Exempt Vs. Non-Exempt Employees: What’s The Difference?

Deciding how to classify exempt vs. non-exempt employees can be confusing at fir...

In this article, we discuss the pros and cons of salaried employees for small business owners to help you decide what is right for you, your team, and your company.

The concept of salaried employees goes back to the Fair Labor Standards Act (FLSA) of 1940, in which the federal government set limits and standards on the way businesses were legally allowed to manage their employees.

One of the main things the FLSA did was establish two distinct categories of employees: non-exempt and exempt.

There are several differences between the two, but it basically boils down to how you pay the employee and whether or not they are eligible for overtime.

Classifying an employee as non-exempt means that:

Classifying an employee as exempt means that:

This latter classification — exempt — is the basis for what most businesses call salaried employees.

The formal definition of this type of team member is:

One who receives a fixed amount of pay regardless of how many hours they work each week.

Most businesses will figure the fixed amount of pay based on a 2,080-hour work year (which breaks down to 40 hours for 52 weeks).

For example, if your business pays its salaried employees $50,000 per year, your HR department will write a check for $961.54 every week ($50,000 divided by 52 weeks).

Salaried employees receive this fixed amount regardless of whether they work more or less than the 2,080 hours on which it was based.

This is in contrast to the non-exempt (or hourly) employee whom your business pays a certain dollar amount (e.g., $15.00) for every hour they work.

For example, if your business pays a certain hourly employee the $15.00 per hour mentioned in the previous sentence and the employee works 40 hours in one week (Monday through Sunday), your HR department will write a check for $600.

From these two examples, you can see that, for the hourly employee, time tracking (hours worked) is a very important issue. For salaried employees, time tracking, while still important for performance reviews and the like, is not as essential.

For more information on the FLSA, exempt, and non-exempt employees, take a few minutes to read these articles from the Sling blog:

Calculating overtime can get very complicated (and expensive) very quickly.

But with salaried employees, you don’t have to worry about the inherent difficulties because you pay the same amount every pay period regardless of the number of hours they work.

Your business may offer comp time as a way to compensate exempt employees who put in extra time at the office, but this benefit is often easier to track and control than overtime.

Another benefit of salaried employees is that payroll is much simpler to calculate. You don’t have to spend time calculating pay rates and hours worked for all of your employees at the end of every pay period.

Instead, you write the same check every time. There are no fluctuations, so the entire payroll process becomes more streamlined and efficient.

Because most businesses don’t require their salaried employees to clock in and out, those team members have more flexibility when it comes to when they work.

The more freedom and flexibility you give your salaried employees, the easier it will be for them — and your business — to deal with medical appointments, family obligations, and emergencies that may pop up without warning.

As we mentioned earlier, salaried employees don’t track their hours as hourly employees do.

Occasionally, those employees may work less than the standard 40 hours per week. Taken to excess, that can have a significant negative effect on your bottom line.

In a normal work situation, however, those same employees may work more than 40 hours other weeks in response to business demands.

Making sure that your salaried employees understand that they are to be at work from 8 a.m. to 5 p.m. (for example) helps avoid any issues and ensures that their total annual time worked averages out to 40 hours per week.

Because salaried employees don’t track their time, it can be difficult to gauge their performance. For these types of employees, it’s more beneficial to track performance based on deliverables instead of time worked.

It’s also crucial to schedule regular performance evaluations since exempt employees work with more autonomy than hourly employees.

Most businesses offer benefits to their salaried employees as a way to attract high-performing team members. If you’re not careful, these benefits can quickly add up and affect your business’s bottom line.

For a deeper discussion on employee benefits, check out these articles from the Sling blog:

As we discussed, you would not typically schedule your salaried employees because they work a consistent, full-time schedule.

Make it clear during the onboarding process that they are to work 40 hours per week and that the standard for that is Monday through Friday, 8 a.m. to 5 p.m. (with a one-hour lunch break in the middle).

That said, your business may choose to operate under some form of compressed workweek or one of several alternative types of work schedule.

In that case, it’s in your best interest to schedule even your salaried employees because they may opt to work four days per week instead of five, and those days may change from one week to the next.

Even if your business doesn’t have to organize its salaried employees, it will still need to schedule meetings and training and employee reviews.

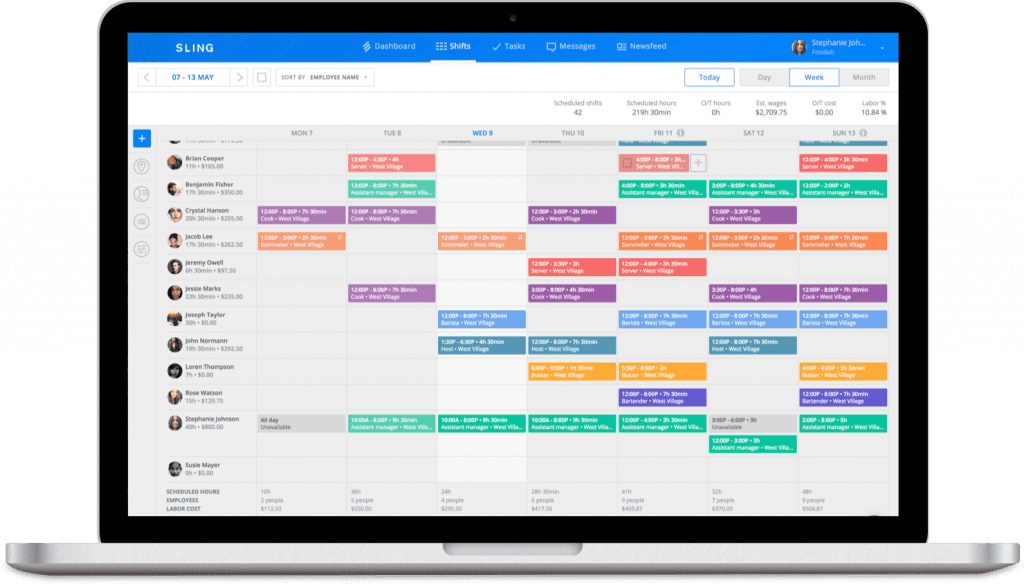

The best way to organize and optimize your workforce — be they salaried or hourly — is with modern scheduling and workforce management software, like Sling.

The Sling app is the best choice to help you manage all aspects of your business. First and foremost, Sling gives you unprecedented control over your scheduling process.

With the cloud-based tools that Sling offers, you can implement employee self-scheduling and quickly and easily build staff rotas one month, two months, even six months or more in advance.

And with the built-in artificial intelligence, Sling automatically reminds you of requested time off, double bookings, and overtime hours so you can finalize the schedule in less time and with less effort.

Sling also acts as a time clock for your business so you can accurately track when your team members work. Because Sling works on a variety of devices, you can set up a central terminal or allow your employees to clock in and out right from their mobile devices.

And with Sling’s powerful geofencing feature, you can prevent early clock-ins, missed clock-outs, and time theft with the touch of a button.

Sling even lets you optimize labor costs by setting wages for each individual employee or position so you can see how much each shift will cost your business.

You can also keep track of your labor budget and receive alerts when you’re about to exceed those numbers.

All of this — and much more — will help you save money, increase profits, and provide structure and direction for your salaried employees.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.