How To Best Prepare A Restaurant Budget To Control Costs

Discover the best way to prepare a restaurant budget and learn what software too...

When you think about it, creating a business budget is probably one of the least exciting responsibilities of being a manager or an owner. But knowing how much money is coming in and where that money goes can mean the difference between success and failure.

In this article, the management experts at Sling discuss budgeting 101 and give you tips on how to build a business budget for your company, regardless of size.

The time frame of your business budget refers not to how long the budget lasts but to the smallest unit of measurement you will analyze.

Some businesses budget by the day. Other businesses budget by the week. Still other businesses budget by the month, the quarter, or even the year.

You can even use multiple time frames in your budget if that makes the most sense for your business. For example, you know you have to pay rent every month, so your monthly income needs to cover that expense.

Instead of hoping you have enough cash at the end of 30 or 31 days, you can calculate how much income you need to bring in and set aside every week (or even every day) so you’re sure to have the right amount. That’s a combination of both a monthly and weekly budget time frame.

Once you’ve decided how to divide your budget, it’s time to crunch some numbers.

The second step in creating a business budget is to determine your total income. This number includes earnings from every channel within your business.

If you run a restaurant, for example, your primary income channel is probably food and drink sold and consumed in your dining room and bar. But you may also offer carryout or catering. Those are other income channels you need to include as part of your total earnings.

If you run a coffee shop, your primary income channel is probably similar to that of the restaurant — dining room sales. But you may also provide daily coffee delivery to local businesses (like catering) and operate a coffee truck on the weekends.

Add all of those income channels together to determine your total income.

The third step in creating an effective business budget is to divide your expenses into very specific categories.

Start by adding up everything you pay on a monthly basis to determine your total expenses. Total income is a good number to compare that with because it allows you to see whether or not your total income covers your total expenses.

If it doesn’t, you’re going to need to find other sources of income so you can pay for what you need to stay in business.

Next, go through each individual expense and place it into one of these six categories:

As you categorize your expenses, keep in mind that some costs will fall into more than one category. For example, rent is an essential, fixed, ongoing expense that you cannot afford to miss.

Food supply for a restaurant is an essential, ongoing, variable expense — meaning you might not need as many potatoes in June as you did in May — that you can tweak if absolutely necessary.

A new coffee machine for the employee break room, on the other hand, is an optional, one-time expense — meaning that you won’t have to pay for it every month — that you may be able to delay.

Once you have all of your expenses divided into the proper category, you can start earmarking your income so you won’t overspend and will be sure to have enough when the bills are due.

In the early stages of your business, it’s vital to pay your essentials before all other expenses.

Costs such as rent, employee payroll, utilities, supplies, and anything else that keeps the lights on, the doors open, and your customers coming back for more are necessary for the operation of your business.

These essential expenses may be fixed or variable (e.g., rent vs. the number of new napkins you need every month), but without them, your business is going to suffer.

If you reach the point where you have to decide between paying the rent and buying new uniforms for your team, rent always comes first — unless everyone ruins their uniform at the same time.

Think of these expenses as the bare minimum your business needs to survive. Because your business can’t do without them, you should always set aside enough money to pay for them each month — even if that means putting off other purchases until later.

Variable expenses are those that change from month to month or that you can increase or decrease based on the needs of your business.

Once you’ve set aside the money necessary to pay (a.k.a. budgeted for) your essential expenses, you can see how much cash you have left over. It might be a little. It might be a lot.

Whatever the amount, that’s what you have to work with to pay your non-essential variable expenses. If you can keep this category low — by, for example, perfecting your inventory control and reducing overtime — you can start saving for larger expenses that you’ve been putting off.

To stay within the business budget you’ve created, it’s imperative not to let your expenses exceed your income. It’s difficult to adjust spending within the fixed and essential categories, but you can certainly cut costs within the variable, optional, and one-time categories.

This is where the next step becomes important.

When you’ve established the basics of your business budget — total income, total expenses, and sub-categorized expenses — it’s time to start planning for the future needs of your company.

Equipment will break down. You’ll need to remodel the dining room at some point. You may need to hire another server to cover gaps in your schedule. You may need to upgrade your POS technology.

With the money left over after paying your essential expenses and your variable expenses, you can earmark funds for these future needs.

If there is no money left over, you have two options:

Either way, you want to make sure that your expenses don’t exceed your income. Ultimately, that’s what creating a business budget is all about: ensuring that your business operates within its means without going into debt.

Creating a budget is a fundamental first step for every manager. Controlling that business budget is essential if you want your organization to succeed.

One of the best ways to do that is to manage and optimize your workforce so as to keep labor expenses under control and under budget.

Managing and optimizing your workforce begins with streamlining and perfecting your business’s scheduling process so you have all shifts covered. It then continues with tracking work hours, communicating with your employees, coordinating tasks, and much more.

That’s where Sling can help.

Sling is a suite of workforce-management tools that is perfect for startups, small businesses, medium-sized businesses, and even large corporations.

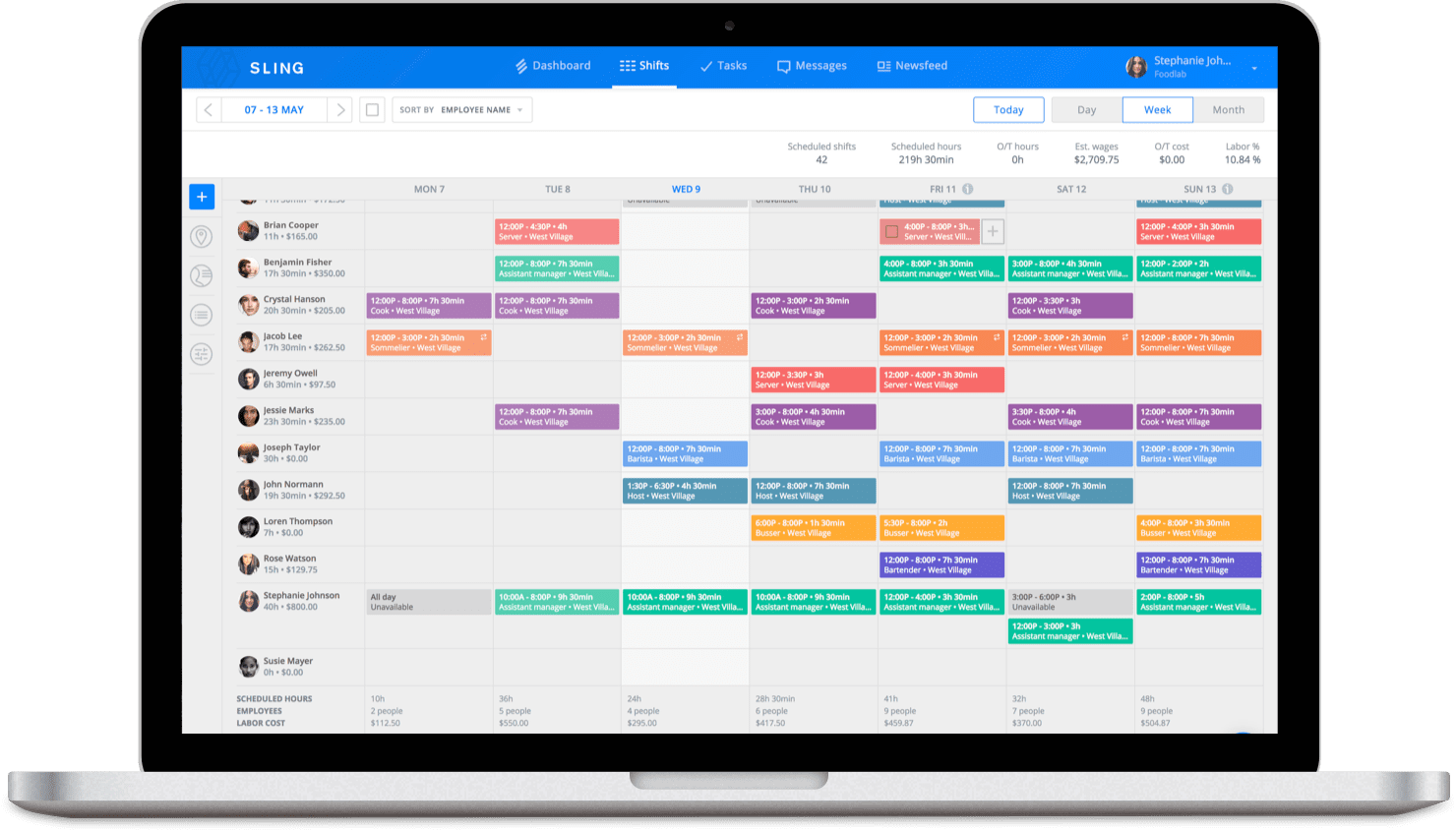

With Sling’s industry-leading scheduling platform, you can create complicated staff rotas — including rotating shifts, overlapping shifts, and night shifts — in minutes instead of hours and distribute the schedule to your employees with just the click of a button.

In addition, Sling allows you to calculate staffing requirements well in advance so you can factor in upcoming leave and give your employees ample notice about when they will work.

Sling even provides onboard artificial intelligence that alerts you to conflicts in the schedule (e.g., overtime, double bookings, and time-off requests) so you can finalize your schedule sooner.

All of that — and much more — makes Sling the easiest and best way to streamline your scheduling process, keep labor costs under control, and stay within your business budget.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.