The Complete Guide To Fringe Benefits | GetSling.com

If you want to bring top talent to your business, consider offering fringe benef...

Restaurant payroll is one of the largest expenses your business will have to absorb. Let it get out of hand and your bottom line will suffer. But there is a way to control your labor expenses so your business is always in the black.

In this article, the restaurant-management experts at Sling discuss all aspects of restaurant payroll so that you can keep a tight rein on the outlay that can make or break your business.

Restaurant payroll — or just payroll by itself — is an umbrella term that refers to multiple aspects of your business, including:

For this article, we will discuss restaurant payroll according to the third definition from the list above: the process of calculating and dispensing wages to your employees.

One of the first steps in setting up restaurant payroll is to get your federal, state, and local paperwork in order.

This includes such requirements as:

It doesn’t matter if you decide to do payroll yourself or hire a payroll service to do it for you, you need all of this information on file before you cut your first check.

Setting up restaurant payroll also requires that you implement some sort of tip reporting process.

You may choose to set a creative tip jar on the counter or institute a tip pooling policy.

Regardless of the process you choose, you’ll need to keep a record of tips received so you can produce an accurate restaurant payroll.

Restaurant payroll is unique in that employees often fill more than one position during a pay period. And your business will usually pay those jobs at different rates.

For example, a host or hostess ($12/hour) may fill in for a server ($8/hour + tips). Or a food runner ($9.50/hour) may fill in for a busser ($8/hour) if you run into a no-call, no-show situation.

For those eventualities — and for accurate restaurant payroll — you’ll need to establish multiple pay rates and keep track of who worked what position and for how much.

Restaurant payroll is easy to figure when you’re dealing with an hourly calculation.

The formula is just hours worked multiplied by the wage for that position (35 hours in a week X $10/hour = $350).

But things can get more complicated when you factor in the multiple pay rates mentioned in the previous section, tips, and even salary vs. hourly pay.

Make sure you’re familiar with the equations that apply to the various pay structures within your restaurant payroll.

Overtime pay has its own set of equations that you’ll need to know to calculate restaurant payroll.

For any hours worked over forty, you’re required to pay the employee time-and-a-half (or 1.5 times their normal hourly wage).

That part is fairly straightforward, but it gets complicated very quickly when you factor in tipped wages and other pay structures.

Be sure you know how to calculate overtime properly so your business doesn’t find itself in legal trouble later on.

We’ll discuss this in a bit more detail later on in this article.

Once you’ve got your restaurant payroll process set up and ready to go, it’s time to start crunching the numbers.

The first step is to collect timesheets so you know how many hours each of your employees worked.

Your timesheets may be of the paper variety, the more modern punch-card type, or the cutting-edge digital style.

The easiest of those to use is the digital timesheet because the numbers often transfer directly into the software you’ll use to run the calculations to determine the final paycheck.

Gross pay for your restaurant payroll simply means the total amount of wages before you take out any taxes or deductions.

Gross pay is the basis for all the other calculations you’ll perform before you reach the net amount that you’ll write on each employee’s check.

If any of your employees work overtime, you figure the numbers as part of your gross pay calculations. For more information on the process, see the section How To Run Restaurant Payroll With Overtime below.

When it comes to restaurant payroll, pre-tax deductions are those that your employee chooses to withhold from their paycheck.

These include such things as:

Once you add up all these pre-tax deductions, subtract them from the employee’s gross pay before moving on to the next step.

Taxes are a big part of restaurant payroll.

Calculating them incorrectly — or skipping them completely — can mean significant legal trouble and hefty fines down the road.

Talk to a labor attorney or accountant to make sure you’re in compliance with any and all local, state, and federal tax laws.

The formal definition of net wages as it applies to restaurant payroll is:

The amount of money left after you subtract mandatory expenses

Mandatory expenses include such numbers as:

If you visualize gross pay as a big pile of money, this step (and the previous two) is you removing expenses a few dollars at a time as required by law.

When you’ve removed all the mandatory expenses from the pile, the rest belongs to the employee.

Net pay, then, is the final amount each employee receives on payday.

The only thing left to do in your restaurant payroll is cut checks and distribute them to your employees.

This may consist of having your employees report to a specific place to pick up a physical check, having someone walk around and hand out checks to each person, or depositing the net pay directly in the bank.

However you choose to do it, this is the last step of your restaurant payroll.

In this section, we’ll show you how to calculate payroll with overtime for a hypothetical employee named Kim. As we mentioned above, you would do this when you figure out each employee’s gross pay.

In this case, Kim works as a hostess for $15 an hour (the standard rate for a host/hostess in your restaurant) and accrues 40 hours during a single week. However, another hostess calls in sick, so Kim covers her shifts and works a total of 50 hours in one week.

Here’s how to run Kim’s payroll with overtime:

First, separate the total time worked into regular hours and overtime hours.

50 hours (total time) – 40 hours (regular work week) = 10 hours (overtime)

Next, calculate the dollar amount you pay for overtime.

$15 per hour (regular pay rate) x 1.5 (overtime multiplier) = $22.50 per hour (overtime pay rate)

With that number in mind, calculate the regular and overtime pay separately.

40 hours x $15 per hour = $600 (regular pay)

10 hours x $22.50 per hour = $225 (overtime pay)

Then, add the two together to get Kim’s total pay for that week.

$600 (regular pay) + $225 (overtime pay) = $825 (total pay for the week)

In this example, Kim works as a hostess for $15 an hour and accrues 35 hours during a single week. However, a bartender calls in sick, so Kim covers her shifts (paid at $20 an hour) and works a total of 50 hours in one week doing two jobs at two different pay rates.

Here’s how to run Kim’s payroll with this type of overtime:

First, separate the total time worked into regular hours and overtime hours.

Second, calculate the pay for her regular hostess hours.

35 hours x $15 per hour = $525 (regular hostess pay)

Third, calculate the pay for her regular bartender hours.

5 hours x $20 per hour = $100 (regular bartender pay)

Fourth, calculate the overtime pay rate for her overtime bartender hours.

$20 per hour x 1.5 (overtime multiplier) = $30 (overtime bartender rate)

Fifth, calculate the pay for her overtime bartender hours.

10 hours (overtime) x $30 per hour (overtime bartender rate) = $300 (overtime bartender pay)

Finally, add up Kim’s regular hostess pay, regular bartender pay, and overtime bartender pay.

$525 + $100 + $300 = $925 (total pay for the week)

With that number, you can then cut Kim’s check, distribute it, and move on to the next major part of restaurant payroll: reporting.

Before we discuss the reporting phase of payroll, please note that the steps discussed above are not an exhaustive list of how to calculate restaurant payroll. Some steps may differ slightly based on the type of restaurant you run and where it operates.

So, whether you calculate payroll in-house or hire another company to do it for you, be sure to review all federal, state, and local requirements — or consult with an attorney or accountant who is well-versed in your industry — before proceeding.

Depending on where you live, your restaurant may be subject to local payroll taxes and required to submit quarterly or annual payroll reports.

Local restaurant payroll reports are less common than the state and federal variety, but check with your city or county government or consult a corporate attorney who is familiar with your business and your area.

Forty-three of the 50 states require payroll reports related to income tax and state unemployment taxes. Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not.

Whether your restaurant is in a reporting or non-reporting state, it’s always a good idea to check your state’s website for details. Every state has slightly different rules, and you want to make sure you’re compliant.

Here are just a few of the possible differences from one state to another:

Being consistent with your state-mandated payroll reports can save you significant time, headaches, and fines down the road.

The three most common state payroll reports are tax withheld, unemployment tax, and workers’ compensation. Let’s examine each in turn.

As the name suggests, this restaurant payroll report provides information to your state’s reporting agency about the amount of tax your business withheld from employee paychecks.

Most states require businesses to submit reports quarterly, but the actual due date varies from state to state. For example, Maryland sets its deadline at the 15th of the first month after the quarter ends, while Washington’s deadline is the end of the first month after the quarter ends.

This illustrates why it’s imperative to check your state’s website for details on what reports are mandatory and when they’re due.

In addition to payroll tax reports, some states require restaurants and other businesses that operate within their borders to submit unemployment tax reports as well.

This is because certain states have enacted regulations that set certain thresholds on the wages a business must pay before it is liable for unemployment tax.

For example, one state may levy an unemployment tax on the first $10,000 earned by each employee during a calendar year, while another state may levy an unemployment tax on any wages earned over $15,000 during a calendar year (but not on those wages under $15,000).

Again, it’s vital to check the requirements in your state before creating and submitting your restaurant payroll reports.

A third state payroll report that may be mandatory in your area is the business’s workers’ compensation numbers.

In some states, the employees themselves purchase this type of insurance through a private carrier. In other states, though, the business purchases a package of workers’ compensation insurance for all of their employees.

If that is the case for your restaurant, you’ll likely have to remit a quarterly report to your state that includes such information as your history of claims and the percentage of payroll that workers’ compensation occupies.

Keep in mind that different positions within your business will have different rates of workers’ compensation and will directly affect the report you produce.

For example, ABC Restaurant will likely have to pay a lower workers’ compensation rate for the new hires on its staff than for the employees who have been there for several years.

The federal level is where you’ll find the bulk of the quarterly and annual restaurant payroll reports. Here are some of the most common federal payroll reports for businesses of all types.

Form 940 is a payroll report submitted annually that indicates federal unemployment tax (FUTA) paid during the year. Federal unemployment tax does not come out of your employees’ paychecks but is paid directly by your business.

Form 940 is due January 31st following the end of the most recent year.

You will use Form 941 to report the following information as it pertains to your employees’ paychecks:

Form 941 must be filed every three months and is due by the last day of the month following the end of a quarter (i.e., April 30, July 31, October 31, January 31).

Form W-2 summarizes an employee’s gross pay for the year and includes information on how much you withheld for local, state, and federal deductions (based on the employee’s specifications on Form W-4).

By law, you must distribute Form W-2 to every employee who worked for you during the year. You also submit W-2s to the state and federal government so they can verify wage and tax amounts.

W-2s are due by January 31st following the end of the most recent year.

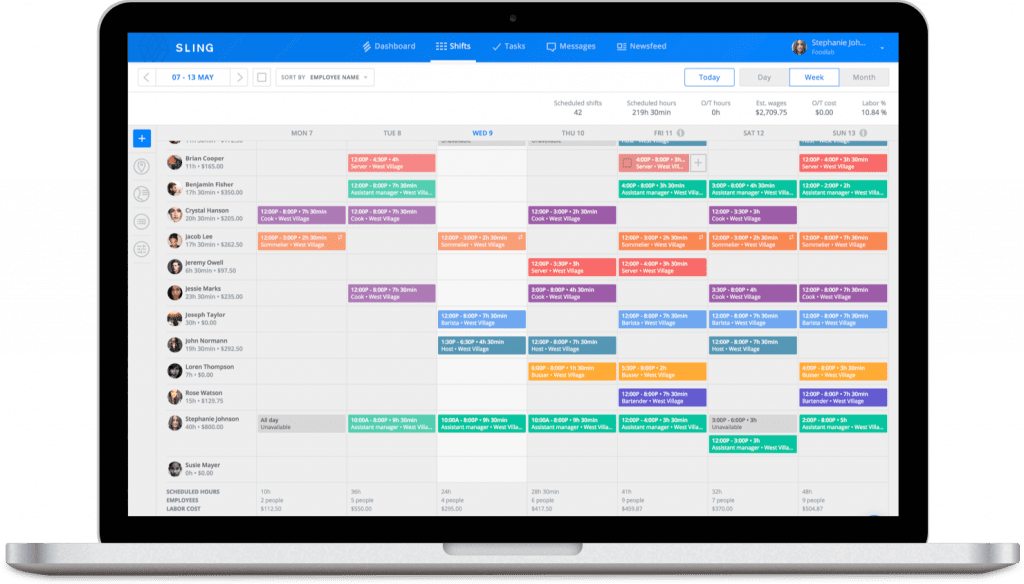

One of the best ways to manage and control restaurant payroll — by far, one of the largest expenses your business will face — is with scheduling.

Effective scheduling gives you the ability to control all aspects of your workforce management so you can stay within your labor budget and maximize profits.

To do that, though, you need the help of a powerful piece of software. You need Sling.

The Sling suite of tools gives you the power to optimize your labor spending — including regular pay, overtime, salary vs. hourly pay, payroll reporting, and every other aspect of payroll accounting you can think of.

And the Sling allows you to do all that and more as you build the schedule in real time so there’s less back-and-forth trying to keep your restaurant payroll under control.

Sling even lets you set wages per employee or position and maximum expenditures per shift so you know exactly what you have to spend. Sling then provides you with alerts when you’re about to exceed the limits you’ve set.

And that’s just the tip of the Sling iceberg.

Other features include:

With Sling, you’ll have unprecedented command of your employee scheduling so you can then fully control your restaurant payroll and keep your business in the black.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.