10 Payroll Reports Every Business Manager Needs To Know

You can’t manage what you don’t measure. That’s why payroll reports are su...

Choosing the right payroll schedule for your team and your business is a daunting task. Paying your employees too often can drain your bottom line, but paying them too infrequently can cause undue hardship on their personal budgets.

In this article, the workforce management experts at Sling give you 4 tips to help you decide which payroll schedule is right for you, your team, and your business.

A weekly payroll schedule means that you pay your employees every week for work done the previous week.

Businesses using a weekly payroll schedule usually distribute checks on Friday for the last full week worked (Monday through Sunday).

For example, if employee A worked 40 hours during the pay period November 4, 2019, through November 10, 2019, you would process their hours worked during the following week and give them a check on Friday, November 15, 2019.

The term “biweekly” is a bit confusing at first because it has two different definitions.

A biweekly payroll could mean distributing paychecks every two weeks. But it can also mean distributing paychecks twice a week.

When it comes to your payroll schedule, however, biweekly always means every two weeks. The amount of work and cost that would go into distributing paychecks twice a week would be unrealistic for most businesses.

When it comes to a biweekly pay period, most businesses choose every other Friday (e.g., September 13, 2019, and September 27, 2019).

Since each month doesn’t always have four full weeks, there will be two months every year with a third pay period. With a biweekly payroll schedule, you’ll distribute 26 paychecks over the course of one year.

A semi-monthly payroll schedule means you pay your employees twice per month. Unlike biweekly, the semi-monthly payroll period has nothing to do with the number of weeks in a month.

You simply choose two days — roughly equally spaced (e.g., the 15th and the 30th) — process the timesheets prior to those days, and pass out checks at that time.

With a semi-monthly payroll schedule, you’ll distribute 24 paychecks (2 paychecks x 12 months) over the course of one year.

In a monthly payroll schedule, you pay your employees for the work they did over the past 30 days.

Because of processing time (typically a week), you may pay your employees for time worked over three weeks of the current month (e.g., November) and one week of the previous month (e.g., October).

You could also structure it so that you pay your employees at the end of the first week in the following month.

In that case, your employees would work November 1 through November 30, you would process the payroll during the first week in December, and paychecks would be sent out on Friday, December 6.

With a monthly payroll schedule, you’ll distribute 12 paychecks over the course of one year.

Advantages: A weekly payroll schedule is most advantageous for your employees because they’ll have access to the money they’ve earned more often.

This is especially true of hourly employees with irregular work hours and possible overtime. For example, if Jan works 60 hours one week and 20 hours the next, getting paid every seven days ensures that she receives overtime money to help her get through the shorter week to come.

Disadvantages: One of the biggest disadvantages of a weekly payroll schedule is the cost. If you outsource your numbers to another company, the fees for such processing can really add up.

On the other hand, if you run your payroll in-house, a weekly payment schedule will tie up a significant portion of your accounting department’s workweek. The investment in time and effort is compounded if your payroll administrator has to calculate payroll accruals and overtime.

Advantages: From a business perspective, biweekly and semi-monthly are very similar schedules. But one major advantage to the biweekly schedule is that overtime is easier to calculate because the pay period is based on 80 hours total (versus 86.67 hours for semi-monthly).

For your team members, biweekly means getting paid every other Friday. And a consistent schedule is nice for them because they can plan their finances around those dates. This type of payroll schedule is also the next best option for hourly employees who work overtime because they receive their paychecks closer to the time when they worked the extra hours.

Disadvantages: A biweekly schedule consists of 26 pay periods in 12 months. Those numbers do not divide evenly into one another. And that can cause issues for your accounting department.

For example, not every month has four full weeks. So, within a full year, there will be two months that have a third pay period.

Most accounting departments run payroll reports on a monthly basis so that third pay period can be inconvenient and lead to confusion when comparing one month’s report to another. Similarly, your HR department typically deducts employee benefits monthly.

Without proper planning, the third pay period can cause issues with your numbers.

Advantages: A semi-monthly payroll schedule is easier for businesses because you only have to manage 24 pay periods in 12 months. Your accountants won’t have to contend with the two extra pay periods that come with a biweekly schedule.

For semi-monthly payments, your business picks two days out of the month — usually the 1st and the 15th, or the 15th and the 30th — and cuts checks on those dates.

Disadvantages: The main disadvantage of a semi-monthly schedule is that payday can fall on any day of the week, even a Saturday or Sunday. Such a variable schedule means that your employees will have to possibly wait for the next business day to receive their checks.

This is not a major disadvantage if your business is diligent about distributing payroll immediately after the weekend (or even before, if possible). But if employees have to wait two, three, or even four days after payday, they may become disgruntled and start to complain.

Advantages: A monthly payroll schedule is most advantageous for your business.

Your accounting department will only have to conduct 12 pay periods, and those periods line up nicely with all the monthly reporting and withholding they have to do for taxes and benefit distribution.

Disadvantages: For employees, the monthly payroll schedule is the least desirable because going a full 30 days without a paycheck can be very difficult. In fact, many states have laws against monthly payroll, so this type of schedule isn’t even an option.

Check local regulations or speak to an attorney or accountant in your area who is familiar with your industry for more details.

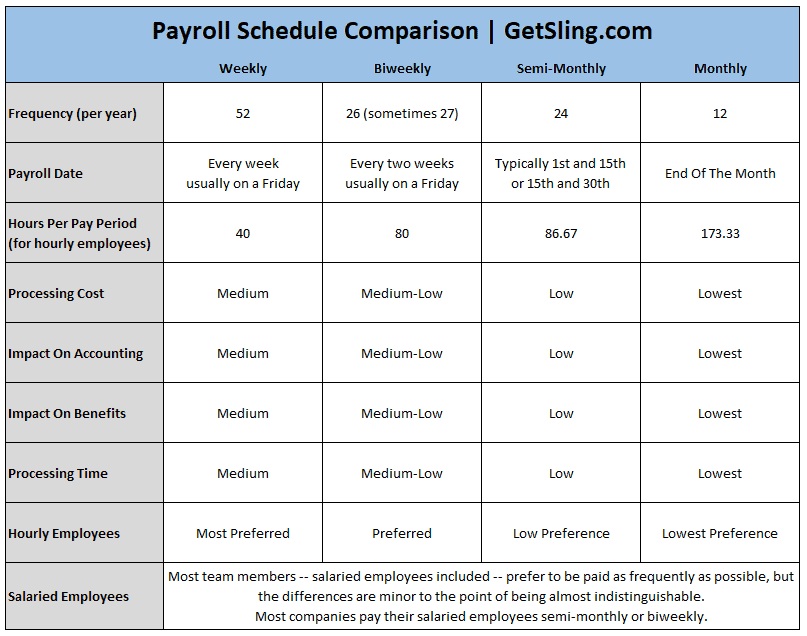

To give you a more visual representation of the four types of payroll schedule, we’ve created a table that compares the various aspects of each.

In the next section, we’ll discuss tips to help you choose the best payroll schedule for your business.

All 50 states have a minimum payroll schedule beyond which it is illegal to pay your employees.

You can always pay your employees more frequently than the law allows, but never less frequently.

Indiana, for example, stipulates that businesses have to pay employees at least semi-monthly (twice a month). Indiana businesses can choose to pay employees biweekly (every two weeks) or weekly, but they can never implement a monthly payroll schedule.

Be sure to check your own state’s payday requirements before you decide which schedule to use.

Whether you process your payroll in-house or outsource it to a third-party company, you need to take into account flexibility before choosing a payroll schedule.

An in-house payroll department may adapt easier to more frequent pay periods, but it may take them more time to get the numbers in order.

On the other hand, a third-party processor may be faster, but they won’t do anything less than a semi-monthly payroll schedule.

Your business has a lot of paperwork to process in connection with payroll. Benefits, overtime, taxes, payroll reports — the list goes on and on.

If your business doesn’t have the time or the capability to complete all of that paperwork on a weekly payroll schedule, you might be better served adopting a semi-monthly schedule instead.

It’s also vital to keep the needs of your team members in mind when choosing the best payroll schedule for your business.

Distributing paychecks once a month may be good for your business, but it may not be good for your employees. On the other end of the spectrum, distributing paychecks every week may be good for your employees, but it may not be good for your business.

Find a payroll schedule that works for both your business and your employees (perhaps biweekly or semi-monthly).

As we discussed earlier in the article, there are benefits and drawbacks to each type of payroll schedule. State or local law may reduce the number of choices you have, but you should still consider all of the options available before settling on which one is right for your business.

There’s no perfect answer, so you may have to give a little and accept the more complicated biweekly schedule — replete with extra pay periods and more difficult reporting — in order to satisfy your employees.

On the other hand, if your accounting department is diligent about getting checks to employees as close to, or even before, payday, all parties involved may be happy with a semi-monthly schedule.

Another factor to consider when choosing a payroll schedule for your business is the needs of both your part-time and full-time employees.

Often, this comes down to how you choose to pay your team.

Whether they’re part-time or full-time, most salaried employees prefer being paid as often as possible. But, for them, the differences between biweekly and semi-monthly are minor enough that they are ok with either (which is why most businesses choose one of these schedules).

Hourly employees, on the other hand — be they part-time or full-time — are most satisfied with a weekly or biweekly payroll schedule. Asking them to go much longer than every two weeks can lead to low morale and retention.

Before you choose a payroll schedule, take a bit of time to consider the needs of your employees so the frequency of their paycheck doesn’t become a divisive issue.

Overtime for hourly employees can be one of the most complicated parts of your payroll. Before you choose a schedule, test how overtime affects your calculations and the overall payroll process.

For those unfamiliar with overtime — or for those who would like to learn more — the federal government established the Fair Labor Standards Act (FLSA) in 1940 to set limits on how many hours per week employers could ask their employees to work at regular pay. The number they settled on was 40 (typically, five eight-hour days).

Above those 40 hours, employers were now required to provide their employees with extra compensation in the form of overtime pay.

The standard overtime rate is 1.5 times the employee’s regular hourly wage. This number is also commonly known as “time-and-a-half.”

So, if one employee makes $20 per hour, their overtime rate is $30 per hour ($20 x 1.5). If another employee makes $10 per hour, their overtime rate is $15 per hour ($10 x 1.5).

For the employee who makes $20 per hour and works 40 hours per week, their gross pay is $800 ($20 x 40). If they work any number of minutes or hours above 40 hours, you must compensate them for that work at your overtime rate.

That means the employee who makes $20 per hour and works 50 hours per week would be paid as follows:

40 regular hours x $20 per hour = $800

10 overtime hours x $30 per hour = $300

$800 regular pay + $300 overtime pay = $1,100 total

For more detail on overtime pay, check out this article from the Sling blog: How To Calculate Overtime Related To Payroll | The Complete Guide.

It’s also worth noting that as long as you comply with federal, state, and local laws on overtime (which dictate a minimum level of 1.5 times regular pay), you can technically compensate your eligible employees however you like.

A common example of this is holiday pay. During major U.S. holidays (e.g., Christmas, Thanksgiving, and New Year’s Day), some businesses pay “double time” (or twice the normal hourly rate).

There are no laws that state an employer has to compensate employees at double their regular rate. It’s simply an incentive that some businesses offer to get employees to work during days they would normally have off.

To better understand how these calculations will impact your workflow, we recommend running some experiments with hypothetical situations to see if they complicate your preferred payroll schedule to the point that another would be better.

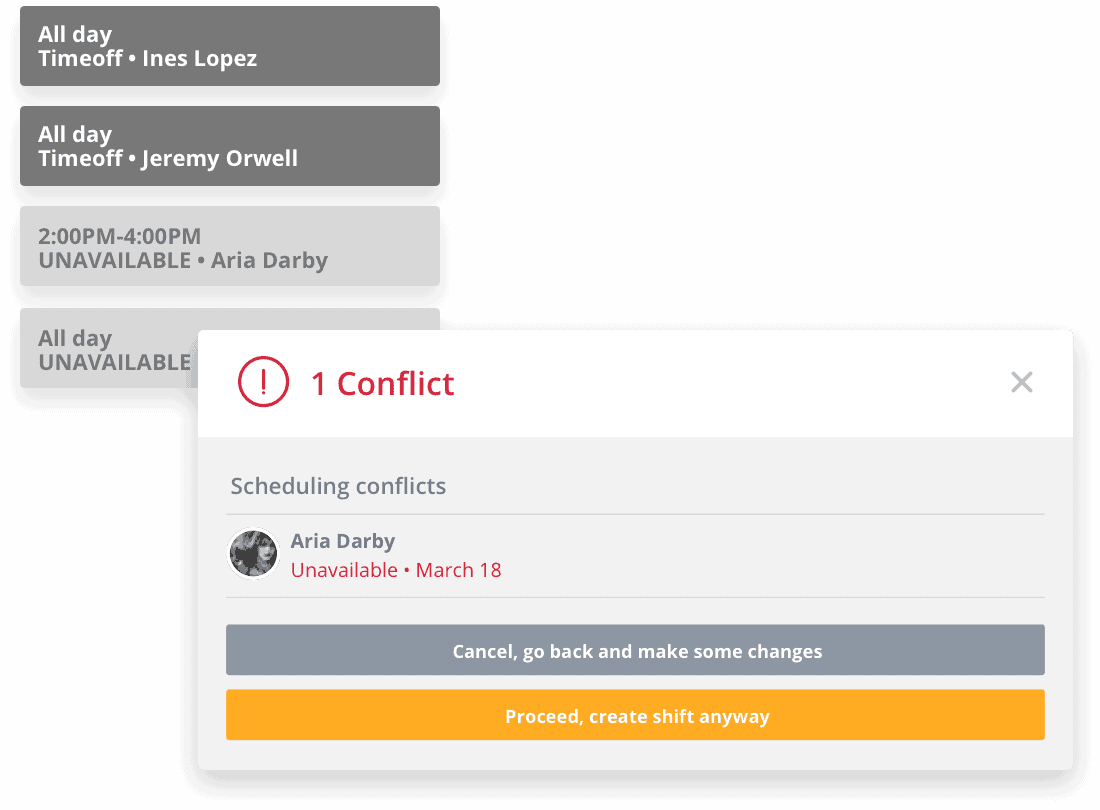

One of the best ways to get control of your entire payroll system is by using a scheduling tool like Sling. The Sling app is designed specifically for streamlining your scheduling process (which affects payroll), so all of its tools are dedicated to that task.

Features include:

Sling’s user-friendly interface makes it easy to see how many hours each employee will work each week — so they don’t stray into overtime territory — and gives you notifications of overlapping shifts and double-bookings.

Sling even provides features that help you distribute your schedule efficiently, keep it up to date, find substitutes, and communicate with your employees.

Add to that the onboard artificial intelligence and you’ve got an extremely beneficial and flexible set of tools that will help you get control of your team, improve engagement, and keep your payroll under control.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.