The best way to calculate work hours: A must-have guide

Struggling to keep up with payroll? Let the experts at Sling show you a better w...

Gross pay vs. net pay is an important part of your business’s payroll process. But it can be a difficult concept to understand for managers, business owners, and employees alike.

The workforce management experts at Sling are here to help. In this article, we tell you everything you need to know to master the ins-and-outs of gross pay vs. net pay.

Gross pay vs. net pay is a confusing topic at first because, outside of the business, medical, and legal fields, we don’t use the word gross very often (unless we mean the more informal “disgusting”).

The formal definition of gross as it applies to currency and payroll is:

without deduction of tax or other contributions

At the most basic level, then, gross means “total.”

So when we’re talking about gross pay, we’re talking about the total pay your employee receives before you take out any taxes or deductions.

An easy way to visualize gross pay vs. net pay is to imagine that you’re sitting across a table from your employee, ready to distribute their salary or hourly pay for a given period.

To start, you place all their earnings on the table between you (perhaps, visualize a big pile of $1 bills). That’s their gross pay.

The formal definition of net as it applies to currency and payroll is:

the amount of money left when expenses are subtracted from the total amount received

Any employee’s net pay, then, is the money they receive after you subtract all deductions, taxes, outlays, and losses. Net pay is the final amount they receive on payday.

Going back to our illustration from earlier, you and your employee are sitting across a table from each other with a pile of money (their gross pay) between you.

You remove $20 here and $100 there to pay for various taxes and withholdings (as mandated by state and federal law).

When you’ve removed all the money from the pile that you’re legally required to remove, the rest belongs to the employee.

Sometimes it helps to visualize them wrapping their arms around the pile and pulling it towards them. Doing so can help you better understand the difference between gross pay vs. net pay.

When it comes to determining payroll, you calculate gross pay vs. net pay using different methods. You’ll also calculate gross pay differently for hourly employees vs. salaried employees.

For hourly employees, you’ll need two pieces of information:

Once you have that information, you add up all the hours they worked during your business’s pay period and then multiply that number by their hourly pay rate.

Here’s a handy formula:

Gross Pay = Hourly Rate x Total Hours Worked During Pay Period

Let’s put that formula to use with a “real-world” example.

Your employee, Ross, worked 40 hours during the first week in November. His pay rate is $20 per hour.

Plug those numbers into the formula and do the math to calculate Ross’s gross pay.

Hourly Gross Pay = Hourly Rate x Total Hours Worked During Pay Period

Hourly Gross Pay = $20/hour x 40 hours worked

Hourly Gross Pay = $800

This, of course, doesn’t factor in overtime, tips, commissions, paid time off, and so on. If those issues apply to your business, be sure to add them in to calculate an accurate gross pay.

When you hire a salaried employee, you agree to pay them a total amount every year.

To calculate gross pay for a salaried employee, you’ll need two different pieces of information:

The gross pay they receive each pay period is a function of the annual amount you pay them and the total number of pay periods in one year.

Here’s the formula that makes it all work:

Salary Gross Pay = Annual Amount You Agreed To Pay / Number Of Pay Periods Per Year

Let’s apply another “real-world” example.

When you hired Rachel, you agreed to pay her an annual salary of $50,000. With holidays and time off, your business operates on 48 one-week pay periods annually.

To figure out Rachel’s gross pay, plug those numbers into the equation.

Salary Gross Pay = Annual Amount You Agreed To Pay / Number Of Pay Periods Per Year

Salary Gross Pay = $50,000 / 48 pay periods

Salary Gross Pay = $1041.66

So, barring bonuses and other income, Rachel’s gross pay every week will be $1041.66.

In the discussion of gross pay vs. net pay, once you’ve used the different methods to calculate hourly gross pay and salary gross pay, the process for figuring out net pay is the same for both types of employees.

When it comes to gross pay vs. net pay, voluntary deductions are those that your employee chooses to withhold from their paycheck (usually through their W-4).

This includes deductions such as:

To illustrate, we’ll continue with Rachel’s example, but you could just as easily complete these calculations with Ross’ numbers as well.

Keep in mind that this is just the first of several steps in calculating net pay, so the equation will grow as we progress through the steps.

Net Pay = Gross Pay – Voluntary Deductions

Net Pay = $1041.66 – $100 (retirement contribution)

Net Pay = $941.66

Remember, that’s just the beginning of the formula.

Let’s move on to the next step to see what else you’ll need to subtract from your employees’ gross pay.

The two most common mandatory taxes are FICA and the federal income tax withholding.

Depending on where your business is located, you may also have state and local taxes to withhold. We’ll just deal with FICA and federal income tax in this example.

When it comes to these two taxes, it’s essential to remember that you’ll have to do some other calculations before you find a number to subtract from your employees’ gross pay.

For example, the FICA tax is 15.3% of an employee’s pay after voluntary pre-tax deductions ($941.66 in the example above).

As the employer, you pay half of this tax (7.65%) and your employee pays the other half.

There are yet more calculations, so be sure your HR department has all the details or talk to an accountant familiar with IRS mandates for your industry.

Here’s a continuation of our gross pay vs. net pay formula:

Net Pay = Gross Pay – Voluntary Deductions – Mandatory Taxes

Net Pay = $1041.6 – $100 – $11 (FICA) – $100 (Federal Tax)

Net Pay = $830.66

If nothing changes over the course of the year, since Rachel is a salaried employee, she will take home $830.66 every week for 48 pay periods. That’s her net pay.

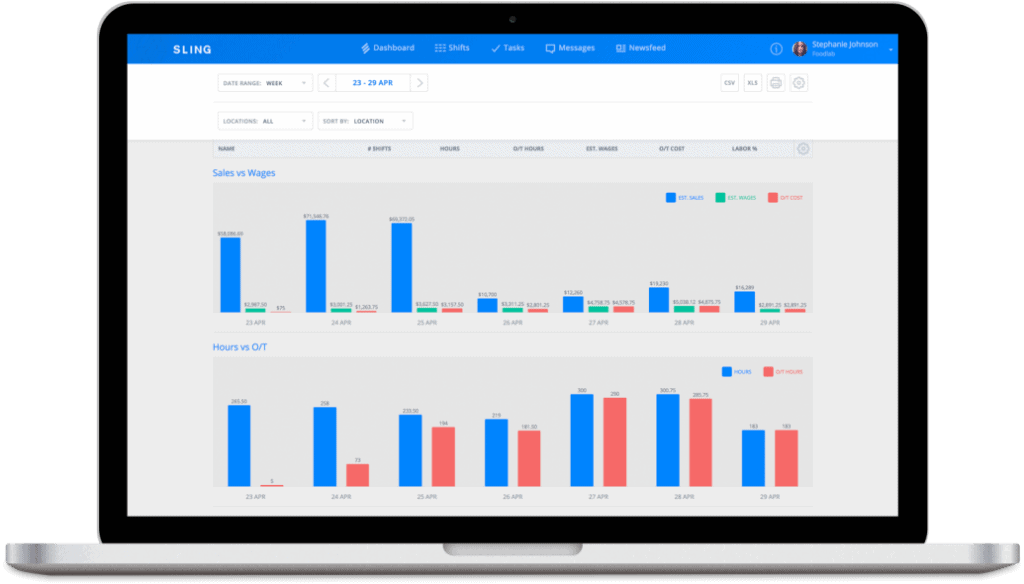

The best way to manage gross pay vs. net pay is to use a suite of software tools like Sling.

Labor costs are one of the largest expenses your business has to absorb. And since you can’t manage what you don’t measure, Sling gives you the power to optimize your spending — including gross pay vs. net pay — as you schedule so there’s less back-and-forth trying to stay under budget.

Sling even lets you optimize labor costs by setting wages per employee or position so you can see how much each shift will cost you.

You can keep track of your labor budget and receive alerts when you’re about to exceed those numbers. This will help you save money and increase profits.

But the power of the Sling app doesn’t stop there.

Sling gives you incredible control over your schedule so you can quickly and easily create schedules one month, two months, even six months or more in advance.

And the built-in artificial intelligence automatically reminds you of requested time off, double bookings, and overtime hours so you can finalize your schedule sooner.

Sling also acts as a time clock for your business.

You can set up a central terminal or allow your employees to clock in and out right from their mobile devices. And with Sling’s powerful geofencing feature, you can prevent early clock-ins and missed clock-outs with the touch of a button.

Gain unprecedented control over your schedule, your time tracking, your labor costs, and your gross pay vs. net pay with the Sling suite of workforce optimization tools.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.