Exempt Vs. Non-Exempt Employees: What’s The Difference?

Deciding how to classify exempt vs. non-exempt employees can be confusing at fir...

“What is comp time?” is a common question among managers and owners because this unique method of reimbursing overtime is not all that common. And, in some cases, it may even be illegal.

In this article, the workforce management experts at Sling answer the question above and discuss everything you need to know to make an informed decision about whether or not to use it in your business.

Comp time goes by many different names, including compensatory time and, much-less common, compensation time. Whichever term you use, read, or hear, they all come back to the same concept.

Compensation time is the practice of providing “payment” for overtime hours in the form of time off instead of overtime pay.

For example, let’s say you have an employee who works 48 hours in one week.

Instead of paying time-and-a-half (the typical overtime rate) for the eight hours above the regular 40, you give the employee eight hours off in another week as compensation for the overtime they worked.

As we mentioned in the introduction, it may be illegal for your business (at the state level, the federal level, or both) and you may be setting yourself up for hefty penalties and the possibility of expensive lawsuits.

It’s important to research the laws and statutes of comp time as they apply to your business before including this type of compensation in your payroll structure.

For the most part, it comes down to two variables:

We’ll discuss this second variable in the next two sections.

According to the Fair Labor Standards Act (FLSA) — a set of rules and guidelines set by the federal government — an exempt employee in a private business is one who meets the following criteria:

Exempt employees do not qualify for overtime. They do, however, qualify for comp time.

Because you pay exempt employees on a salary basis (their annual compensation is set), comp time acts as a “payment” of sorts for any hours they work over the regular full-time schedule.

That said, your business is not required to offer comp time to exempt employees if it chooses not to. Whether or not to offer comp time is solely up to the employer.

Those who do incorporate it into their pay structure often view it as a fringe benefit of sorts they can use to attract high-potential team members and retain high-performing team members longer.

If you choose to offer comp time to exempt team members, it’s essential to create a policy in your employee handbook so the benefit is managed properly.

It’s also a good idea to talk to a lawyer familiar with your industry before deciding to offer it in your business.

According to the Fair Labor Standards Act, a non-exempt employee in a private business is one who meets the following criteria:

Non-exempt employees do not qualify for comp time. They do, however, qualify for overtime.

Because you most often pay non-exempt employees on an hourly basis, the federal government views comp time as a way for businesses to get around paying hourly employees overtime for any hours they work over their regular part-time schedule.

In essence, the federal government views comp time as a way for businesses to take advantage of hourly employees and avoid paying higher overtime rates. They’ve, therefore, made it illegal to give non-exempt employees comp time.

Again, before you consider adding this form of compensation to your payroll structure, talk to a lawyer about how comp time does or does not apply to your business.

Even after learning about comp time, many managers ask, “What is comp time vs. overtime?” and, “How do the two compare when it comes to payroll?”

Here’s an example to answer both of those questions.

Let’s say you have an employee who works 48 hours in one week (from earlier in this article).

For 40 of those hours, you would pay the employee their regular wage (e.g., $10/hour). But, for the other eight hours, you would pay the employee at an increased rate.

That increased rate is typically time-and-a-half or, in this case, $15/ hour ($10 x 1.5 = $15). So the employee’s total paycheck for the week would be 40 hours at $10/hour ($400) plus eight hours at $15 ($120) for a total of $520.

That might not seem like much at first, but if the employee consistently works eight hours of overtime every week, you would have to pay them an extra $5,760 annually.

Now multiply that by the number of employees on your team and you can see how the cost for overtime pay can quickly add up and affect your bottom line.

What makes comp time so appealing is that businesses can avoid the high cost of overtime labor by giving employees time off instead of paying them.

So, if your employee worked 48 hours one week, with comp time, you could give them the following Wednesday off (eight hours) and only pay them for the 40 regular hours they worked.

You can see how this would have a significant impact on your labor cost budget.

The money you save using comp time could be channeled into improving your business, building inventory, or expanding your customer base.

But remember, in many cases, comp time is illegal and can open your business up to all manner of financial and legal penalties.

Penalties for violating comp time laws can be extremely harsh whether you knowingly or unknowingly violated the FLSA.

Those penalties include:

It’s also illegal to ship goods your business produces while violating comp time laws, so it’s easy to see how complicated the situation quickly becomes when you disregard federal, state, and local comp time laws.

To prevent any issues, be sure to talk to a lawyer before considering comp time in your business.

The best way to avoid the penalties and difficulties of comp time and the expense of overtime is to incorporate a scheduling tool, such as Sling, into your workflow.

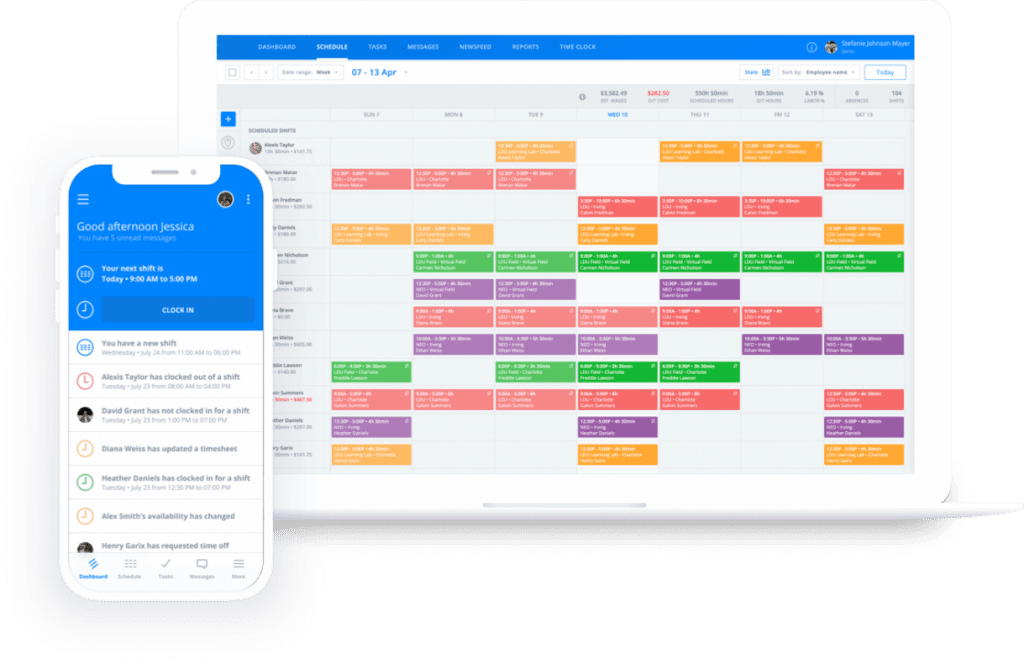

We designed the Sling app with a suite of tools that work together to streamline your scheduling process and all your workforce management tasks.

The user-friendly interface provides notifications of overlapping shifts, double-bookings, and overtime and makes it easy to see how many hours each team member will work each week.

And, thanks to its flexibility and built-in artificial intelligence, Sling makes quick work of even the most complicated schedules and overtime accumulation.

What once took hours with other methods now takes minutes thanks to:

Sling even provides features that help you distribute your schedule efficiently, keep it up to date, and find substitutes in an emergency.

Sling truly is the turn-key solution for all your scheduling, comp time, overtime, and workforce optimization needs.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.