Self-Scheduling: Definition, Benefits, And An Example

Need a flexible way to organize the shifts your team works? Self-scheduling may ...

Every business needs time clock rules for hourly employees. Without them, your business could be running afoul of the federal government and the team members you depend on to get the job done.

In this article, we tell you everything you need to know about time clock rules for hourly employees.

With that knowledge, you’ll be better positioned to keep your team happy, satisfy all federal government mandates, and streamline the time-tracking and payroll processes.

Through the Department of Labor, the federal government established the Fair Labor Standards Act (FLSA), which sets guidelines related to time clock rules for hourly employees, part-time vs. full-time, overtime, wages, and record-keeping practices.

Most states also have their own laws that apply to clocking in and out. And practices even differ from industry to industry, so it’s essential that you talk to an attorney who is well-versed in both labor law and the industry in which your business operates.

In many ways, the distinction between hourly employees and salaried employees comes down to one thing: overtime.

According to the FLSA, hourly employees are “Non-Exempt.” That means that they must be paid hourly, make at least the federal minimum wage, and have less responsibility than others (e.g., a barista or a food runner).

Because your business pays these employees by the hour, they must clock in and out every day. They also qualify for overtime.

Whether they work full-time or part-time, if they work more than 40 hours a week, you have to pay them overtime. This is in sharp contrast to salaried employees, who the FLSA refers to as “Exempt.”

That means that they are paid on a salary basis (not hourly), make at least $43,888 annually in 2025, and have more responsibility (e.g., a manager or assistant manager) than other employees.

Because these employees receive a salary (meaning they are paid a flat amount whether they work 40 hours or not), exempt employees do not qualify for overtime.

As a result, salaried (i.e., Exempt) employees don’t need to track their hours for federal, state, local, and industry compliance and don’t need time clock rules like their hourly counterparts.

You may, however, choose to have your salaried employees track their hours for more accurate billing, recordkeeping, project management, and resource allocation.

First and foremost, following all time clock rules means that you will stay in compliance with the Fair Labor Standards Act and any state, local, and industry laws that apply.

Staying in compliance prevents legal issues and expensive fines that can harm your business.

Following all time clock rules for hourly employees also means that everyone gets paid correctly for all regular and overtime hours they worked.

That can help prevent wage disputes, avoid misunderstandings, and legal issues related to unpaid wages or miscalculated hours.

With a standard set of time clock rules, your business will have more accurate records of actual work done and be better able to manage spending and stay within budget.

This alone can save your business hundreds, if not thousands, of dollars every year by giving you more control of the money coming in and going out.

Time theft is when an employee deliberately, accidentally, or negligently accepts wages for work they didn’t do.

A common example of this is ghosting, or buddy punching, where one employee clocks in for another employee who is not actually there.

So, if Arthur is running late and doesn’t want to get in trouble, they may ask Bev to clock in for them so their timecard shows that they arrived at 8:00 a.m. rather than 8:25 a.m.

A more serious example would be if Arthur has Bev clock in and out for them and then doesn’t show up for work at all while still getting paid for a full eight hours.

Setting clear rules for clocking in and out in your employee handbook, defining time theft, and outlining the penalties for each infraction can help prevent it from occurring in the first place.

One thing every business must do regarding time clock rules for hourly employees is to keep accurate records of all time worked.

Businesses incorporate all manner of automated time-keeping systems into their workflow, including:

Biometric clocking — Biometric scanners track arrival and departure

Proximity clocking — Manual input methods such as swipe cards, key fobs, or ID badges

PC Clocking — Any PC with an internet connection becomes a clock-in/clock-out station

Mobile Phone Clocking — Employees use a mobile phone or device to punch in and out

SMS Clocking — Employees text a virtual phone number when they begin and end work

We’ll discuss the best way to keep accurate time — which incorporates many of these modern options — later on in this article.

Setting your time clock to record in 24-hour time isn’t mandatory, but it does make things easier when it’s time to calculate payroll.

So what’s the difference between standard time and 24-hour time?

Standard time counts from 1:00 to 12:59 and then starts over. To distinguish morning from afternoon/evening, standard time includes a.m. (for morning) and p.m. (for night).

Twenty-four-hour time, on the other hand, counts the morning hours from 1:00 to 12:59 just like the standard format (e.g., 7:24 a.m., 9:11 a.m., 11:47 a.m., etc.). But after 12:59 a.m., 24-hour time begins counting by adding an hour to twelve.

For example, 1:00 p.m. in standard time would be 13:00 in 24-hour time, 2:00 p.m. would be 14:00, 3:00 p.m. would be 15:00, and so on.

With 24-hour time, you don’t need the “a.m.” or “p.m.” because no two times are written the same.

From this brief explanation, it may not be obvious, but 24-hour time makes calculating work hours and conducting payroll much easier. Here’s an example to illustrate the point.

Let’s say Opal clocks in at 8:00 a.m. (standard time) and clocks out at 4:00 p.m. Unfortunately, the math to calculate total work hours isn’t straightforward, so you’re going to have to do a bit of work to find the answer.

But let’s say that Opal clocks in at 8:00 (24-hour time) and clocks out at 16:00. With 24-hour time, calculating total work hours is much easier. All you have to do is subtract eight from 16 to get eight (16 – 8 = 8)

So, Opal worked eight hours that day.

If you calculate time cards manually, with practice, you’ll be able to convert between standard time and 24-hour time in just a few seconds.

If you use software to manage the payroll process, you can set the system to record numbers in 24-hour time at the point of clock-in and use that same format until you cut checks.

One of the first steps in setting up time clock rules for hourly employees is choosing the time increment your business will track.

Most businesses track time in 10- or 15-minute increments (anything less than 10 starts to make payroll more difficult). But not everyone clocks in or out on the 10- or 15-minute mark.

To help simplify payroll calculations, the FLSA allows employers to round the clock-in and clock-out time to the nearest increment tracked.

For example, if your business tracks time in 10-minute increments, 5:01, 5:02, 5:03, and 5:04 would round down to 5:00 for payroll purposes, while 5:05, 5:06, 5:07, 5:08, and 5:09 would round up to 5:10 for payroll purposes.

Similarly, if your business tracks time in 15-minute increments, any time between 5:01 and 5:07.59 rounds down to 5:00, while any time between 5:08 and 5:14.59 rounds up to 5:15.

This system of rounding for 15-minute increments is commonly called the 7-Minute Rule and also applies to 24-hour time.

Extending the example above into 24-hour time, any time between 17:01 and 17:07.59 rounds down to 17:00, while any time between 17:08 and 17:14.59 rounds up to 17:15.

Whatever time increment you choose to track, be sure to record it in your employee handbook and explain the rounding rule you’ll abide by.

While this shouldn’t be too difficult to enforce (most employees want to be paid for the work they do), your business needs to state explicitly that team members must record all time worked inside or outside regular business hours.

If they respond to work emails, check phone messages, or perform other business-related activities from home (or anywhere else), they need to keep track of that activity and add it to their timesheet when they return to work.

Another important factor in time clock rules for hourly employees has to do with training and travel time.

The FLSA stipulates that employers must pay team members for certain nonproductive time, including the aforementioned travel and training.

If, for example, a team member travels overnight on a work-related task, you are obligated to pay them even if that nonproductive time occurs outside their regular workday (e.g., from 6 p.m. to 8 p.m.) and regular workweek (e.g., on Sunday).

If you build rest breaks of 20 minutes or less into your schedule, you must pay team members for this downtime.

Make sure to explain to your team that they do not clock out for non-work intervals lasting 20 minutes or less, regardless of the reason for the break.

At the end of each pay period, before calculating payroll, each employee must review their time card and verify that everything is correct.

If done on paper timecards, employees write their initials to indicate that they accept the hours worked as recorded. If there’s an issue, they need to talk to their supervisor to rectify the situation.

If done on an electronic timekeeping system, the software may provide a checkbox that the employee ticks after reviewing their hours worked.

One of the most basic time clock rules for hourly employees is that all team members must be paid on scheduled days.

Your business is allowed a great deal of freedom to set its own pay periods. Whatever schedule your business decides on, it must adhere to those pay periods at all times.

The actual day you pay your employees may change slightly because of holidays and other interruptions, but you are required by law to pay your team as close to the established payday as possible.

For example, if you pay your team on the second and fourth Fridays of every month but a holiday falls on the second Friday, make every effort to complete your payroll and have it ready for distribution by Thursday before the holiday, or by the following Monday at the very latest.

Overtime is necessary in all businesses, but you want to keep tight control over who works more hours than normal. If you don’t, labor costs can quickly spiral out of control and affect your bottom line.

To keep expenses under control, add a stipulation to your time clock rules for hourly employees that all employees must get permission from their supervisor before they work any overtime.

You can also add language to make this rule apply to ANY unauthorized work time, such as clocking in early or clocking out late.

If an employee fails to obtain permission for overtime or other unauthorized activities and does that work anyway, your business is still obligated to pay them.

This can put your business in a difficult position, but with discipline and proper training, you can rectify the situation and avoid any future issues.

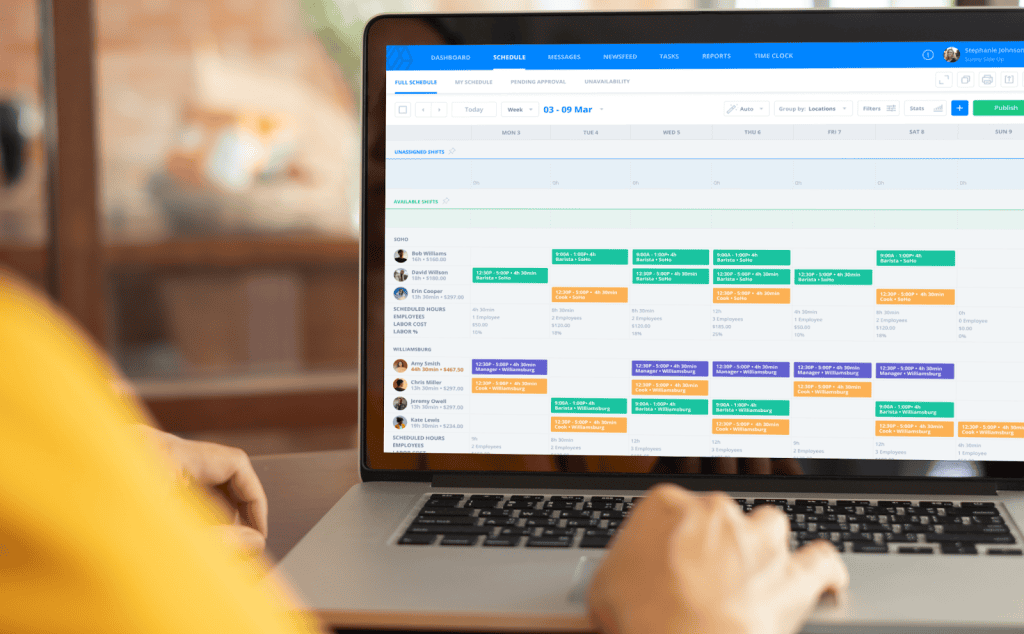

Most businesses find that automating their time clock rules for hourly employees with workforce management software is the best way to maintain FLSA, state, local, and industry compliance.

Regardless of what your business does and where it’s located, the Sling suite of employee management tools is the best solution for streamlining the time tracking and payroll processes.

Sling has built-in features that make it easy to:

And that just skims the surface of what Sling has to offer. You also get an integrated time clock (that employees can use to clock in and out on any desktop, laptop, tablet, or mobile device) as well as powerful scheduling, organizing, and communication features.

Sling is the best way to establish and maintain time clock rules for hourly employees so your business runs smoothly at all times.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

As the employer, you are allowed to change the numbers on an employee’s time card. That said, you should talk to the employee first about why you need to make the change. Then, get their consent (including a signature) and document everything for future reference.

If you don’t follow these steps, you may find yourself facing serious legal consequences as well as federal, state, local, and industry violations of wage and hour laws.

Failure to comply with time clock rules for hourly employees can result in significant penalties for your business.

They can include things like having to pay back wages (often with interest), fines and civil penalties, lawsuits, legal fees, and damage to your business’s reputation.

The Fair Labor Standards Act (FLSA) requires that employers keep payroll records for at least three years.

On top of that, the FLSA requires that employers keep all records they used to compute wages and payroll (e.g., time cards) for at least two years.

State and local laws may have additional requirements, as may the industry in which you operate.

Consult with an attorney or an accountant who is familiar with your industry and where it operates for further details.

Schedule faster, communicate better, get things done.