Exempt Vs. Non-Exempt Employees: What’s The Difference?

Deciding how to classify exempt vs. non-exempt employees can be confusing at fir...

Your business is unique to you, your location, and your team members. While no two businesses are the same, there is one universal truth that ties them all together: They must manage payroll, either on their own with tools and software or with outside help.

Whether you’re in charge of a small or large business, have one employee or 100, calculating employee paychecks and managing payroll correctly is one of the most important things you can do to keep your company on the road to success.

In this article, we discuss the correct way to manage payroll so you can set up a system that benefits your team and your business.

There are plenty of reasons why you should be actively involved in your business’s payroll process that go beyond the most obvious (that your employees want to be paid!).

We’ll get to the how-tos of managing payroll in just a bit. For now, let’s take a look at reasons why you as the owner or manager should be invested in the process.

One of the main reasons it’s important to manage payroll — and to do so correctly — is compliance with local, state, and federal laws.

If your business fails to abide by one or more of the mandates and due dates, it can face significant legal trouble and hefty fines down the road.

Another reason why it’s important to manage payroll accurately every time is employee morale. If your team can’t depend on receiving a correct check on payday, their job satisfaction, productivity, and efficiency will fall.

Accuracy is essential in the payroll process. Without it, it’s all too easy to fall outside the bounds of compliance and cause unnecessary friction between your business and your employees.

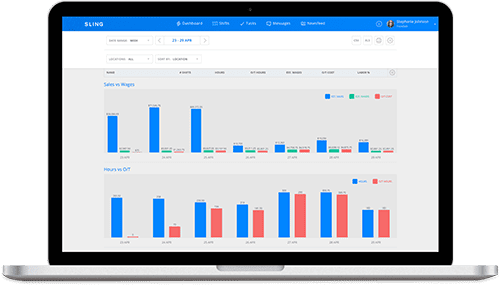

Human error is the biggest cause of miscalculations, missed payments, and other mistakes. You can remove this variable from the equation by automating many of the manual payroll processes with software, such as Sling.

Sling tracks your team’s wage and salary data, time on the clock, and more so you can manage payroll without spending time double-checking your work.

You’ll want to make sure you’re holding on to all the necessary data when it comes to your business’s payroll. Complying with local, state, and federal payroll laws involves long-term record keeping.

Government agencies may have questions from time to time, so it’s good to keep timesheets, pay stubs, and other wage-related data for at least three years.

Digitizing your records and keeping backups can significantly reduce the burden of manually storing files upon files in your office.

When you manage payroll correctly and efficiently — or hire another company to do it for you — your business saves time that can be better spent on more important, strategic objectives.

The old adage, “Time is money,” is never more true than when it comes to running payroll. If your payroll process is overly complicated or takes too much time to complete, you are losing time and money that could have been spent growing the business.

Plus, a complicated payroll process increases the risk of human error.

Before we dive into a basic discussion of how to manage payroll, it’s important to mention that the steps we outline are not an exhaustive description of the process.

Your business may need to add more steps to the list of actions or do more within each step in order to make your payroll complete. It all depends on the type of business you run and where your business operates.

So, whether you calculate payroll in-house or outsource it to another company (more on this later), be sure to review all federal, state, and local requirements — or consult with an attorney or accountant who is well-versed in your industry — before proceeding.

Whether you choose to manage your business’s payroll yourself or with the help of software like Sling, hopefully you now understand why it’s so important. With that in mind, let’s move on to how to easily and effectively manage your payroll.

Payroll depends on accurate data. So, to manage payroll correctly, the first step involves collecting all of the necessary employee data.

This includes:

With this information in hand, you’re ready to move on to the meat of managing payroll.

The hours listed on each employee’s weekly timesheet allow you to calculate their gross pay.

Gross pay is the total regular hours worked times the hourly rate you pay each employee. This yields the total amount of wages before you apply deductions and subtract taxes.

Occasionally, an employee may work overtime (which is typically any amount over 40 hours in a single week). In that case, the federal government mandates that all businesses pay employees who qualify for overtime at a minimum of 1.5 times their regular hourly rate.

So, if employee A works 40 regular hours at $12 per hour and five overtime hours at $18 per hour ($12 x 1.5 = $18), their gross pay would be:

Regular Pay = Regular Hours x Per Hour Rate

Regular Pay = 40 Regular Hours x $12 Per Hour

Regular Pay = $480

Overtime Pay = Overtime Hours x Per Hour Rate

Overtime Pay = 5 Overtime Hours x $18 Per Hour

Overtime Pay = $90

Gross Pay = Regular Pay + Overtime Pay

Gross Pay = $480 + $90

Gross Pay = $570

Gross pay is the number you use to calculate taxes and from which you deduct voluntary and mandatory expenses.

Net pay (a.k.a. take-home pay) is calculated by first deducting any benefits, contributions, and the like from the employee’s gross pay.

Next, withhold federal income tax, payroll taxes (i.e., FICA), and any other state or local taxes and withholdings that apply.

Finally, apply post-tax deductions, if necessary, for some types of benefits, retirement plans, and wage garnishments.

The number you’re left with after all of that is the employee’s net pay. For more details on these important calculations, take a few minutes to read these articles from the Sling blog:

Your business is responsible for paying half of the payroll tax (FICA) total calculated in the previous step. It’s also responsible for paying federal and state unemployment taxes.

Depending on where your business is located, other employer contributions may apply. Consult with an attorney or an accountant who is familiar with your industry and the area where your business operates.

This is the step that everyone jumps to when they hear the term manage payroll. But, as we’ve seen, the payroll process actually starts well before cutting checks.

However and whenever you choose to pay your employees (e.g., a paper check on the 15th and 30th of each month, a direct deposit once at the end of every month, or a pay card every week), be sure to do so accurately and consistently.

Once you’ve distributed the paychecks, update your records so that all information is in its proper place.

Depending on how you’ve set up the process and how you manage payroll as a whole, updating your records may involve filing paper pay stubs in the appropriate cabinet, saving a copy of a digital file as a backup, or both.

Either way, it’s vital to maintain accurate records of any payments you make that involve wages, overtime, and other employee activity.

So, now that you’ve paid your employees, that’s it, right? Not so fast. The next major step in the payroll process is sending the tax withheld and any employer contributions to the proper authorities.

Such payments are typically due by the 15th of the following month — e.g., May taxes are due by June 15th — but be sure to consult with an attorney or an accountant in your area for more details.

Finally, the federal government (and some state and local governments) requires businesses to file tax reports every few months (i.e., quarterly) or at the end of the year. Again, be sure to file said reports on time so your business can maintain its compliance.

If taxes and due dates are a speed bump for your business, don’t be afraid to hire an attorney or an accountant to get you started — that’s what they’re there for.

You may have to spend a bit up front, but doing so can save you money, stress, and time down the road and help you avoid running afoul of the IRS.

In many cases, restaurant payroll will follow the same process described in the previous section. But sometimes restaurant payroll can be a bit more complicated because you may encounter novel situations that don’t usually occur in other businesses.

For example, there may be times when a single employee performs two different jobs at two different pay rates and accrues overtime in the process.

These situations can certainly complicate some of the calculations we talked about earlier, but you can handle this with a bit of instruction and practice.

Managing payroll when an employee works two jobs at two pay rates

Let’s say you have an employee named Carl, who regularly works as a bartender for $20 an hour and accrues 35 hours at that job during a single week.

On Friday, one of the hosts calls in sick, so Carl agrees to cover the shift and work for $15 an hour (the standard host pay rate). He accrues a further eight hours at that pay rate for a total of 43 hours for the week.

First: Separate the total time worked into regular hours and overtime hours.

Second: Calculate Carl’s pay for the regular bartender hours.

35 hours x $20 per hour = $700 (regular bartender pay)

Third: Calculate Carl’s pay for the regular host hours.

5 hours x $15 per hour = $75 (regular host pay)

Fourth: Calculate Carl’s pay for the overtime host hours.

3 hours x ($15 per hour x 1.5 standard overtime multiplier)

3 hours x $22.50 = $67.50 (overtime host pay)

Fifth: Add up Carl’s regular bartender pay, regular host pay, and overtime host pay.

$700 + $75 + $67.50 = $842.50 (total gross pay for the week)

Keep in mind that these calculations are a variation of step number two — Calculate gross pay — in the How to manage payroll section from earlier in this article.

You still need to calculate net pay and determine employer contributions before writing Carl’s paycheck for the week.

As you can see from this simple example, managing payroll can get very complicated very quickly. There are a lot of rules to follow and a lot of fine points that can dramatically affect the final outcome.

Some businesses don’t have the staff, expertise, or time to perform these calculations in-house. Instead, they choose to outsource their payroll to a third-party company that specializes in crunching all the numbers required by law to make payroll complete.

But is outsourcing right for your company? Or would your business be better off conducting payroll in-house?

There are pros and cons to managing your payroll in-house. But there are also pros and cons to outsourcing your payroll to a third-party company.

There are five specific categories you’ll want to consider when choosing between outsourcing your payroll and managing it in-house. Let’s take a look.

Managing payroll in-house gives you complete control over the process. That can be both a benefit and a drawback in some cases.

Yes, you’ve got control over what’s going on, but you also have to be concerned about the level of detail your accounting team produces every time they run payroll.

If the control falters even just a little bit, your business can run into problems with employees and with local, state, and federal governments.

On the other hand, if you outsource your payroll, you have to give up the majority of control over the process. That can result in a loss of understanding about what the third-party company is doing with your numbers.

As a result, you may not be able to fix problems as quickly should they arise because you’ll first have to contact customer service and then wait for a response.

Managing payroll in-house means you can keep all of your sensitive company data — e.g., social security numbers, employee salaries, and business and employee banking information — as secure as possible.

Outsourcing your payroll requires your business to turn over that sensitive data to a third party, who will then store copies at their location.

While most payroll providers have strong security, there’s always a chance that a breach may occur. Even just having a second copy of your business’s sensitive data out there may be too much or a risk for some companies.

Managing payroll in-house can take a lot of time. If your business doesn’t have the trained personnel or the technology to automate large parts of the process, your team may be crunched for time at the end of each pay period.

In some cases, they may not be able to finish everything between the end of the work week when timesheets start rolling in and your scheduled payday.

Sending your payroll to a third-party company may result in faster completion (because their team has more training and they have access to specialized technology), but you also have to factor in transportation/transmission time.

Many businesses still rely on physical time cards for clocking in and clocking out. You may need to employ a delivery service to transport those time cards from your location to the third-party payroll company.

Depending on the distance between your companies, that can add days to the payroll process.

On the other hand, your business may have implemented a digital timesheet solution allowing you to send the information via the internet.

That can speed up the transmission time but may not be entirely feasible because of the number of employees you have, the size of the data, or any number of other factors.

Employing a team within your business to run payroll may increase the risk of errors creeping into calculations. This may result in non-compliance fees that can cut into your profits and lead to long-term problems with employees and local, state, and federal authorities.

Professional payroll companies, on the other hand, may be much more accurate in their calculations.

That said, errors can occur there as well. In those cases, however, third-party companies will often pay the fines and penalties for you as part of their service.

Businesses typically decide to manage payroll themselves in order to save money.

But in-house payroll comes with a whole host of added expenses, including:

Using an outsourced payroll solution can save your business from having to pay those expenses itself — which may add up to much more than you would pay a third-party company to do the work for you.

If your business chooses to conduct payroll itself, you will also have to contend with the cost of training new team members and updating the computers and tools that the payroll department uses on a regular basis.

Outsourcing your payroll sidesteps these worries and makes it much easier for your business to budget for future payroll needs because all you have to figure on is the third-party company’s fee for doing the work.

You don’t have to worry about the cost of onboarding new accountants, updating software, and replacing obsolete accounting computers.

The best way to manage payroll is with software that helps you with every step of the process. And we’re not just talking about crunching the final numbers.

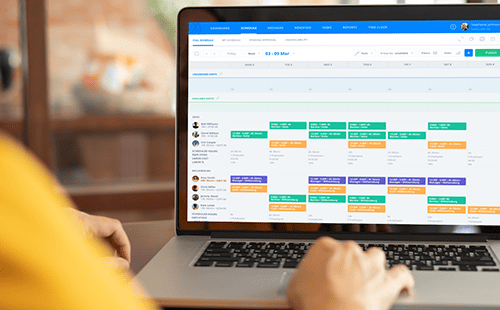

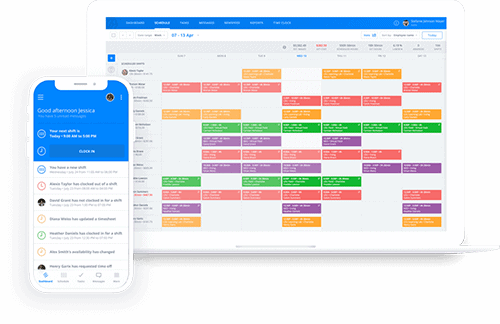

The Sling app, for example, simplifies payday by streamlining and automating many of the processes that come before it.

With Sling, you can:

You can even export data quickly and easily to integrated tools, such as Toast Payroll and Gusto, or produce reports in a variety of formats — both digital and hard copy — and transfer them to the payroll processor of your choice.

So, whether you need a tool to help you communicate with your team, organize and control necessary tasks, track time, control labor costs, or oversee multiple locations, Sling is the software for you.

And when you’re ready to simplify payroll and ensure your team is paid on time, try Toast Payroll & Team Management.

To learn more about how Sling can help you manage your business better, organize and schedule your team, and track and calculate work hours, browse our features page today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.