Restaurant Ratios and How to Use Them to Increase Profitability

Want to get control of restaurant spending and increase profitability? Learn how...

To paraphrase a familiar expression: Nothing is certain but death, taxes, and overhead costs. If you’re a manager or business owner, this maxim rings as true as its shorter counterpart.

That’s because overhead costs are something you always have to contend with whether you want to or not. They are part of the foundation of your business and often mean the difference between success and failure.

In this article, the management experts at Sling will answer all your questions about overhead costs and help you get a handle on this important business expense.

Table Of Contents

Overhead costs are recurring expenses that sustain your business but don’t contribute to income. These expenses are often called indirect costs because they are not part of business activities that generate revenue.

This type of cost can be divided into three categories: fixed, variable, and semi-variable.

Fixed overhead costs are the same from month to month. Examples include:

Variable overhead costs are affected by business activity. When business activity goes up, variable overhead costs will too.

Examples of variable overhead costs include:

Semi-variable overhead costs fluctuate slightly from month to month based on usage. Examples of semi-variable overhead costs include:

These divisions become less important when you calculate overhead costs, but it’s vital to the operation of your business to know the difference between the three types.

Overhead costs are not the same for every business.

For example, if you run a recording studio, you might categorize rent as a direct cost because it contributes to revenue. But if you run an ad agency, you might categorize rent as an overhead cost because the building in which you work doesn’t affect your income.

If you’re unsure how to classify an expense, talk to an accountant familiar with your industry.

Depending on your business, overhead costs make up a large portion of the money you spend every month. Knowing and controlling them can mean the difference between profit and loss for your business.

Here are a few benefits of calculating your overhead costs:

Now that you understand what overhead costs are and why they’re important, let’s turn our attention to how to calculate and control them.

The easiest way to get started calculating your overhead costs is to look at a list of expenditures from the previous year. You don’t need every transaction, just the general categories.

Here’s a basic list of yearly expenses:

If you use an accounting program, print out a report that lists these annual expenses. Or take a look at your income tax report to see what the IRS categorizes as expenses.

The yearly numbers you see in step one are just totals. They’ll give you a general idea of what you’re spending, but it’s more useful to reduce those numbers to a monthly component.

Why look at a month and not just the year? Because even if you pay certain expenses on an annual basis, you should set aside money every month to cover the cost.

Insurance is a prime example. Your insurance bill arrives every twelve months, but you don’t want to leave it to chance that you’ll have enough money to cover this expense. Divide your premium by 12 and earmark that amount only for insurance at the end of the year.

Other expenses — like electricity and natural gas — are pretty much the same from month to month, so you can base your overhead costs calculations off the bill they send you.

Here’s a basic example of monthly expenses:

Remember, overhead costs are what you spend just to keep your doors open. The money you spend to buy a cake for your head waitress’s birthday isn’t this type of expense.

Now that you know what you spend every month on electricity, insurance, wages, etc., add up those numbers to calculate your monthly overhead costs.

TOTAL $1800

The sum of all your recurring monthly expenses makes up your overhead costs.

Now that you know your overhead costs, you can calculate your overhead rate. Overhead rate is a comparison of your overhead costs to your revenue. This number is usually expressed as a percentage of your income. Here’s the formula for overhead rate:

Overhead Rate = Overhead Costs / Income From Sales

Let’s say you brought in $28,000 last month and spent $1,800 in overhead costs. When you plug those numbers into the equation, it looks like this:

Overhead Rate = $1,800 / $30,000

Overhead Rate = 0.06 or 6%

For every dollar you made last month, you spent $0.06 on overhead costs. That’s pretty good. But, obviously, the lower your overhead costs the higher your profit.

Armed with the overhead cost data mentioned above — including overhead rate — you can calculate other key metrics for your business.

Depending on the type, size, and accounting practices of your business, you may not need some of this information, but you can always tailor equations to your own particular circumstances.

For example, your business may find it more useful to examine overhead costs on a per-unit basis rather than according to billable hours. If that is the case, simply substitute your per-unit numbers in the billable hours equation.

Let’s examine some of the more common metrics you can utilize once you have calculated your overhead costs.

As the name suggests, a break-even analysis is a set of numbers that measures the point at which your business breaks even (and then begins to make a profit).

Ideally, the price you charge for your product or service should cover your overhead costs and other expenses, as well as leave a bit left over as profit. The break-even analysis will help you see what you need to charge to maximize profit.

The equation for this metric is:

Break-Even Point = Overhead Costs / (Sales Price – Variable Costs)

Variable costs, in this case, are expenses such as materials, labor, and other outlays that change based on hours worked and units produced.

Let’s say your overhead costs are $10,000 per month, your sales price is $22, and your variable cost is $2 per unit.

Plug those numbers into the equation and you get:

Break-Even Point = $10,000 / ($22 – $2)

Break-Even Point = $10,000 / ($20)

Break-Even Point = 500

The results of this calculation show that you need to sell 500 units in one month to cover your overhead costs as well as your variable costs (i.e., break even).

Is that a realistic number for your business? If not — if you estimate you’ll only sell 250 units per month — you’ll need to work to reduce overhead costs, variable costs, and other expenses in order to break even.

The price you charge per hour should be enough to cover the overhead costs necessary to do business.

If you don’t include your overhead costs in the price you charge for work done, you’re actually spending more than you’re making. That deficit will accrue over time and become a drain on your bottom line.

Here’s how to calculate a billable hour price that includes overhead costs:

Billable Hour Price = (Monthly Overhead Costs / Total Monthly Billable Hours) + Hourly Rate

Let’s say your business generates the following numbers:

Plug those numbers into the billable hour price equation and you get:

Billable Hour Price = ($2,000 / 480) + $50

Billable Hour Price = ($4.17) + $50

Billable Hour Price = $54.17

With a billable hour price of $54.17 (perhaps rounded off to $55), your business will bring in enough capital in a month to pay all the team members that did the work ($50/hour) plus the overhead costs necessary to make their work possible.

As we mentioned at the beginning of this section, your business may operate on a per-unit basis rather than a billable-hour basis. That’s OK.

You can tailor the billable hour equation to determine a per-unit price that also pays for overhead costs.

Per-Unit Price = (Monthly Overhead Costs / Total Units Sold) + Current Price Per Unit

For this example, our hypothetical business has monthly overhead costs of $2,000, 250 total units sold, and a current price per unit of $50.

Here’s how to figure per-unit price with those numbers:

Per-Unit Price = ($2,000 / 250) + $50

Per-Unit Price = ($8) + $50

Per-Unit Price = $58

In order to cover the cost of overhead in the price you charge for your product — assuming you sell at least 250 units — you would have to charge $58 for each unit.

As you can see from that equation, eight dollars of that cost goes directly into paying overhead while the other $50 goes to pay variable expenses. Anything leftover (after deducting those variables from the unit price) is profit.

Overhead absorption rate is a calculation of the indirect costs that you should subtract from your income for variables such as indirect labor, materials, and other expenses that are not directly traceable.

All of this, as the title of this subheading suggests, should be absorbed into your overhead costs so you’re not overspending.

There are a number of ways to calculate overhead absorption rate based on the numbers you need for your business, including:

Let’s examine the first three in more detail.

This metric helps you separate direct material cost from your total product cost.

The equation is:

Direct Material Percentage = (Direct Material Costs / Overhead Costs) x 100

Here’s a hypothetical calculation:

Percentage On Direct Material Cost = ($7,000 / $20,000) x 100

Percentage On Direct Material Cost = (0.35) x 100

Percentage On Direct Material Cost = 35 percent

So, in this case, 35 percent of your overhead is dedicated to direct material expenditures.

Direct labor percentage is similar to direct material percentage except that it shows labor percentage rather than material percentage.

The equation is:

Direct Labor Percentage = (Direct Labor Costs / Overhead Costs) x 100

Again, we’ll use a hypothetical set of numbers to provide an example. In this case, we’re using data from a month of activity, but you can choose any time frame that is useful for your business.

Direct Labor Percentage = ($6,500 / $20,000) x 100

Direct Labor Percentage = (0.325) x 100

Direct Labor Percentage = 32.5 percent

This number shows that your overhead includes 32.5 percent labor expenses.

Once you’ve calculated direct materials percentage and direct labor percentage as part of your overhead absorption, you can use those two data points to figure out your prime cost percentage.

Prime cost is the sum of your direct material cost and your direct labor costs (Prime Cost = Direct Material Cost + Direct Labor Cost) as a function of overhead.

Here’s the equation:

Prime Cost Percentage = (Prime Cost / Overhead) x 100

Let’s plug-and-chug with the two direct costs from above to see what we get:

Prime Cost Percentage = (($7,000 + $6,500) / $20,000) x 100

Prime Cost Percentage = ($13,500 / $20,000) x 100

Prime Cost Percentage = (0.675) x 100

Prime Cost Percentage = 67.5 percent

Another calculation based on overhead costs that you can use to improve your business is overhead rate per employee.

To find this, first calculate your total labor cost for a given time period (e.g., a month). Be sure to include everything that goes into paying your team, including:

Next, plug that number into the following equation along with total overhead costs for the same time period:

Overhead Rate Per Employee = (Total Overhead Cost / Total Labor Cost)

Let’s say your business has a total overhead cost of $20,000 per month and a total labor cost of $5,000 per month.

Here’s the calculation:

Overhead Rate Per Employee = ($20,000 / $5,000)

Overhead Rate Per Employee = $4 per hour

That means for each hour your employees work, $4 goes to cover the costs of overhead.

Whether you need these numbers right now depends on where your business is in its lifecycle. But regardless of the size of your business or the number of employees, you can reduce overhead costs by reducing payroll.

One of the largest overhead costs that all businesses contend with is payroll. The wages you pay your employees likely make up the bulk of your monthly expenditures.

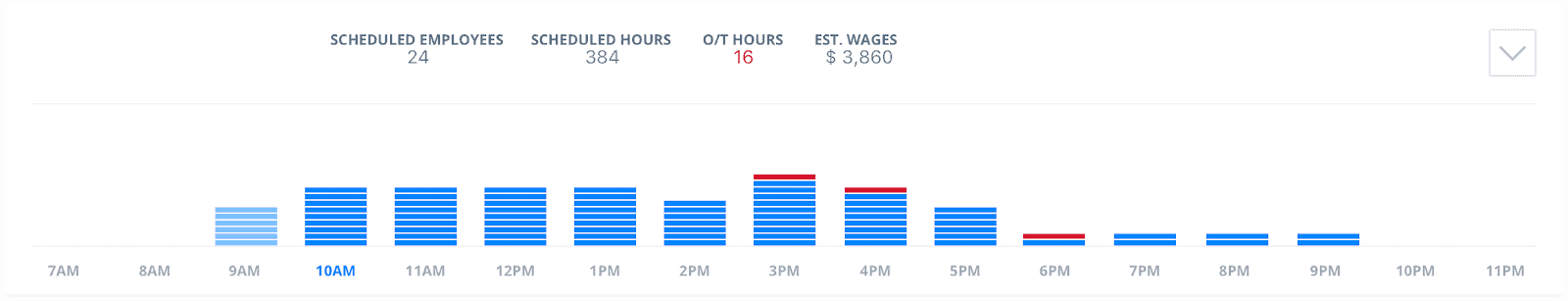

You can get control of those numbers — and reduce overhead costs in the process — by harnessing the power of apps like Sling.

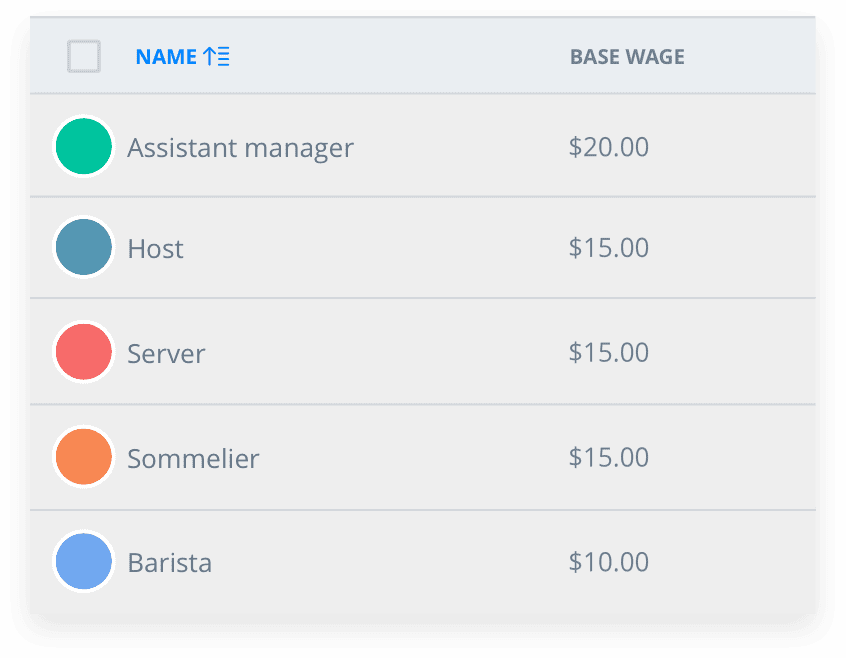

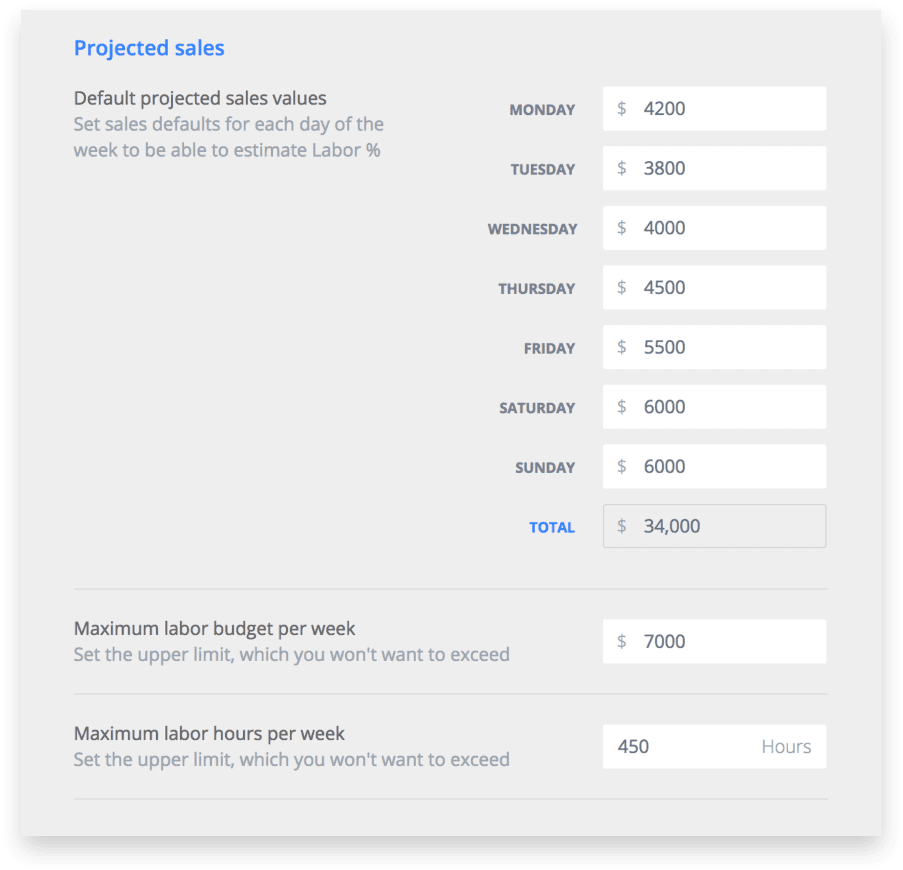

Sling’s labor costs feature gives you the ability to optimize your payroll as you schedule so that your spending doesn’t get out of control. You can set wages per employee or position and see how much each shift is going to cost.

Sling also helps you keep track of your labor budget and will alert you when you’re likely to exceed the numbers you’ve set. Sling will even notify you when you’re about to schedule someone into overtime so that you can make the necessary changes.

And that’s only one of Sling’s many features that will streamline and simplify the way you organize and communicate with your employees.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.