The best way to calculate work hours: A must-have guide

Struggling to keep up with payroll? Let the experts at Sling show you a better w...

Here’s a frightening fact: many businesses calculate their payroll and payroll taxes incorrectly. What’s worse, miscalculations often go overlooked. That can cost your business time and money and may even lead to legal issues. So if you’re wondering how to do payroll correctly on your own and avoid all those problems, Sling is here to help.

In this article, we’ll give you a step-by-step guide to payroll preparation so you can be sure you’re not missing anything. Before we get to that, it’s important to discuss exactly what payroll is and what it isn’t.

Payroll may seem complicated at first, but you can reduce it down to four key categories:

Pretty simple, right? On the surface, yes. But within each of those categories, there exist multiple steps that you’ll need to satisfy and paperwork that you’ll need to complete. Here’s how to do payroll accounting yourself without missing any details.

We’ve broken down the payroll process into eight simple steps. The first four steps don’t require much from you, the manager, other than a bit of research and making sure everyone has their forms turned in.

Steps five through eight require some number crunching, but we’ll show you a software solution to make handling payroll much easier.

A federal employer identification number, or EIN for short, is like a social security number for your business. Be sure to apply for one before your business opens. You may also need a state EIN, so remember to check the business resources (Secretary Of State’s website) where you live.

Payroll laws will differ from state to state and city to city. There can even be significant differences based on what type of business you run. That’s why it’s crucial to do a bit of research before attempting to tackle payroll.

The most common pay periods are:

Some businesses pay their employees daily. Others pay them every two months. It all depends on the type of business you run, what your employees will agree to, and the laws where your business operates.

The federal government requires that all businesses file a W-4 and I-9 form with the IRS for each employee. The I-9 form is proof that an employee is a U.S. citizen and has the right to work in the United States. The W-4 form supplies the information you’ll need to calculate taxes for each worker.

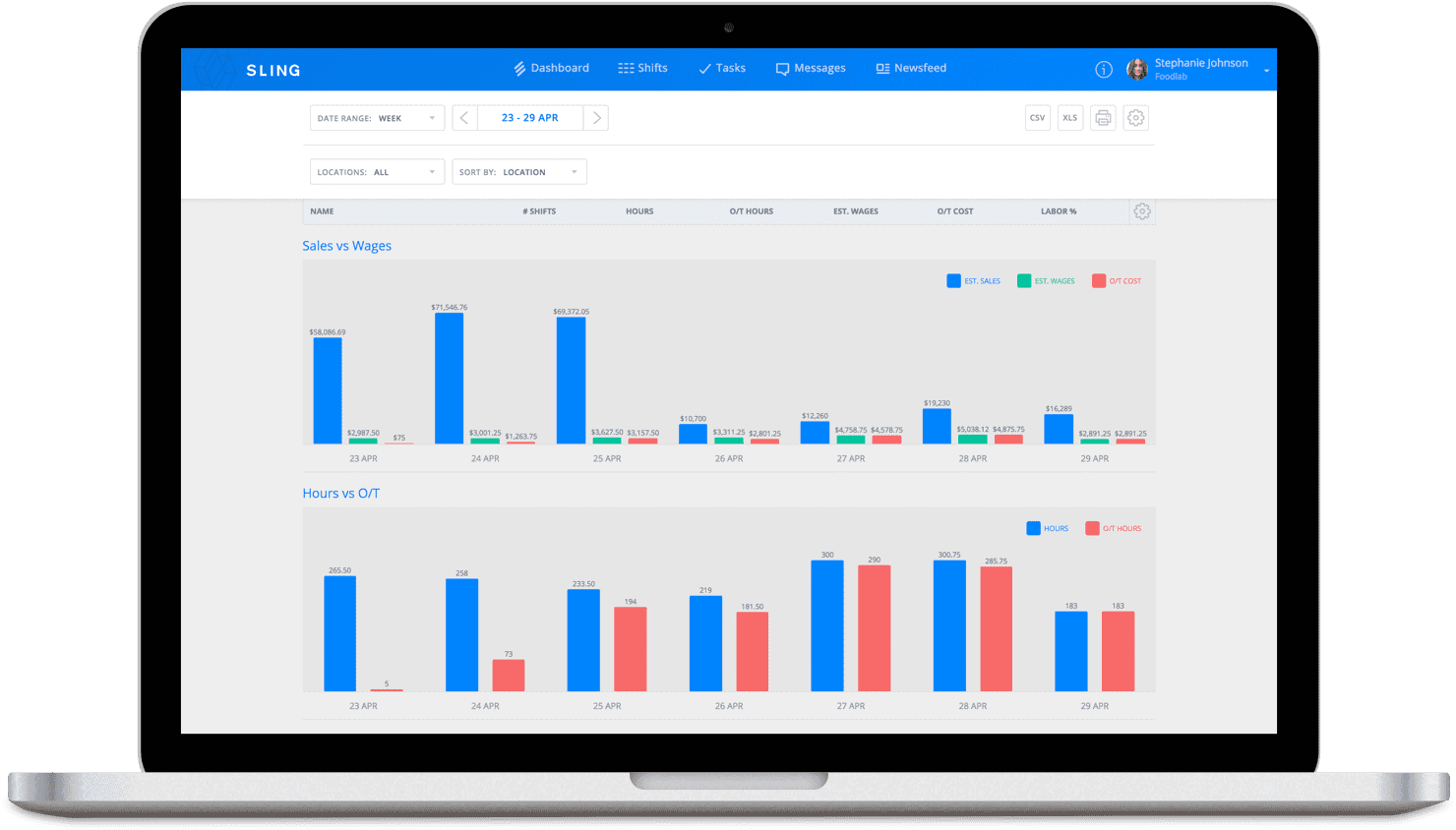

The best way to track and total the hours worked by each employee is with a software tool like Sling. Sling keeps track of all your employees’ comings and goings (their hours worked) with both local and mobile clock-in.

Then, at the end of each pay period, you simply review the data to make sure it’s correct and edit as needed. After that, simply export the timesheet for payroll processing.

Gross pay is simply the number of hours worked multiplied by the employee’s pay rate. The equation looks like this:

35 hours worked X $25/hour = $875

That’s the amount your employee would receive if there were no taxes (which there always are).

Based on your employee’s W-4, tally the withholding taxes and subtract them from the gross pay. So, for example, if the W-4 indicates that you withhold $75 for federal taxes and $25 for state taxes, this is what the equation looks like:

35 hours worked X $25/hour = $875 – $100 = $775

That last number ($775) is the net pay that your employee receives in his or her paycheck.

It’s also essential to keep track of the taxes you withheld (the $100 in the above example) because you’re going to need those numbers for the next step.

Depending on filing requirements, you’ll need to pay the government all the taxes withheld during a given period of time (e.g., every three months, every 12 months). So if the employee in the example above worked 45 weeks during the year and had the same paycheck every week, you would owe the government $4500 (45 weeks worked X $100 in taxes each week).

You’ll also need to complete, file, and distribute a W-2 to each employee (even if they no longer work for your business). The W-2 gives the government and your employee the following information:

Your employee will use this information when preparing their own tax return at the end of the year.

So there you have it: how to do payroll accounting yourself. It may sound like tedious, time-consuming work (and it can be if you have several employees), but tools like Sling can significantly reduce the time it takes to process all the necessary information.

Sling simplifies the time-tracking procedure to the point that there are no paper timesheets or fixed terminals necessary. It also helps you track, control, and optimize labor costs. That can have a serious impact on your bottom line.

Before you learn how to do payroll accounting with overtime numbers, you need to establish a few key facts:

Most businesses don’t pay their salaried employees overtime, and some employees don’t qualify for overtime even if you pay them on an hourly basis. A large portion of it depends on how you set up your payroll system and regulations set by the U.S. Department of Labor.

Regarding point three, the standard overtime rate is 1.5 times the employee’s regular hourly rate (also called “time-and-a-half”). That’s why it’s vital to know what you pay each employee before calculating overtime.

Once you establish the four key points mentioned above, you’re ready to begin calculating the overtime pay with one of the four methods discussed below.

To help you understand the formulas and the data they produce, we’ll use a hypothetical employee named Lily as an example. Here are the numbers we’ll use:

With those numbers in mind, let’s walk through the first method.

First, separate the total time Lily worked into regular hours and overtime hours.

50 hours (total time) – 40 hours (regular work week) = 10 hours (overtime)

That calculation may seem very basic (which it is in this instance), and you may be wondering why we included it.

Here’s why: Sometimes an employee will work 1 hour and 15 minutes or 4 hours and 30 minutes of overtime, so you won’t be able to do the calculation in your head. Get into the habit of following the outline steps, and you’ll have no problem, regardless of the numbers.

Next, calculate the dollar amount you pay for overtime.

$20 per hour (regular pay) x 1.5 (overtime rate) = $30 per hour (overtime pay)

With that number in mind, calculate the regular and overtime pay separately.

40 hours x $20 per hour = $800 (regular pay)

10 hours x $30 per hour = $300 (overtime pay)

Then, add the two together to get Lily’s total pay for that week.

$800 (regular pay) + $300 (overtime pay) = $1,100 (total pay for the week)

Now that you’ve got that calculation under your belt, the next example will just have formulas.

50 hours (total worked) x $20 per hour (base pay) = $1,000

$20 per hour (base pay) x 0.5 = $10 (overtime pay rate)*

*For this method only, all overtime hours will be paid at $10 per hour because you already calculated the bulk of the pay in the first step.

10 hours (overtime) x $10 = $100

$1,000 + $100 = $1,100 (total pay for the week)

You can see that you arrive at the same number regardless of the method you use. Choose the one that makes the most sense to you.

Now let’s investigate what happens when Lily’s hourly rate changes.

In this example, Lily works 40 hours during the morning shift and 10 hours during the night shift. The night shift includes a $1 per hour premium to her base pay. The difference in her pay rates based on the shift she works is called shift differential.

The method we’ll use is similar to the procedure outlined in the first method on this list (Separate Hours).

40 hours (morning shift) x $20 (regular pay) = $800

$21 per hour x 1.5 = $31.5 per hour (overtime pay rate)

10 hours (overtime) x 31.5 = $315

$800 + $315 = $1,115 (total pay for the week)

In certain industries, employees may need to work different jobs at different pay rates (this is especially common in restaurants).

For example, Lily works 40 hours in one department at a pay rate of $20 per hour. But then she fills in for another department when someone gets sick and works 10 hours at a pay rate of $15 per hour.

These multiple variables may seem complicated, but it’s really the same math as you worked through in previous methods.

Here’s how it works out:

40 hours x $20 per hour = $800 (regular pay)

$15 per hour x 1.5 = $22.50 per hour (overtime pay rate)

10 hours (overtime) x $22.50 = $225 (overtime pay)

$800 (regular pay) + $225 (overtime pay) = $1,025 (total pay for the week)

As you can see from these examples, once you have the basic formulas down, the more complicated scenarios are fairly simple to figure out.

Whether you learn how to do payroll accounting yourself, or you outsource it to another company that does it for you, there are a number of reports that your business must submit and keep track of in order to stay in compliance with local, state, and federal laws.

We mentioned the W-2 earlier in the article, but here are some more important payroll reports you need to know.

Form W-3 is the document you use to submit Form W-2 to the Social Security Administration. It summarizes all the W-2s for your business.

Like the W-2s, it is due by January 31st following the end of the current year.

Form 940 is a payroll report submitted annually that indicates federal unemployment tax (FUTA) paid during the year. Federal unemployment tax does not come out of your employees’ paychecks but is paid directly by your business.

Form 940 is due January 31st following the end of the current year.

You will use Form 941 to report the following information as it pertains to your employees’ paychecks:

Form 941 must be filed every three months and is due by the last day of the month following the end of a quarter (i.e., April 30, July 31, October 31, January 31).

Please note that this is not an exhaustive list of how to do payroll. It does contain the most common steps in the payroll process, but some may differ slightly based on your business and where it operates.

Be sure to review all federal, state, and local requirements — or consult with a professional — before calculating your own payroll.

Learning how to do payroll accounting manually (i.e., with pencil, paper, and a calculator) is a good skill to have. As a manager, you never know when you’re going to need to do a quick bit of math.

But crunching numbers the old-fashioned way does take a lot of time — time that would be better spent focusing on improving your business. Thankfully, there is a tool that makes payroll accounting easy: Sling.

But Sling is more than just a glorified adding machine. It’s an artificial-intelligence-powered scheduling and time tracking app that allows you to control labor costs and overtime spending as you build the staff rota.

From the moment your employees clock in, their data is available and ready for processing. And at the end of the pay period, all it takes is a few clicks or taps to produce the numbers you need.

You can then transfer data in the blink of an eye to integrated payroll tools such as Gusto and ADP while maintaining the level of detail your business needs to succeed. Sync as much or as little information as necessary, including such variables as:

You can even produce your own payroll reports — both digital and hard copy — and manually export them in a variety of formats for easy transmission to a third-party payroll processor.

Once payroll is complete, you can import labor cost information from your payroll processor for easy analysis and integration into future calculations and reporting.

And because all of your information is stored in the cloud, you can manage your payroll processing from any smartphone, tablet, laptop, or desktop. As long as you have an internet connection, you can access your data anywhere, anytime. That’s payroll accounting for the 21st century!

For more free resources to help you learn how to do payroll accounting yourself, organize and schedule your team, and manage your business better, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.