How Do Employee Benefits Work? | A Guide For Managers

Many managers wonder, “How do benefits work to keep my team, and my business, ...

If you want to bring top talent to your business, consider offering fringe benefits. As a business owner or manager, you know that salary isn’t always the determining factor in who accepts your job offer. Sometimes, it’s intangibles like company culture or how well your team works together.

Other times, it’s the perks you offer on top of wages that motivate a potential employee to come to work for you. These are the fringe benefits that can really make a difference in your hiring and retention process.

In this article, the management experts at Sling discuss how you can use fringe benefits to offer more to your existing and future employees.

A fringe benefit is any perk that a business provides for its employees in addition to their hourly wage or salary.

Here are some common fringe benefits:

The list goes on and on. And, really, you can create your own fringe benefits to suit the way your business operates and what it can afford to offer.

Whatever form the fringe benefits take, many businesses view these little extras as an expression of loyalty for valued employees and hope that they will create a very real boost in morale and engagement.

Absenteeism has a profound effect on your business’s productivity. And nine times out of 10, that absenteeism can be traced back to illness. But when lifestyle fringe benefits — like health insurance and gym memberships — are offered, employees are healthier and miss less work.

The more benefits an employee gets from his or her employer the happier (and, as a result, more productive) they tend to be on the job. Adding just one fringe benefit is an easy and effective way to improve work performance in your teams.

Fringe benefits can play a twofold role in promoting career advancement.

Some businesses only offer fringe benefits to upper-level positions. That gives those employees in lower-level positions an incentive to seek career advancement.

Additionally, fringe benefits like job training and educational assistance give these employees the means they need to acquire new skills, which can lead to promotions and career advancement.

Fringe benefit packages can attract talented workers and give them more of a reason to choose your business over a competitor’s.

With a strong fringe benefits package in place, you may not even have to advertise for new hires. Word of mouth from existing employees may be enough to draw skilled workers to your door.

When talent is naturally attracted to your business, you have plenty of choices in who you hire. That can lead to bringing on board individuals with more skills than just those few required to get the job done.

And with a more diverse team, your entire business will benefit.

Fringe benefits motivate employees to work harder, which leads to improved performance overall. That, in turn, leads to higher company revenues and a successful business. All of that stems from a few well-applied fringe benefits.

In most cases, fringe benefits are taxable. There are a number of notable exceptions to this rule, including:

These exclusions aren’t subject to federal income tax withholding, social security, Medicare, or federal unemployment tax and aren’t reported on Form W-2.

When fringe benefits are taxable, they usually fall into one of two categories:

Partially taxable means that only a percentage of the value of the fringe benefit is used to calculate the tax due. Transportation allowances and company cars are good examples of partially taxable fringe benefits.

Tax-deferred means that you don’t have to pay taxes right now, but you will eventually. Pension plans and 401ks are good examples of tax-deferred fringe benefits.

For more information on how fringe benefits may impact your bottom line, refer to the IRS’s Publication 15-B, Employer’s Tax Guide To Fringe Benefits, or consult a qualified attorney or tax professional.

One fringe benefit that often goes overlooked by many employers is a flexible schedule. There are many forms of flexible schedule available today, including:

There are so many options you’re sure to find one that works well for your business. Best of all, flexible schedules are nontaxable under the current IRS regulations. There’s no extra burden on you (e.g., paperwork, labor, or tax withholding) like there would be if you offered a fringe benefit with monetary value, like a company car or a gym membership.

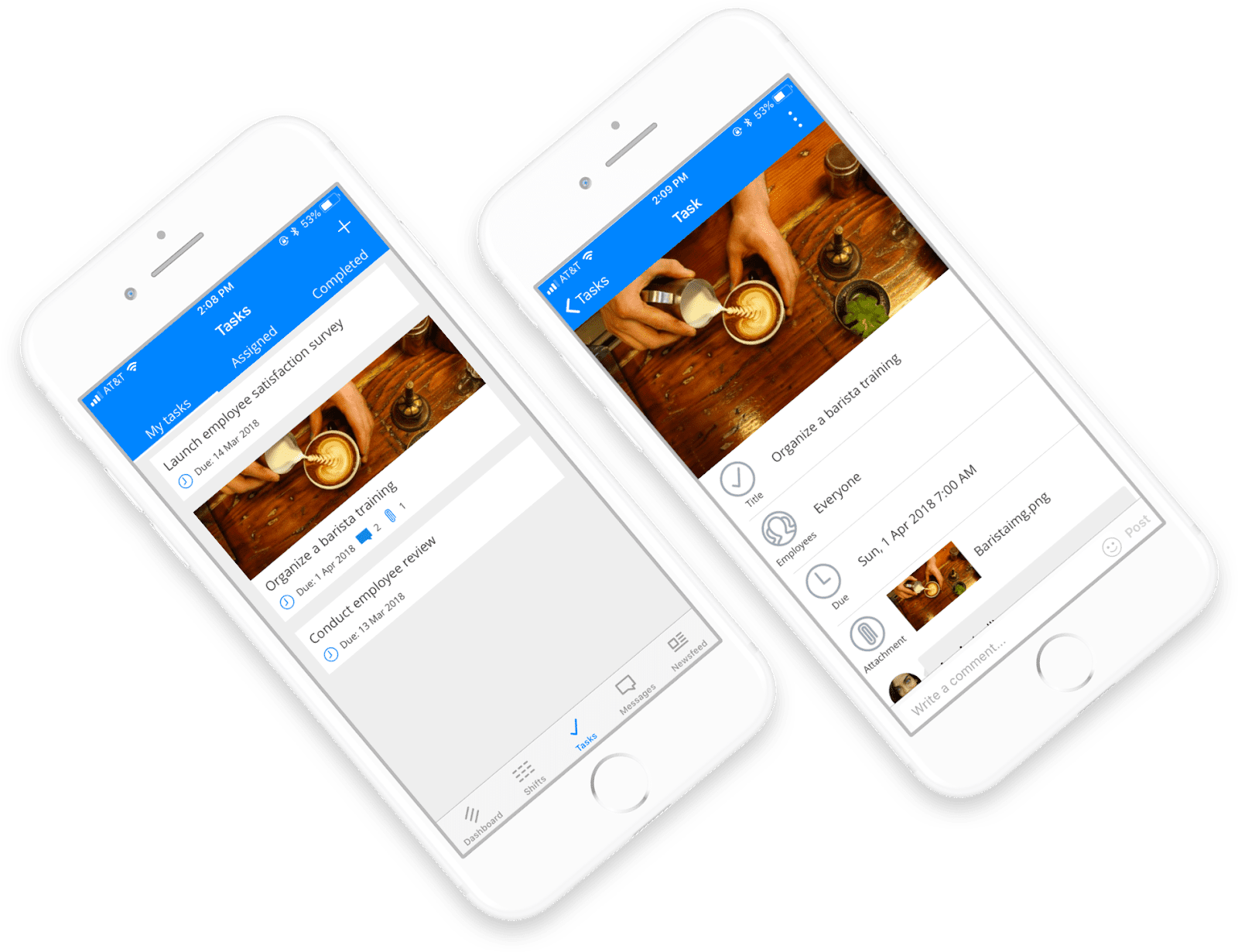

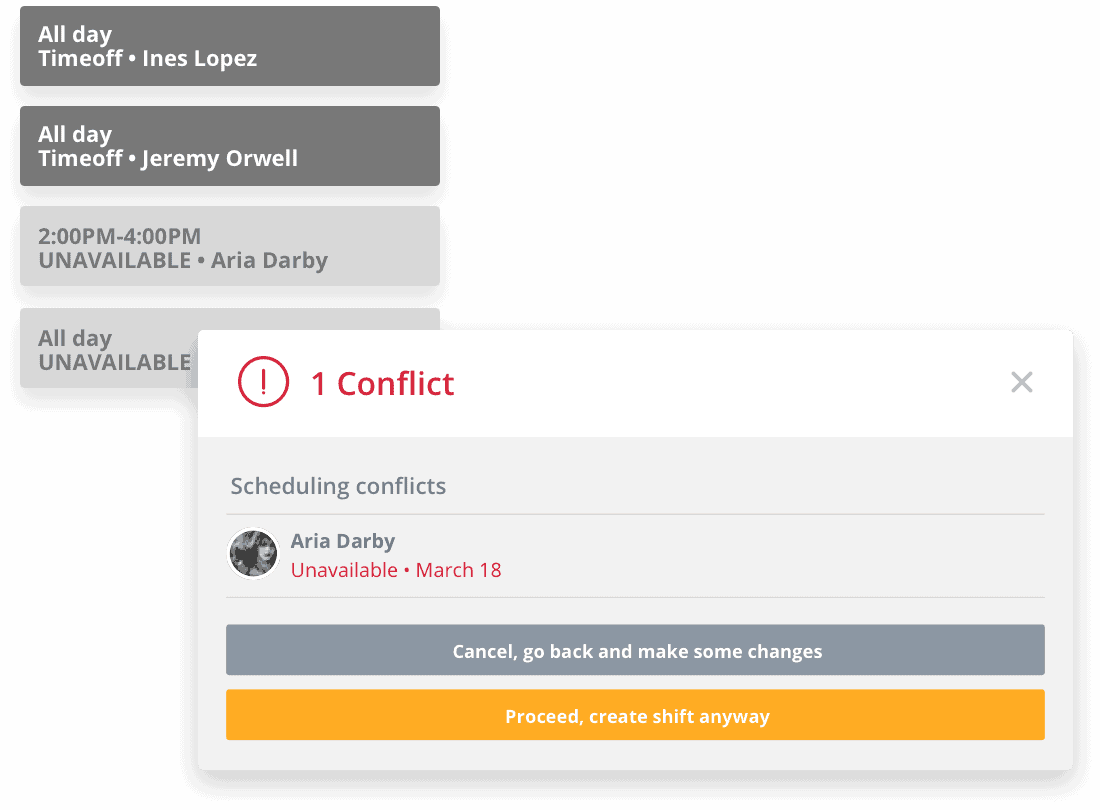

Once you decide to offer a flexible schedule as a fringe benefit, the Sling app makes it easy to incorporate even the most complicated shifts into your regular workflow.

Sling is packed with intuitive tools — like employee and task color coding, recurring shifts, and time-off notices. Sling even allows for notifying employees about no-shows and available shifts with advanced communication features and push notifications sent directly to their phones.

These features (and many more) make Sling the best schedule maker for businesses of all sizes. Try Sling free today and you’ll discover how it opens up blocks of time for more important tasks and allows you to offer a fringe benefit without putting undue burden on your business.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.