How To Find A Seasonal Job And Get Hired

Seasonal jobs aren’t just for high-school and college students anymore. Many a...

Do you hire seasonal employees? If so, you may be required by law under the ACA to provide health insurance to some of these workers — or face stiff penalties.

If this is your first time hiring seasonal employees or your business is now big enough to qualify under the ACA, it’s vital that you understand the details of what the government expects of you.

In this article, we’ll give you the basics of the ACA, help you determine if your new hires are seasonal employees, and show you how to determine if the ACA applies to your business.

ACA is an abbreviation for the Patient Protection and Affordable Care Act (Affordable Care Act for short) that Barack Obama enacted back in 2010.

Within the Affordable Care Act itself is a component that applies directly to businesses of a certain size — the Employer Shared Responsibility Provision (ESRP or Employer Mandate for short).

Under the ESRP, applicable large employers must provide health insurance to their full-time (30+ hours per week) employees. There is, however, an exception for seasonal employees.

If certain variables don’t exceed the set threshold, your business may be exempt from the ACA’s employer mandate. We’ll discuss these variables in the next two sections.

To help determine if you are hiring seasonal employees or not, ask yourself the following questions:

If you answered yes to both questions, then you have seasonal employees regardless of how many hours you expect them to work.

Under IRS and Treasury Department regulations, seasonal employees are not full-time, benefits-eligible even if they work 30 hours or more per week.

Examples of those who qualify as seasonal employees include:

Examples of those who do NOT qualify as seasonal employees include:

But just because you hire seasonal employees doesn’t mean that you are liable under the ACA. The size of your business is also a factor.

The ACA mandates that applicable large employers (ALEs) must offer health insurance to their full-time employees. An ALE is a business that employs 50 or more full-time equivalent workers (FTEs) who work 130 hours or more each month.

If your business falls into that category, the ACA requires that you provide health coverage. But there is an exception. If the following criteria apply, your business is not an ALE:

In that case, your business is not subject to the Affordable Care Act’s mandate to provide health insurance.

When dealing with the intricacies of the ACA, seasonal employees, and ALE status, it’s essential that you seek legal counsel from an attorney familiar with the local, state, and federal laws in your area.

If you don’t, you could find yourself in violation of the ACA without even knowing it. According to the IRS, lack of knowledge is not an excuse, and they may levy hefty fines and penalties on your business that could affect your bottom line.

Regardless of whether you hire part-time seasonal employees, full-time seasonal employees, or a combination of both, be sure to list all of the applicable ACA information in your employee handbook.

That way, each employee will know what to expect when you hire them to work and where to look for answers to common questions.

Additionally, be sure to update your employee handbook periodically — rules do change (i.e., elimination of the individual mandate). Review it with long-time employees during a staff meeting and with new hires during the onboarding process.

When you do that, there will be no confusion about who is a seasonal employee, who is a part-time employee, and who is a full-time employee.

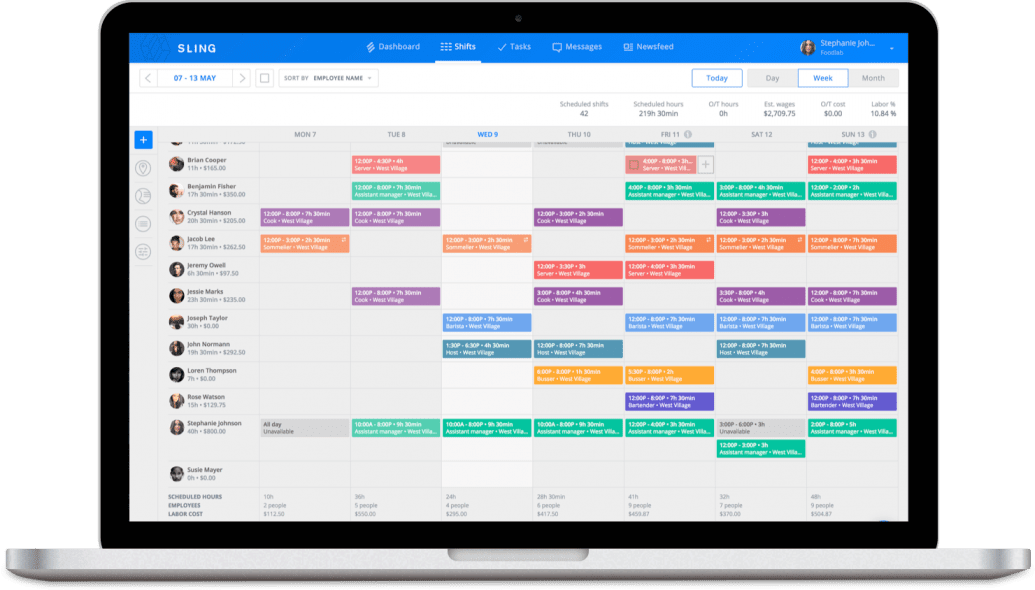

Controlling seasonal employees’ hours can help you avoid fines. And one of the best ways to gain this control is by using a scheduling tool like Sling. The Sling app is designed specifically for streamlining your scheduling process, so all of its tools are dedicated to that task.

Sling’s user-friendly interface makes it easy to see how many hours each employee will work every week and gives you notifications of overlapping shifts and double-bookings.

Sling also brings together two additional toolsets to make your work life easier: time tracking and labor cost control.

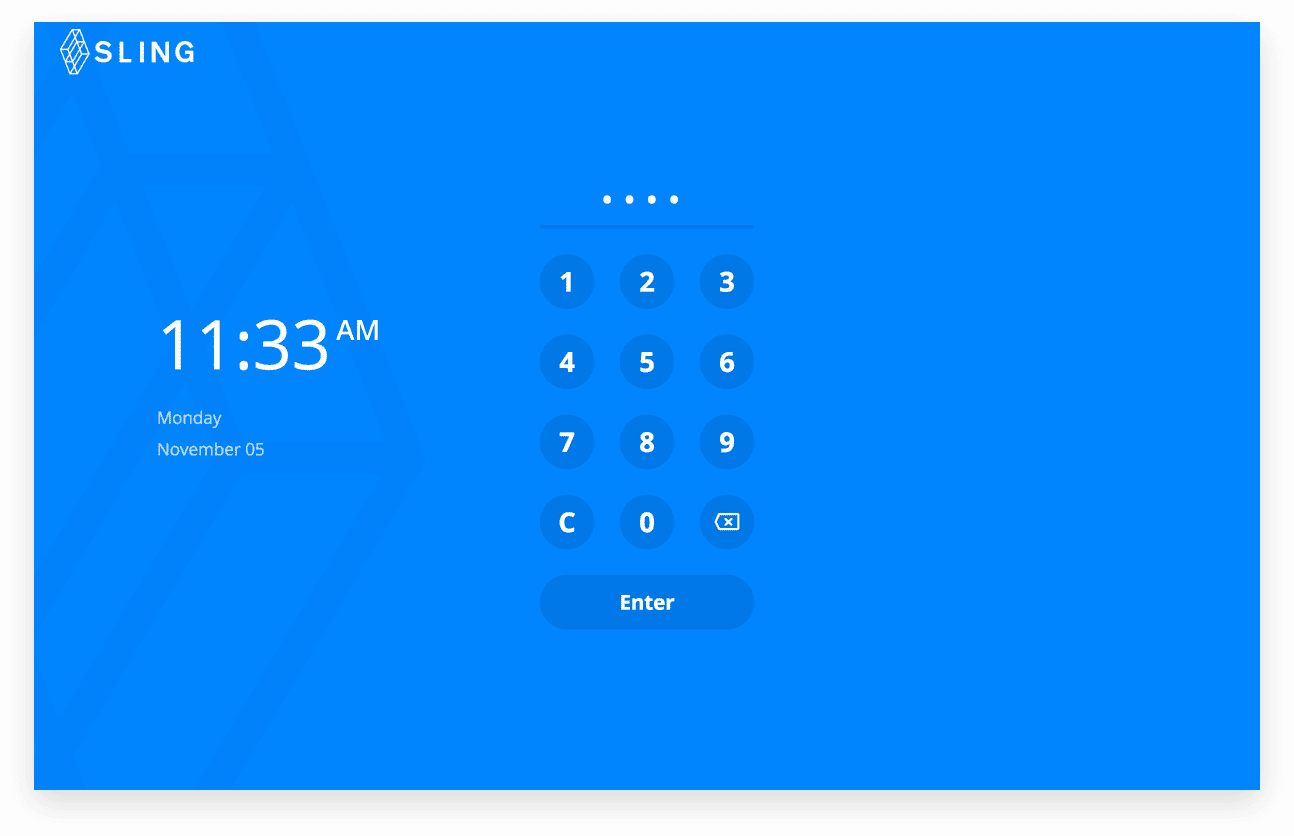

During the workweek, Sling’s unique time-tracking features allow you to turn any phone, tablet, or computer into a fully-functional time clock that your employees can use to clock in and out.

At the end of the workweek, just a few clicks or taps is all it takes to export your employees’ timesheets for payroll processing. Simply review the timesheets, edit and approve, and then send them to your choice of third-party program for seamless payroll calculation and distribution.

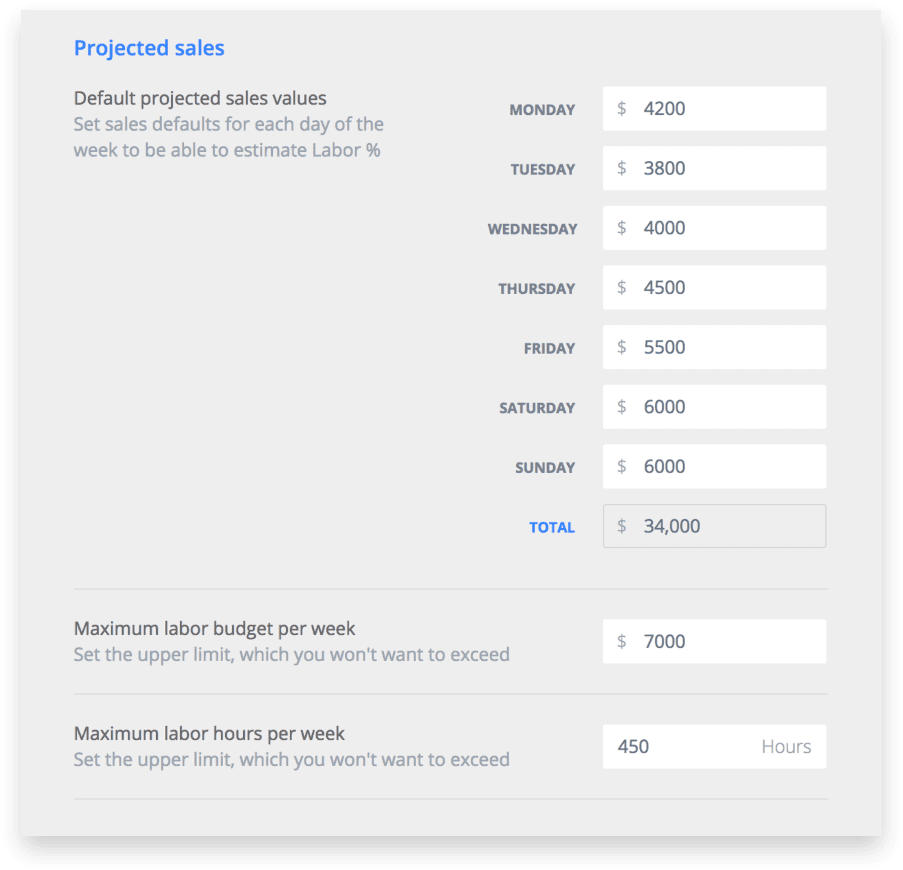

You can then go back and use Sling’s labor cost tools to measure, manage, and optimize your spending as you create the next schedule.

No more endless revisions trying to squeeze all the shifts and work necessary under your existing budget. One pass through the schedule and you’ll know if you’ve exceeded your labor costs or not. Then it’s just a few clicks here and there to bring your spending back into the black.

Sling even provides features that help you distribute your schedule efficiently, keep it up to date, find substitutes, and communicate with your employees.

It’s a turn-key solution for all of your workforce management and optimization needs (whether you hire seasonal employees or not). Try the app today for free and see what worry-free scheduling is all about.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.