Exempt Vs. Non-Exempt Employees: What’s The Difference?

Deciding how to classify exempt vs. non-exempt employees can be confusing at fir...

Managers in the 20th century often served as their own payroll hours calculators. That meant extensive time spent manually number-crunching using paper, pencil, and a calculator or one of those old adding machines.

Thankfully, technology has advanced enough that many managers now have software to do the math for them. Even with these advances, it’s still essential to know what goes into the process of calculating each employee’s work hours for the pay period.

In this article, we’ll discuss the steps involved in running your own payroll hours calculator, give you tips for making it more accurate and pain-free, and then introduce you to technology that does all the math for you.

(If you’re brand-new to the payroll process and need to go over some of the basics of doing payroll yourself, this blog might be a helpful place to start.)

If you decide you’d prefer to crunch the numbers yourself rather than using software or another tool, here’s everything you need to know about calculating payroll hours for your team.

The first step in the payroll hours calculating process is to add up the total hours an employee worked during your business’s pay period.

There are two common ways to do this: with actual time or rounded time.

Using actual time to calculate the total hours worked means using the exact numbers recorded on the employee’s timesheet (either digital or the paper kind), down to the minute.

For example, imagine that your employee, Miranda, has turned in the following time card for the workweek:

With that information, you would first determine how many hours she worked each day.

Depending on how you feel about long-form addition, the easiest way to find the total hours worked for the week is to add up all the hours and then add up all the minutes.

Hours worked

8 + 8 + 8 + 8 + 8

–––––––––––––––––

Total hours worked = 40

Minutes worked

15 + 10 + 4 + 4 + 4

–––––––––––––––––

Total minutes worked = 37

So, Miranda worked a total of 40 hours and 37 minutes for the pay period.

But we aren’t finished yet. You can’t use that number to calculate gross pay because it’s not in decimal format. We’ll get to that in step two. Now, we’ll show you another way of calculating total hours worked: the rounded time method.

Calculating an employee’s time on the clock using the rounded time method involves rounding the time up or down to give yourself cleaner numbers to work with.

But be careful: There are strict federal laws that govern the practice, and mistakes can lead to trouble for your business, not to mention your employees feeling cheated if their time is miscalculated.

Here are the basic rules:

Recorded times such as 9:07 a.m., 9:22 a.m., and 9:37 a.m. are rounded down to the nearest 15-minute interval (9:00 a.m., 9:15 a.m., and 9:30 a.m., respectively).

Recorded times such as 9:08 a.m., 9:23 a.m., and 9:38 a.m. are rounded up to the nearest 15-minute interval (9:15 a.m., 9:30 a.m., and 9:45 a.m., respectively).

Now, let’s see how this looks in practice by using our trusty employee Miranda’s example timesheet:

When we apply the rounded time method to Miranda’s time card, we get:

When we add all those numbers together, the total hours worked for the pay period (using rounded time) comes out to 40 hours and 30 minutes.

Great! That’s a nice round number. But just like the actual time method above, you can’t use that number to calculate gross pay. You have to convert it to decimal format first.ust like the actual time method above, you can’t use that number to calculate gross pay. You have to convert it to decimal format first.

Whether you use the actual time or rounded time method, you should now have the total hours and minutes your employee worked for the pay period. But there’s one more step before you’ll know how much to pay.

Because the wage you pay your employees is based on increments of one hour, you’ll have to convert their total time to decimal format before multiplying it by their wage to calculate gross pay.

To convert from minutes to a decimal, divide the minutes by 60 or just refer to the handy chart above.

So, for example, if we use Miranda’s actual time worked (40 hours and 37 minutes), it would convert to 40.62 hours. If we use Miranda’s rounded time worked (40 hours and 30 minutes), it would convert to 40.50 hours.

With those decimal equivalents in hand, you’re ready to calculate the wages to pay for regular hours worked and overtime hours worked (more on this later).

Standard time format is what you see when you look at most digital clocks in the States. The hours range from one to twelve, and “a.m.” or “p.m.” differentiate between morning and afternoon.

(Did you know a.m. and p.m. stand for “ante meridiem” and “post meridiem,” respectively? That’s Latin for before and after midday.)

Twenty-four-hour time (a.k.a. military time) counts the morning hours just like the standard format (e.g., 7:24 a.m., 9:11 a.m., 11:47 a.m., etc.). But after 12:59 p.m., 24-hour time keeps the hours rolling up to 24. For example, 1:00 p.m. becomes 13:00.

You’ll notice that you don’t need the “p.m.” to indicate afternoon as you do with standard time format. That’s because the other one o’clock (in the early hours of the morning) is written 01:00.

Wondering why we’re telling you all this? Because using a 24-hour time format makes calculating hours worked (including overtime) much easier if you choose to do it manually.

For example, let’s say Miranda clocked in at 9:00 a.m. (standard format) and clocked out at 5:00 p.m. You’re going to have to do some roundabout math to calculate the hours worked because you can’t simply subtract one number from the other.

Now, let’s say that Miranda clocked in at 09:00 (24-hour format) and clocked out at 17:00. Calculating the hours worked becomes a simple matter of subtracting nine from 17 to get eight. Miranda worked eight hours that day.

Very rarely will every one of your employees clock in and out precisely on the hour. There are going to be some people early and some people late. This is where a rounding policy comes into play.

As we mentioned earlier, the U.S. Department of Labor recommends keeping track of hours worked in fifteen-minute increments. Before calculating payroll hours, determine if you will use a rounding policy and what that will look like.

Above and beyond the basic math of the process, another big part of running a successful payroll hours calculator is to comply with all local, state, and federal laws and regulations.

To do that — to make sure your business is in compliance at all times — regularly review the federal mandates that apply to your operation and make changes when and where necessary.

It’s important not to skip this step because local laws may supersede federal laws or vice versa on everything from breaks to employee exemption.

For example, while we talked about rounding work hours to the nearest 15 minutes, the federal government also allows for rounding work hours to the nearest 10 minutes if that works better for your business.

That said, a local law in your area may dictate that businesses use the 10-minute rounding rule rather than the 15-minute rounding rule.

If you were to somehow miss that and implement the 15-minute rule instead, your business could face stiff penalties, fines, and even legal action in some cases.

To avoid any potential issues associated with setting up a payroll hours calculator, tallying work hours, and figuring out payroll, consult with both a legal and a tax professional before, during, and after your processes and systems are in place and running.

Doing so early on ensures that everything from the clock-in/clock-out process to the way you distribute checks and pay taxes proceeds according to all local, state, and federal guidelines.

It’s then beneficial to ask said professional to conduct an audit at least once a year — more if you feel it’s necessary — to make sure that any changes don’t slip by you unnoticed.

Regardless of the type of business you run, the number of employees you have, or where your operation’s located, automating your time tracking process with workforce management (WFM) software is the best way to keep everything running smoothly.

Advanced WFM apps, like Sling, come with features that make it easy to:

And those are just a few of the benefits you can enjoy when you implement a workforce management app to help you calculate payroll hours.

For more information on the best way to automate your employee time tracking process, check out these articles from the Sling blog:

When it comes to the actual math of calculating payroll hours, one of the most important things you can do is ensure that your numbers are as accurate as possible.

Even small inaccuracies can quickly add up and cost your business hundreds, if not thousands, of dollars per employee every year.

One of the largest sources of inaccuracies that most businesses face is time theft — when an employee accepts wages for work they didn’t do (usually through deliberate, accidental, or negligent time tracking).

You can prevent time theft in all its forms with the following suggestions:

If the inaccuracies that lead to time theft do occur, issue a verbal warning on the first offense. If they occur again, consider a written warning in their file, suspension, or even termination.

Whatever discipline you choose, make sure everyone is aware of the consequences beforehand, understands the magnitude of the offense, and is treated fairly in the process.

Once you’re done calculating payroll hours, you can use those numbers to figure out how much you owe your employees for the work they’ve done and how much tax you have to pay local, state, and federal authorities.

For more details on setting up your own payroll process, consult with an accountant or financial professional, labor attorney, and/or third-party payroll provider.

Gross pay is defined as the total regular hours worked — the payroll hours you just calculated — times the hourly rate you pay each employee. The equation looks like this:

Gross Pay = Total Regular Hours x Pay Rate

So, if Tim works 40 regular hours in one week and their pay rate is $20 per hour, their gross pay would be:

Gross Pay = 40 hours x $20 per hour

Gross Pay = $800

This number serves as the base off of which you apply the rest of the calculations in this section.

If Time worked more than 40 hours in one week, he’s probably eligible for overtime.

The federal government mandates that all businesses pay employees who qualify for overtime at a minimum of 1.5 times their regular hourly rate.

To figure out Tim’s overtime pay rate, you would multiply $20 by 1.5 to get $30. Any hours over 40 that Tim worked in a single week should be paid at this rate.

So, for example, if Tim worked 45 hours one week, his overtime pay would be:

Overtime Pay = Overtime Hours x Overtime Pay Rate

Overtime Pay = 5 hours x $30 per hour

Overtime Pay = $150

Finally, add the overtime pay to the gross pay you calculated in the previous step. In this case, that would be $800 plus $150 for a true gross pay of $950.

Deductions are classified as dollar amounts that you subtract from gross pay. These deductions can be mandatory or voluntary and may include such things as:

Add all the deductions together and then subtract that total from the gross pay you calculated earlier.

As an example, let’s say that your business deducts $200 from every check for group health benefits and Tim wants another $100 in extra taxes taken out as well.

Tim’s adjusted gross pay would be:

Adjusted Gross Pay = Gross Pay – Total Deductions

Adjusted Gross Pay = $950 – ($200 + $100)

Adjusted Gross Pay = $950 – $300

Adjusted Gross Pay = $650

Calculating taxes is an essential step in the payroll process. If you don’t do it correctly, or you skip it altogether, your business can be subject to hefty fines and significant legal trouble.

We’re not going to go over all the details that apply to business taxes in this article because there are just too many and tax laws differ from state to state and even city to city.

The best thing you can do to make sure you’re doing your payroll taxes correctly is talk to an attorney or financial professional who is familiar with your business and the area in which it operates.

Net pay (a.k.a. take home pay) is the result of subtracting all deductions, taxes, and other expenses (e.g., fringe benefits) from an employee’s gross pay.

We talked about deductions and taxes in previous sections, but you may also have to subtract other amounts, including post-tax deductions, retirement plan contributions, wage garnishment, and others.

The dollar amount you’re left with at the end of all that is the employee’s net pay.

For more details on these important calculations, take a few minutes to read these articles from the Sling blog:

After you determine net pay, all that’s left to do in the employee-facing part of the process is pay your employees. As simple as that may sound, there’s quite a bit more involved than just writing checks.

Your business will have to decide how and when that occurs. Some businesses pay their employees with a paper check every week. Other businesses pay via direct deposit every two weeks. Still others give their employees a refillable pay card once a month.

If all of this sounds like a lot of work to you, we couldn’t agree more. Serving as your own payroll hours calculator takes up a lot of your valuable time.

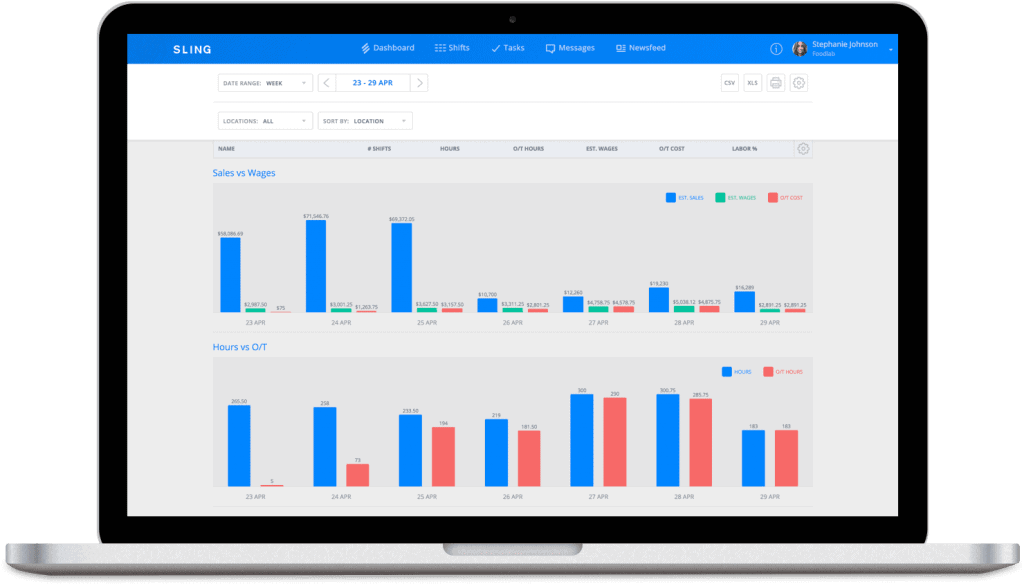

We think your time is better spent managing and growing your business. That’s why we built employee time tracking and reporting into our software to simplify your payroll process.

With Sling, you set the rules that govern work-hours time tracking (e.g., rounding or no rounding), and the app does the rest for you.

As employees record their time using the integrated time clock, Sling crunches the number in the blink of an eye. That means less work for you and more accurate data for figuring out the final paycheck.

It also means that work hour data is available anytime you need it — at the beginning of a pay period, in the middle, or right before the end. Such insight helps you better control labor costs and keep your business in the black.

And that’s just the tip of the Sling iceberg!

We mentioned the integrated time clock and the built-in payroll hours calculator, but our software also offers such advanced features as:

All of that and much more in a powerful software suite whose components work seamlessly together to provide the most comprehensive workforce management and payroll hours calculator available.

Want to see it for yourself? Try Sling for free today!

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit our blog page.

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

See Here For Last Updated Dates: Link

Schedule faster, communicate better, get things done.