Restaurant Bookkeeping: A Comprehensive Guide for Managers

Effective restaurant bookkeeping is essential if you want to ensure your operati...

If your business is open more than eight or nine hours, you know how difficult it can be to find team members to work the early morning and late night time slots. But, with a shift differential in place, you may actually find that those hours become the ones everyone clamors for.

In this article, we discuss exactly what shift differential pay is and demonstrate how to calculate it so you can make the process work for your business.

To fully understand shift differential, it’s helpful to examine one component of the concept individually because it makes up the foundation of everything that comes after it.

A differential is a pay structure in which an employee makes more than their base pay because they take on more responsibilities, perform work that others don’t want to (or can’t) do, or work abnormal hours.

An easy illustration of a differential is hazard pay in which a high-tension power-line worker, for example, gets paid one rate for work done on the ground and another, higher rate for work done off the ground.

When you understand that a differential is just a higher pay rate for different types of work, the concept of a shift differential becomes easier to understand.

A shift differential (sometimes referred to as shift differential pay or shift differential rate) is an increase in an employee’s hourly or salary rate when that employee works a shift outside the “normal” business hours that typically run from 8 or 9 a.m. to 5 p.m.

So, for example, if your restaurant is open from 6 a.m. to 10 p.m., you may break work hours into two shifts of eight hours each (i.e., 6 a.m. to 2 p.m. and 2 p.m. to 10 p.m.) and offer a shift differential to those who work the early morning slot.

The shift differential rate you use is entirely up to you and can be whatever number works best for your team and your business.

When considering how much to increase pay, consider factors such as:

Many businesses find it effective to start with a low rate — 5% or less — and increase by one or two percent until they find a number that motivates employees to volunteer for the shift or shifts in question.

For example, you may start your shift differential at 5% for the early morning shift. That means an employee whose base pay is $10 per hour would make $10.50 per hour for any time worked before 8 a.m.

If that doesn’t get you the number of employees you need, you may decide to try 8% for a few weeks, bump it up to 10% for a few weeks, and then finally settle on 12% so that your team sees the value in working those shifts.

Once you’ve set the rate that works best for your business, the next big step is to learn how to calculate the shift differential when it comes time to cut checks.xt big step is to learn how to calculate the shift differential when it comes time to cut checks.

Let’s say that your business decided to offer a shift differential for an early morning shift. How would you go about calculating the dollar amount you would pay each employee?

Here are two options.

As we mentioned earlier, you could set your differential pay rate at any percentage that works for your business and your team.

To help you understand the calculations to come, we’ll set the following variables as an example:

With that information in mind, here’s how to calculate shift differential pay starting with the percentage.

Differential Pay Rate = Base Pay + (Base Pay x (Shift Differential Percentage))

Differential Pay Rate = $15/hour + ($15/hour x (20/100))

Differential Pay Rate = $15/hour + ($15/hour x 0.20)

Differential Pay Rate = $15/hour + $3

Differential Pay Rate = $18/hour

So, if Rebekah comes in from 5 a.m. to 8 a.m. to prep for your restaurant, she would earn $18 per hour for that early morning work.

As an alternative to the percentage method outlined in the previous section, you could also start with a dollar amount and figure out the percentage from there.

Here are the details for that calculation:

With that information, we can then crunch the numbers using the following equation:

Percentage Of Base Pay = ((Differential Pay – Base Pay) / Base Pay) x 100

It looks a lot more complicated than it actually is and will make more sense once we plug in the numbers.

Percentage Of Base Pay = (($17/hour – $15/hour) / $15/hour) x 100

Percentage Of Base Pay = (($2/hour / $15/hour) x 100

Percentage Of Base Pay = 0.133 x 100

Percentage Of Base Pay = 13.3

So, if Rebekah comes in from 5 a.m. to 8 a.m. to prep for your restaurant, she would earn an extra 13.3% of her base pay for that early morning work.

What if an employee works a shift with a higher rate and accrues overtime during those hours? The calculation isn’t as difficult as it may seem at first.

Here are the details we’ll use:

To figure out her paycheck, first calculate the 40 hours of “regular” time worked with the following equation:

Regular Pay = Hours Worked x (Base Rate + (Base Rate x Shift Differential)

Regular Pay = 40 x ($15/hour + ($15/hour x 20%)

Regular Pay = 40 x ($15/hour + $3)

Regular Pay = 40 x $18/hour

Regular Pay = $720

Next, calculate Rebekah’s overtime pay based on the eight hours of overtime she worked, the higher shift differential rate, and the legally mandated time-and-a-half metric.

Here’s the equation:

Overtime Pay = Overtime Hours Worked x ((Base Rate x Shift Differential) x 1.5)

Overtime Pay = 8 overtime hours x (($15/hour + ($15/hour x 20% shift differential)) x 1.5)

Overtime Pay = 8 overtime hours x (($15/hour + $3) x 1.5))

Overtime Pay = 8 overtime hours x ($18/hour x 1.5)

Overtime Pay = 8 overtime hours x $27/hour

Overtime Pay = $216

Finally, add Rebekah’s regular pay and overtime pay together to find her gross pay for the week.

Gross Pay = Regular Pay + Overtime Pay

Gross Pay = $720 + $216

Gross Pay = $936

For more on calculating overtime, check out this step-by-step guide from the Sling Blog.

Implementing a shift differential for a restaurant team is no different than implementing one for a factory team or an office team.

For other types of jobs, the extra pay is often applied to swing shifts, overnight shifts, or shifts that are different from the “normal” 9-to-5. In restaurants, though, it can be more useful to apply shift differential pay to evenings, weekends, and holidays.

These times are generally considered less desirable, so offering a higher pay rate can help you incentivize the shifts that your restaurant staff wouldn’t necessarily volunteer to work.

As we’ve mentioned, offering a shift differential is entirely up to you. If you think the extra pay might make it easier for you to build a full shift during busy evening, weekend, or holiday hours, give it a try and see what happens.

After a few weeks or months, if you find that it’s not working, you can always eliminate the benefit and try something else.

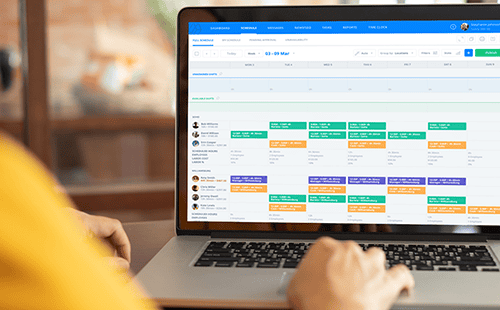

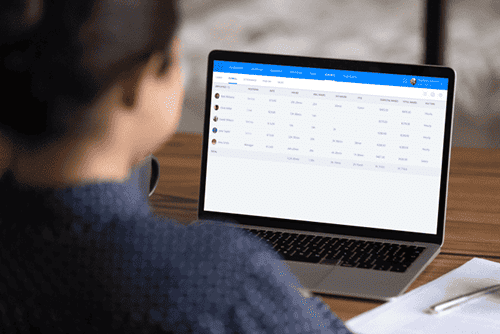

Whatever type of shift differential program you implement — or even if you choose not to put one in place — using the right technology to track and process your team’s work hours can make everyone’s job much easier.

Modern scheduling, shift planning, and workforce management software gives you the power to monitor, organize, and control every aspect of the way your team works.

And, advanced automation and reporting makes processing complicated pay rates — such as shift differential pay, overtime, flex time, and comp time — much easier than before.

In most cases, these features are just the tip of the benefits iceberg. Apps such as Sling can help your business in other ways as well.

For example, Sling includes scheduling, task management, team communication, and labor cost management tools that can help you and your employees improve the everyday activities that make your business work.

Take some time to examine the responsibilities built into each shift and identify those that are more important or more crucial than others. Doing so can help you find the right rate for the jobs being performed.

For example, you may set a higher differential for the chef’s role and a lower differential for the bussers or food runners.

Customizing the shift differential according to the responsibilities at play may be a more effective way to attract high-performing team members to work the shifts you need.

The best way to keep everything fair and productive is to create policies for shift differential pay and make them available in your employee handbook.

These policies should lay out the rules of the program and address such topics as:

Keep in mind that these policies are an evolving document — once written, they aren’t necessarily set in stone. Revisit and reexamine the “rules” of the program every so often and add or subtract policies to make things run better.

As you build the rules and regulations that will govern the shift differential pay in your business, include language that gives you the right to rescind the program at any time.

The only caveat to that is if your business is subject to a collective bargaining agreement with an employee union.

If that situation applies to your operation, consult with an attorney to find out if the shift differential program is part of the employees’ contract. If it is, your business can’t alter anything without first renegotiating the contract.

It can be extremely beneficial to ask for feedback from your team — before the program starts and once it gets going.

With a pre-interview, you may find that a shift differential isn’t enough incentive to solve the employee engagement or productivity issues it’s designed to address. Employee feedback may indicate that another solution or benefit is a better fix.

Similarly, once the program is in place, asking for more feedback can give you insight into what’s working and what isn’t.

Getting feedback from your team before and after implementing shift differential pay can help you identify how to structure the program so that it has more benefits than drawbacks.

Shift differential pay is entirely voluntary, so your business can set whatever rate works best. Many businesses settle on a number between 5% and 20%, but you can go lower or higher if you choose.

You may find that a shift differential of 2.5% works better for your bottom line. Or, you may find that a shift differential of 30% is the most effective at motivating team members to work those hard-to-fill shifts.

If you’re implementing a brand new shift differential program, start with lower numbers and work your way up until you find the sweet spot that works well for your team and your business.

Regardless of whether your shift differential program is new or has been in effect for a long time, it’s important to train (and retrain) your team so that they’re thoroughly familiar with how everything runs.

After you create policies for your shift differential pay, meet with your team, familiarize them with the process, and answer any questions that may come up.

Take notes along the way and transfer everything you learn or that needs clarification back into the handbook. It’s also a good idea to include information about the shift differential pay in any onboarding programs you have for new hires.

One very important aspect of implementing shift differential pay in your business is making sure that you treat all employees equally.

You get to set the rules of the program, so you may decide to apply it to specific shifts or use it as an incentive to encourage employees to volunteer for hard-to-fill time slots.

It really doesn’t matter how you choose to structure the extra pay as long as you make it available to everyone on your team.

That said, there may be some non-discriminatory reasons not to offer shift differential pay to certain employees.

For example, a team member may be new to your business and you outline in your employee handbook that the extra pay doesn’t kick in until they’ve been on staff for a full month. There’s no discrimination there, and they will be eligible for shift differential pay after 30 days.

If you’re concerned about implementing fair policies in your business, consult with an attorney. They’ll be able to help you set up a system that is equal for all employees.

Because shift differential pay is a “bonus” of sorts, many managers wonder if payroll taxes still apply. They do still apply and here’s why.

Payroll taxes are calculated from all gross wages that an employee earns for any given time period (e.g., a week, two weeks, one month).

It doesn’t matter if those gross wages include regular pay, overtime pay, and shift differential pay (or any combination of the three), you’ll calculate payroll taxes based on the total amount they make for whatever pay period your business adopts.

So, for example, if an employee worked 40 hours at a regular pay rate and earned $400, you’d take the $400 and multiply it by the current payroll tax rate percentage (e.g., $400 x 15.3%).

If an employee worked the same 40 hours but eight of those hours included shift differential pay and they made $450, the calculation remains the same: $450 x 15.3%.

Be sure to talk to an attorney, an accountant, or a payroll specialist if you have any questions about the taxes your business will owe at the end of the year.

If you find yourself relying on shift differential pay because your business is under or overstaffed, consider analyzing labor data to resolve the issue.

Doing so allows you to engage in workforce forecasting and identify the right number of employees for the work on hand or the time of the year.

In addition, you can use past shift data, seasonal trends, work demands, and any other information available to get as accurate a picture as possible about the future labor demands of your business.

Offering shift differential pay (or not) is just one variable in a much larger workforce management strategy. How can you best execute this strategy and keep your team and your business organized? With help from Sling.

The Sling app is a suite of advanced tools that can help make managing shift differential and teams of any size as efficient and productive as possible.

Those tools include:

Try Sling for free today to experience firsthand how the software can help you get control of your shift differential pay and all of your workforce activities.

Then, for more business management resources, help scheduling your employees, and tips for leading a successful team, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.