How To Calculate Overhead Costs In 3 Easy Steps

To paraphrase a familiar expression: Nothing is certain but death, taxes, and ov...

You got into the restaurant business because you love food and you want to make people happy with that food. It’s a noble pursuit and one that seems relatively simple on the surface: make food, serve it to people. But underneath that simple premise is a whole host of complex responsibilities that you may not be trained for, nor particularly enjoy. Chief amongst those complex responsibilities is restaurant accounting.

Restaurant accounting is one of the most important aspects of making your business successful but is often overlooked (or avoided) because it can be difficult tracking and making sense of all those numbers.

But there is light at the end of the tunnel. Restaurant accounting doesn’t have to be feared and put off until the last minute. There are ways to simplify and streamline the process. This article will discuss ten steps to effective restaurant accounting.

Most of us are not trained accountants. Because of this, the terms we are forced to learn are like a completely new language. Yes, they’re English words but, they might as well be gibberish for all the meaning they convey. Terms like revenue, profit-and-loss, prime cost, red, black, and a whole host of others, can have your head swimming in no time. What exactly do those terms mean? What constitutes revenue and what constitutes expenses? What does a profit-and-loss statement tell me? What’s the difference between bookkeeping and accounting?

It may seem like an uphill battle, but just learning the definitions for the most important terms can give you incredible insight into the financial side of your restaurant. Websites like Investopedia can be a great start for those unfamiliar with the processes involved in tracking money. But if it just seems too daunting for you to handle, consider the next step as the most important.

Hiring an accountant to help you with your finances is a good idea for any and every restaurant. If the whole thing is just too confusing for you, or bookkeeping is too complex to manage, an accountant can handle it for you. Even if you’ve got a good grasp on the entire bookkeeping process, a professional accountant can help you interpret the information that your accounting produces.

Whether you’re just starting out in the restaurant business, or you’ve been doing it (and the accounting) for years, hiring an accountant is a great way to ensure that everything is being done correctly, that your business is profitable, and that you’re complying with all federal, state, and local tax and payroll laws.

To find the right accountant, talk to other managers, owners, or chefs to see who they use. Look for someone with knowledge of your local laws and experience in the restaurant accounting niche.

Whether you use an accountant for your day-to-day bookkeeping or not, you’re going to need to use the right tools to make your restaurant accounting easier. Tracking financials used to be done in complicated-looking, multi-columned ledgers. Those rows upon rows of figures would be enough to make even the most enthusiastic number lover rub their eyes in confusion. Thankfully, we no longer have to rely on ledgers and columnar pads. The computer has changed all that.

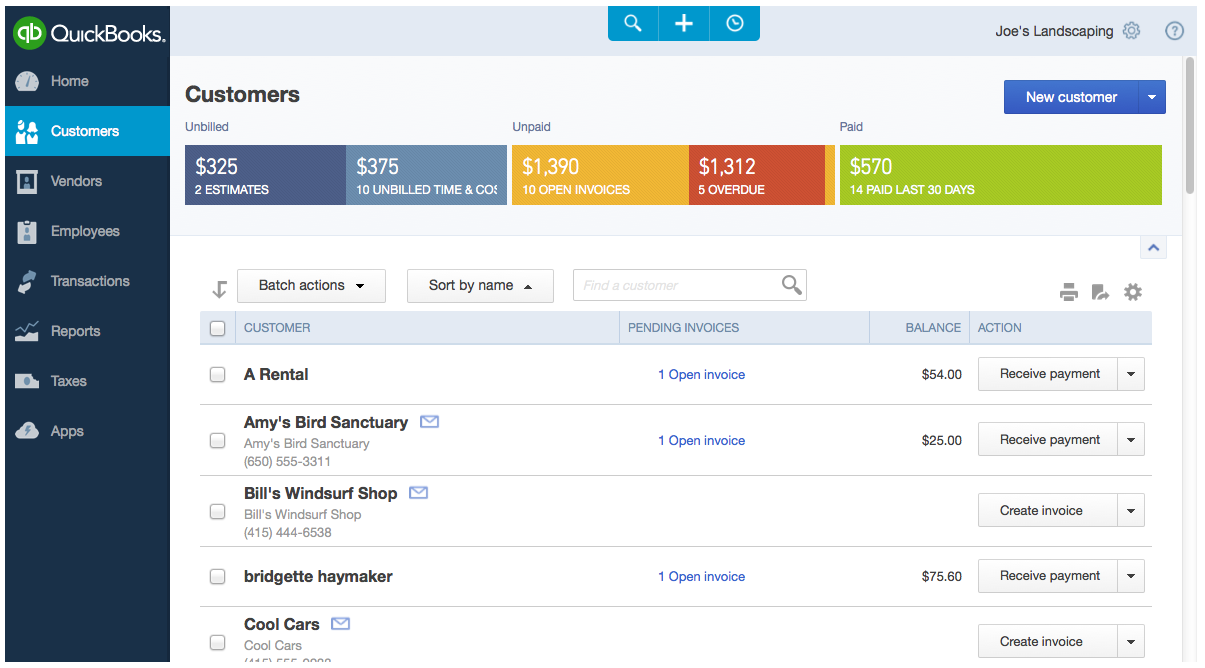

Accounting software products are everywhere these days so you’ve got plenty of choices. Brand-name products like QuickBooks even make specialized modules that are specific to restaurant accounting.

The nice thing about many of these tools is that they look like a checkbook—something that most of us have experience with. That can make the learning curve just a bit easier.

Whether you use accounting software or choose to go the paper-and-pen route, the numbers your need to record will be the same. Here’s a list and a breakdown of each.

We’ll delve deeper into the food inventory and food cost ratio in a section below. For now, it’s important that you keep track of daily food sales, food purchases, and any inventory on hand. These numbers become important at the end of the month.

For food sales, keep track of the amount of money your restaurant earned during each meal period of the day. If possible, record these numbers daily, or at least weekly.

You can also use the food sales worksheet you created above to record beverage sales. Be sure to categorize your number by drink type including beer, soft drinks, wine, and cocktails. As with food sales, record these number daily, or at least weekly.

The cashier’s summary keeps track of all the transactions entered at a single cash register. If you have more than one cash register, you need more than one summary sheet. The summary should include starting cash on hand as well as all dollar amounts run through that register. If possible, you should also categorize the credit card transactions by card company (e.g., Visa, MasterCard, American Express, etc.). Other numbers to make room for include sales tax collected, tips charged to credit cards, and how payment was made (e.g., cash, check, credit card, etc.).

A sales and cash summary keeps track of total food sales, total beverage sales, sales tax collected on each, tips charged, and other relevant data. You may also choose to further categorize this sheet by specific types of food and specific types of beverages if that helps you make sense of the numbers.

Operating expenses are also important for tracking your bottom line. You’ll need to record numbers like rent payments, depreciation, startup costs, loan payments, employee wages, employee benefits, insurance, payroll, marketing, utilities, administration expenses, necessary repairs, and maintenance, just to name a few. This is a great place to compare the total of all sales with the total of your operating expenses. That gives you a good idea if you’re in the red, breaking even, or turning a profit.

Finally, you’ll need some kind of break-even report. This analysis lets you know what needs to be done to break even and how long it will take to get there. This report uses a combination of numbers from the other areas of your business to project future earnings and expenses.

That’s a lot of data! It can be extremely overwhelming which is why we don’t suggest you try to do it with a pen and paper. Accounting and bookkeeping software make this process so much easier. You can link your accounting software with your point-of-sale system (see below), enter just a few sets of numbers, and then generate reports for each of the categories mentioned above, plus a whole lot more. Outside of hiring someone else to crunch the numbers, using a software program is your best bet for effective restaurant accounting.

As with hiring a bookkeeper, talk to your friends in the business and see what tools they use to track their restaurant accounting. Then, take advantage of free trials and investigate numerous programs. You don’t have to spend a lot of time trying every feature of the application. Just enter a few transactions and see if things make sense to you.

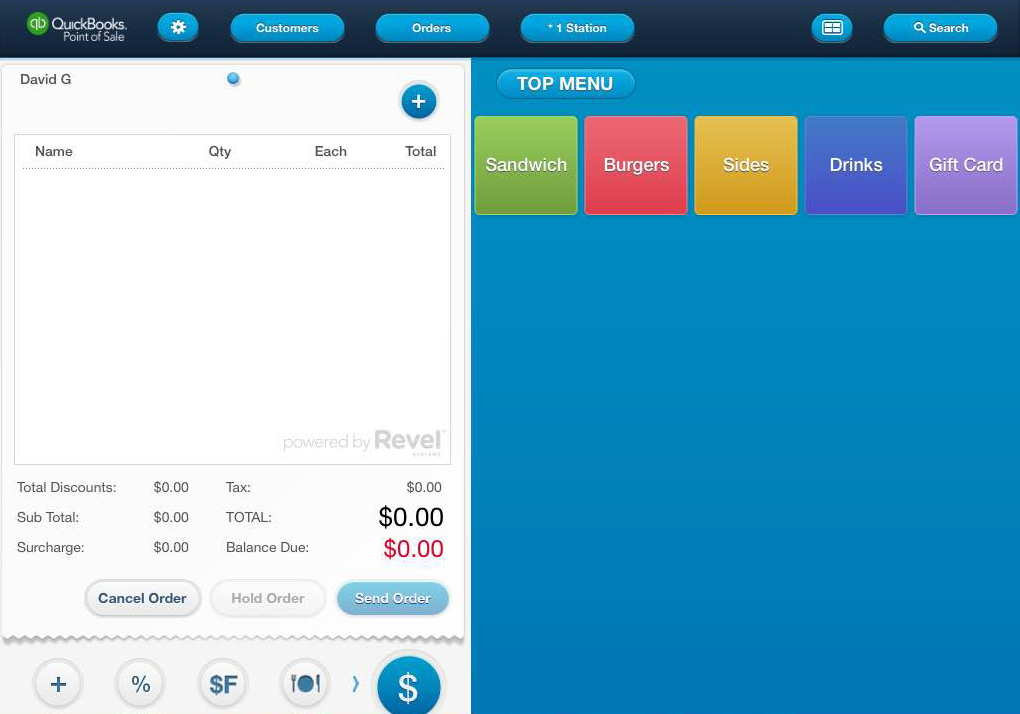

This step in the restaurant account process is often overlooked. It’s overlooked because many managers don’t consider the decidedly “front-of-the-house” point-of-sale (POS) system as applicable to the “back-of-the-house” accounting system. That’s a shame because the two systems are intimately intertwined.

Imagine being able to link your POS system and your restaurant accounting system so that you could track inventory and labor costs, methods of payment, and a whole host of other variables. How much easier would your life be if the two systems worked well together? I think that question answers itself.

Like accounting software, point-of-sale software abounds these days. We mentioned QuickBooks in the accounting section above. The company also produces QuickBooks Point Of Sale which connects your business to your books with hardware and cloud-based software. QuickBooks is not the only option out there but we bring it up to illustrate the level of integration that is possible when you correctly pair your point-of-sale system and your restaurant accounting software.

The vast majority of restaurant sales depend on credit cards. Most credit card terminals require that you close out that batch of transactions every day. When you do that, the credit card company starts the process of transferring that money to your bank account. Basically, you’re going to have a deposit every day.

Because of those daily deposits, it’s important that your bookkeeping—the place you record money in and money out—mirror that activity. Some restaurants will wait until the end of the week to record one “lump sum”, but that doesn’t give you an accurate picture of your day-to-day sales. Day-to-day sales are important because they affect other aspects of the business like inventory and payroll. Be sure to record all sales—all money that came in—on a daily basis to make the reporting easier in the future.

Every restaurant has expenses. Keeping those expenses under control is one of the best ways to make your business profitable. Depending on how you pay and the arrangements you’ve made with vendors, bills may come due once a month, every two weeks, or even weekly.

Start out by entering and paying your bills once a week. As you gain some experience with restaurant accounting, you may discover that while sales need to be recorded every day, expenses may only need to be recorded every two weeks. It all depends on how you pay those bills.

Whatever terms you work under, don’t let your bills pile up. Taking a half hour every other day impacts your busy schedule less than an hour-and-a-half every week or three hours every two weeks.

Here are 7 tips on how to prepare a restaurant budget

Yes, you could do the payroll yourself, but there a two good reasons why you should consider outsourcing the payroll portion of your restaurant accounting: liability and cost.

Payroll laws and taxes are constantly changing so staying in compliance with federal, state, local, and workforce requirements can be a full-time job. On top of that, if mistakes are made in withholding or payment, penalties and interest can be substantial. It’s better to have a trained, experienced professional handle your restaurant’s payroll so you don’t have to stay on top of all the complicated changes.

Another factor to consider is that of cost. Think about how long it would take you to slog through the payroll every week. Think about how long it would take you to stay current on all the myriad details that surround the different withholdings and taxes and fees for each employee. Now ask yourself, “What else could I be doing with that time?” There are, no doubt, much more important things you could be doing to help make your business profitable. The relatively small cost for outsourcing your payroll is more than offset by the time you save and the stress you do away with.

Financial reports are the movie screen on which your restaurant’s profitability (or lack thereof) is displayed. Those reports are how you know what’s going on behind the scenes. Additionally, financial reports provide insight into what you can do to take your restaurant to the next level. That’s why it’s important to produce those reports on a regular basis.

Concentrate on such numbers as sales vs. expenses, labor ratios, and prime cost. Another beneficial report is the profit and loss statement. This report can be produced weekly, monthly, quarterly, even yearly to show you in what directing your business is going financially.

But analyzing those reports can be a difficult proposition. What does that graph show? What does the difference between these two numbers mean? Is my restaurant heading in the right direction? This is where an accountant comes in handy. She can help you make sense of what all the numbers mean and make sure your restaurant accounting, and the restaurant itself, is on the right track.

Keeping track of your inventory and how it affects your restaurant can make or break your business. This is because food and beverage, along with labor costs, is by far your largest expense. Factor in non-perishable items like paper towels, cleaning supplies, tableware, and kitchen equipment, and you’re looking at 75% or more of expenses.

One way to see how your inventory impacts your bottom line is by calculating your restaurant’s food cost percentage. Here’s a simple breakdown of the process. For this example, we’ll focus on just food.

The equation figure out food cost percentage is:

(Beginning Inventory + Food Purchases – Ending Inventory) / Food Sales = Food Cost %

Before we delve into the final percentage, let’s define each term so you know where to find these numbers for your own restaurant.

Most restaurants just divide their food purchases by their food sales, but that number can be misleading. Here’s why.

Imagine that you inventory your food supplies on September 30th and then again on October 31st. This gives you a monthly inventory report with the following numbers:

September 30th Inventory – $3000 October 31st Inventory – $5000

During that month, your restaurant also generates the following figures:

Food Sales – $80,000

Food Purchases – $30,000

If you just used those last two numbers to analyze your profit and loss, you’d come up with the following:

\$30,000 / $80,000 = 0.375 or 37.5%

These numbers tell you that you spent $30,000 to make $80,000 for a profit of 37.5%. But what about the inventory that you already had on hand? That needs to be factored in as well. That takes us back to the original equation mentioned above.

(Beginning Inventory + Food Purchases – Ending Inventory) / Food Sales = Food Cost %

($3000 + $30,000 – $5000) / $80,000 = 0.35 or 35%

This second calculation tells you that you actually spent $28,000 (not $30,000) to make $80,000 in sales for a profit of 35%. Sure the difference in percentages is only 2%, but that is significant in an industry where the average profit margin is between 4% and 5%.

Restaurant sales are retail sales, and are therefore subject to local and state sales tax. In addition, employee payroll is subject to state unemployment, payroll taxes, Social Security, and Medicare taxes. Check local and state laws in your area to see if these taxes apply to your restaurant. If they do—which they most likely will—you must report sales and payroll amounts on a regular basis (e.g., monthly, or every three months). On top of all that, you must also pay federal income tax based on your business’ net profits. Most payments will occur every few months or annually, but schedules for local, state, and federal taxes are usually based on payroll volume and will be dictated by the IRS when you apply for an employer identification number (EIN).

Sales tax should be applied to every purchase a customer makes in your restaurant to cover the tax you will owe the state at the end of the month. Not sure how to calculate the monthly sales tax you owe for your restaurant? Here’s a simple formula.

Let’s look at an example. Let’s say the sales tax rate in your area is 5%. That means you will be charged 5% on all sales made during, for example, the month of May. You need to be charging your customers that 5% to cover the bill you’ll have. If you don’t, that tax will come out of your pocket and will seriously affect your profitability.

Once you know your sales tax rate (5%), multiply that by the total sales for the month. Keep in mind that not everything you sell may be taxable. Some items might be tax free in your state and may not require that you charge sales tax. This is important for both you, and your customers, so make sure you check with the appropriate agency to determine what is taxable and what is not.

Back to the example, let’s say you made $100,000 on taxable items during the month of May. Your calculation would look like this:

\$100,000 x 0.05 = $5000

That means that you will owe $5000 in sales tax for the month of May. See why it’s so important to charge your customers that number? A mere $5000 can mean the difference between just breaking even and actually making a profit.

Once you’ve calculated your sales tax, be sure to pay on time so you don’t accrue any penalties and late fees. These fees can quickly add up and will soon exceed that original $5000 you were supposed to pay. It’s not worth the risk to underpay (or not pay) your taxes on time and in full whenever you are required to do so. If you’re not comfortable calculating and paying taxes, hire a professional who can do it for you. The small price you pay for her services pales in comparison to the high price you would pay if you failed to file or filed incorrectly.

Don’t know what the sales tax is in your area? Look up your local sales tax information.

If all of this—learning the language, using accounting software, keeping track of all the numbers, and paying the appropriate taxes—feels overwhelming to you, don’t panic. In this case, we suggest you rely on steps two and seven: hire an accountant and outsource your payroll. Remember, the relatively small fees you pay for these services (which can be written off as operating expenses) can save you serious time and stress. That time and energy can be focused in other areas to help your restaurant remain profitable.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.