Gross Pay Vs. Net Pay: The Complete Guide For Managers

Gross pay vs. net pay is an important part of your business’s payroll process....

Payroll processing can be one of the most complicated and time-consuming activities that your business has to face. It’s no wonder, then, that many managers choose to outsource their payroll activities to a company that specializes in running the numbers.

Whether you calculate paychecks in-house or send your information to a professional, it’s still essential that you know how payroll processing works.

In this article, we’ll discuss that very topic and introduce you to a tool that will simplify and streamline all your payroll activities.

To really understand payroll processing, it’s important to back up a step and examine the definition of payroll itself. Payroll is a broad term that can refer to different aspects of your business, depending on how you use the word in conversation.

For example, if you say, “Ted, Robin, and Lily are on the payroll,” you’re referring to the group of individuals you employ.

If you say, “Payroll increased 3.14% in the past quarter,” you’re referring to the wages you pay your employees.

If you say, “I’ll start running payroll tomorrow at 9:00 a.m.,” you’re referring to the act of calculating and distributing paychecks.

It’s that third definition — with a bit of the second definition as well — that forms the foundation of payroll processing. Because, at its most basic, that’s exactly what you’re doing: processing the numbers that allow you to pay your employees the wages they’ve worked for.

When you hear the term payroll processing, it’s easy to jump right to the act of writing checks and distributing them on payday.

But payroll actually starts well before that day and extends well beyond it.

Here’s how it breaks down:

So, while doing the actual math may only occupy one day’s work, the other aspects of payroll processing — such as time tracking, paying taxes, and maintaining records — are ongoing.

For the remainder of this article, we’ll focus on the act of payroll processing itself — doing the math — rather than the ongoing jobs around it.

For more information on these peripheral (yet still important) aspects of payroll, take a few minutes to read these articles from the Sling blog:

The first step in processing your payroll numbers is to collect timesheets. Your timesheets may be paper, punch card, or digital.

The easiest of those options is the digital timesheet because the numbers quickly transfer into the software you’ll use to run the final calculations. And even if you choose not to transfer the data, it will at least be in a more manageable format so there won’t be so much math involved.

Whatever format your timesheets come in, they provide one of the two essential numbers for payroll processing: total regular hours worked.

Once you have the total regular hours worked (not including overtime), it’s time to calculate gross pay.

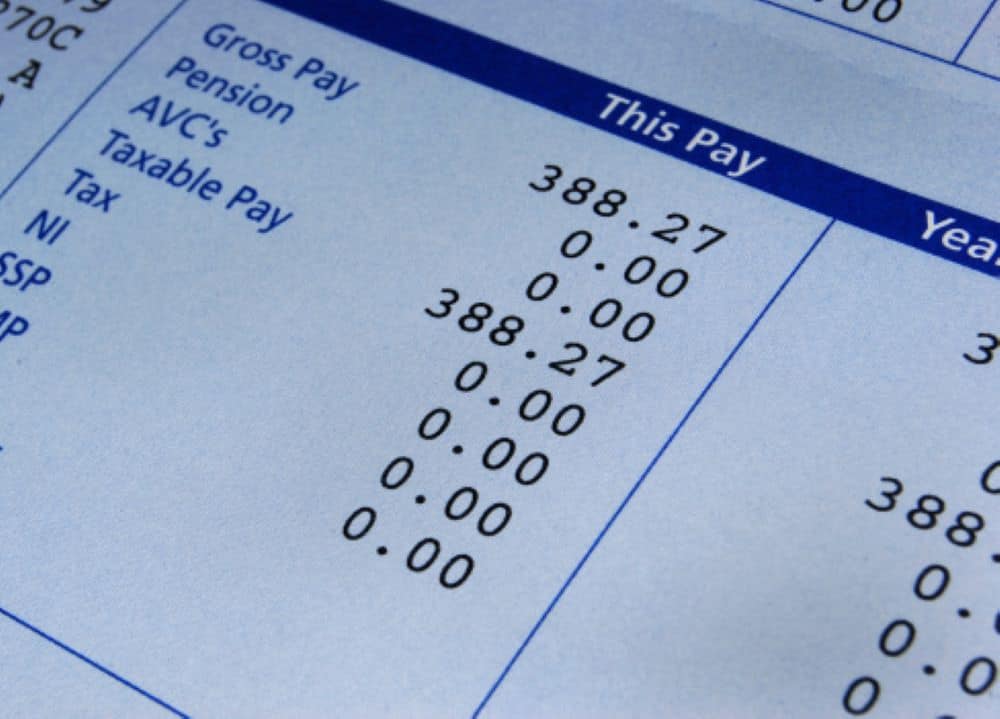

Gross pay is the total regular hours worked times the hourly rate you pay each employee. This yields the total amount of wages before you apply deductions and subtract taxes.

So, if employee A works 40 total regular hours in one week at a $15 hourly rate, their gross pay would be $600 (40 x 15 = 600).

In some cases, employee A may work a bit of necessary overtime during the week. In that case, you would add in the overtime before doing anything else.

The federal government mandates that all businesses pay employees who qualify for overtime at a minimum of 1.5 times their regular hourly rate.

To figure out employee A’s overtime rate, you would multiply $15 by 1.5 to get $22.50.

You would then multiply that dollar amount by the number of hours over 40 that they worked during the week.

For example, employee A works 43 hours one particularly busy week. Their regular pay is $600 (see the previous section), but you have to pay them overtime for the three extra hours they worked.

In this case, you would multiply those three overtime hours by the $22.50 overtime pay rate for a total of $67.50 (3 x 22.50 = 67.50).

Finally, add the overtime pay to the regular pay to reach their true gross pay ($600 + $67.50 = $667.50).

Depending on what benefits your business offers and how each employee fills out their W-4, this is the point where you apply those voluntary deductions.

Examples of things you might subtract from an employee’s gross pay include:

Applying the deductions is easy: just add up all the numbers for a total dollar amount and then subtract that amount from the gross pay.

Calculating taxes and subtracting them from your employees’ paychecks is one of the most important parts of payroll processing.

If your numbers are incorrect — or you don’t do them at all — your business can face significant legal trouble and hefty fines down the road.

The best way to ensure that you calculate taxes correctly and are in compliance with all local, state, and federal laws is to talk to an attorney or an accountant familiar with your business and the area in which it operates.

At this point, you’ve calculated gross pay (including overtime), applied voluntary deductions, and subtracted taxes from the total.

The last bit of math left to do is to determine net wages (or the amount of money left after subtracting mandatory expenses).

Crunching the numbers to reach net wages involves subtracting any other mandatory expenses your business might have, such as:

When you’ve removed any of these expenses from the after-tax gross pay, the rest belongs to the employee.

The last thing left to do in the employee-facing part of payroll processing is to cut checks and distribute them on payday.

But, as a business, your responsibility doesn’t stop there.

After you’ve gone through all the math necessary to calculate payroll taxes, you must send them to the proper authorities by the requisite due date.

Most taxes are due by the 15th of the following month — e.g., June taxes are due by July 15th — but be sure to consult with an attorney or an accountant in your area.

Processing your business’s payroll doesn’t have to be difficult and time-consuming. With the right tools, getting the data you need to produce employee paychecks may be just a few taps or clicks away.

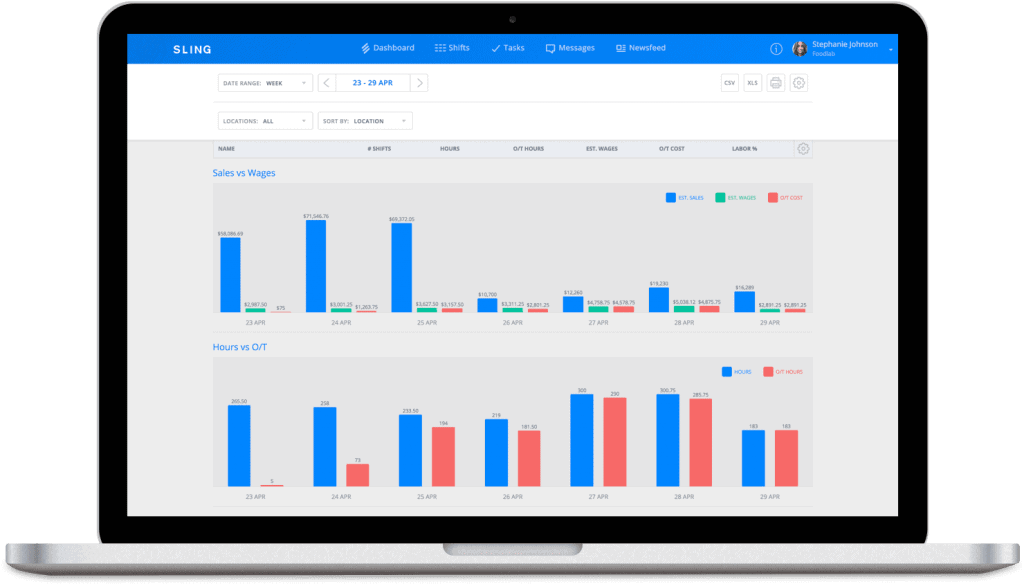

The Sling app, for example, makes employee data — including total hours, time-on-task breakdown, and overtime — available for review and processing any time you need it.

And, with the built-in time clock and labor cost controls, you don’t have to try to get multiple pieces of software to work together. Sling does it all for you.

At the end of the pay period, you can export data quickly and easily to integrated tools, such as Gusto and ADP, or produce reports in a variety of formats and manually transfer them to the payroll processor of your choice.

You can even import your numbers back into Sling once payroll processing is complete. This feature gives you the ability to analyze the data in-house and integrate it into future calculations and reporting.

And that’s just one aspect of what Sling can do for your business.

Whether you need help with team communication, task management, time tracking, labor cost control, multiple location control, or payroll processing, Sling is the perfect tool for the job.

To learn more about how Sling can help you manage your business better, organize and schedule your team, and track and calculate work hours, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.