create a report to show you how much overtime you’ve paid for during the week. Or to show you the range of wage rates and the average you pay your employees. It all depends on what information you need to keep your business in the black.

Common payroll reports include:

All of these reports can give you valuable insight into how efficiently your business is running.

Depending on where you live, your business may be subject to local payroll taxes required to submit quarterly or annual payroll reports. Check with your local government or consult a corporate attorney who is familiar with your business and your area.

Forty-three of the 50 states require payroll reports related to income taxes and state unemployment taxes. Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not.

Whether your business is in a reporting or non-reporting state, it’s always a good idea to check your state’s website for details. Every state has slightly different rules, and you want to make sure you’re compliant.

Here are just a few of the possible differences from one state to another:

Being consistent with your state-mandated payroll reports can save you significant time, headaches, and fines down the road.

The three most common state payroll reports are: tax withheld, unemployment tax, and workers’ compensation. Let’s examine each in turn.

As the name suggests, this payroll report provides information to your state’s reporting agency about the amount of tax your business withheld from employee paychecks.

Most states require businesses to submit reports quarterly, but the actual due date varies from state to state. For example, Maryland sets its deadline at the 15th of the first month after the quarter ends, while Washington sets its deadline at the end of the first month after the quarter ends.

This illustrates why it’s imperative to check your state’s website for details on what reports are mandatory and when they’re due.

In addition to payroll tax reports, some states require businesses that operate within their borders to submit unemployment tax reports as well.

This is because certain states have enacted regulations that set certain thresholds on the wages a business must pay before it is liable for unemployment tax.

For example, one state may levy an unemployment tax on the first $10,000 earned by each employee during a calendar year, while another state may levy an unemployment tax on any wages earned over $15,000 during a calendar year (but not on those wages under $15,000).

Again, it’s vital to check the requirements in your state before creating and submitting your payroll reports.

A third state payroll report that may be mandatory in your state is your business’s workers’ compensation numbers.

In some states, the employees themselves purchase this type of insurance through a private carrier. In other states, though, the business purchases a package of workers’ compensation insurance for all of their employees.

If that is the case for your business, you’ll likely have to remit a quarterly report to your state that includes such information as your history of claims and the percentage of payroll that workers’ compensation occupies.

Keep in mind that different positions within your business will have different rates of workers’ compensation and will directly affect the report you produce.

For example, a tool and die company will likely have to pay a lower workers’ compensation rate for the clerical staff working the front office than for the employees operating heavy equipment or machinery.

The federal level is where the bulk of the quarterly and annual payroll reports lie. Here are the five federal payroll reports you should be familiar with.

You will use Form 941 to report the following information as it pertains to your employees’ paychecks:

Form 941 must be filed every three months and is due by the last day of the month following the end of a quarter (i.e., April 30, July 31, October 31, January 31).

In some instances, your business may be eligible to file Form 944 instead of Form 941. Both reports indicate the same information, the difference being that Form 944 is filed annually instead of quarterly.

Keep in mind that only certain businesses may use Form 944. It depends on the total amount of social security, Medicare, and federal income taxes you withhold each year. The IRS will notify you if you are eligible to file Form 944 instead of Form 941.

Form 944 is due January 31 following the end of the current year.

Form 940 is a payroll report submitted annually that indicates federal unemployment tax (FUTA) paid during the year. Federal unemployment tax does not come out of your employees’ paychecks but is paid directly by your business.

Form 940 is due January 31 following the end of the current year.

Form W-2 summarizes an employee’s gross pay for the year and includes information on how much you withheld for local, state, and federal deductions (based on the employee’s specifications on Form W-4).

By law, you must distribute Form W-2 to every employee who worked for you during the year. You also submit W-2s to the state and federal government so they can verify wage and tax amounts.

W-2s are due by January 31 following the end of the current year.

Form W-3 is the document you use to submit Form W-2 to the Social Security Administration. It summarizes all the W-2s for your business.

Like the W-2s, it is due by January 31 following the end of the current year.

As we mentioned at the start of this article, your business can choose to generate a payroll report as frequently or infrequently as it suits the workflow, and as long as you abide by local, state, and federal requirements.

There is a minimum — typically quarterly, or, in some cases, annually — but if you choose to tie your reporting to your payroll distribution, here are some tips for choosing the best way to do it.

All 50 states have a minimum payroll distribution beyond which it is illegal to pay your employees. That means that your business can always pay employees more frequently than the law allows, but never less frequently.

Indiana, for example, stipulates that businesses have to pay employees at least semi-monthly (twice a month). Indiana businesses can choose to pay employees biweekly (every two weeks) or weekly, but they can never implement a monthly payroll schedule.

If you marry your reporting to the payroll schedule, can your business handle generating payroll reports semi-monthly or biweekly? If not, you may want to opt for the quarterly reporting option if your state allows it.

Be sure to check your own state’s requirements before you decide which schedule to use.

Whether you process your payroll reports in-house or outsource them to a third-party company, you need to take into account flexibility before choosing a schedule.

An in-house payroll department may adapt easier to more frequent reporting, but it may take them more time to get the numbers in order.

On the other hand, a third-party processor may be faster, but they typically won’t do anything less than a semi-monthly schedule.

Your business has a lot of paperwork to process in connection with its payroll reports. Benefits, overtime, taxes, unemployment, workers’ comp — the list goes on and on.

If your business doesn’t have the time or the capability to complete all of that paperwork more frequently, your business might be better served adopting a less-frequent reporting schedule instead.

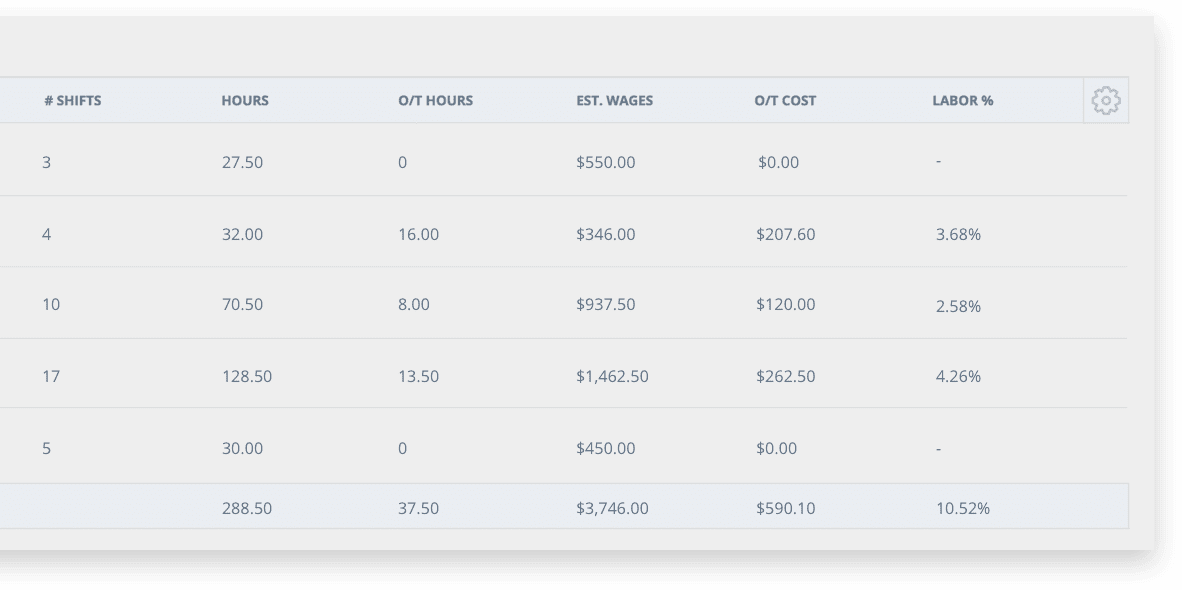

Payroll reports are there to give you an idea of what you’re spending to pay your workforce. Remember, you can’t manage what you don’t measure. And the easiest way to track labor costs and produce payroll reports is with an app like Sling.

Sling contains powerful tools that let you:

And that’s just the beginning of what Sling has to offer. You also get extremely powerful employee scheduling and organizing features as well as a built-in time clock that can be used on your employees’ mobile devices, flexible messaging options, newsfeed, and task list.

Sling even provides features that help you distribute your schedule efficiently, keep it up to date, find substitutes, and communicate with your employees.

Add to that the onboard artificial intelligence and you’ve got an extremely beneficial and flexible set of tools that will help you get control of your team, improve engagement, and simplify all the numbers you have to crunch on a regular basis.

Sling really is the best way to manage your payroll reports, track labor reports, and keep your business running smoothly.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.