How To Calculate Overhead Costs In 3 Easy Steps

To paraphrase a familiar expression: Nothing is certain but death, taxes, and ov...

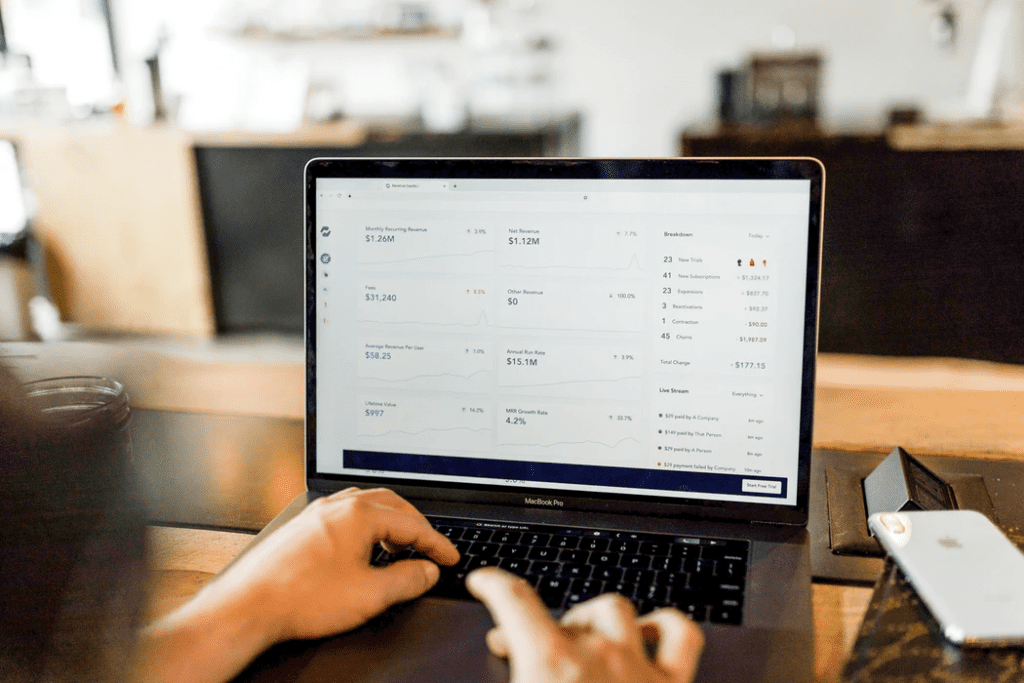

Looking for a way to increase profits, get control of your expenses, and keep your bottom line in the black? The solution is simple: Calculate your restaurant’s prime cost.

In this article, we take an in-depth look at why this expense matters for your restaurant, how to calculate it, and the best way to keep it under control.

Prime cost is a key metric for all businesses because it provides information about two expenses that can dramatically affect your bottom line: direct material cost and direct labor cost.

The formal definition is:

All the direct costs and expenses directly attributed to the manufacture of a product.

As we mentioned, expenses attributed to the manufacture of a product include direct material costs and direct labor costs.

Direct material costs — sometimes referred to as cost of goods sold (COGS) — include any and all supplies and materials (raw or otherwise) that your business consumes during the manufacture of a product.

It’s important to note that indirect costs such as manager salaries, transport and delivery, and facility utilities are not direct material costs and are not used to determine prime cost.

Similarly, direct labor costs include only the wages your business pays to workers who contribute directly to the manufacture of the product.

However, it does not include expenses such as engineering fees, design fees, and factory manager wages. Only those who contribute to the hands-on assembly of a product are considered part of the direct labor equation.

Now that we’ve discussed prime cost as a general concept, let’s see how this metric applies to restaurants specifically.

The definition of prime cost for a restaurant is the same as it is for any other business.

All the direct costs and expenses attributed to the creation of your menu items.

Just like the general definition, this expense for a restaurant includes direct material costs and direct labor costs.

In the foodservice industry, this cost is a bit more straightforward because the direct material costs and direct labor costs are simply the food and ingredients your restaurant uses to create its menu offerings and the wages you pay to those who cook the food and deliver it to the customers.

Now that you’ve been introduced to the basic concept, let’s delve deeper into the math to see how it all works.

As we touched on in the previous section, prime cost is the total of your ingredients (a.k.a. direct material costs or cost of goods sold) plus all the labor expenses that go into making and serving your restaurant’s food.

The equation is:

Prime Cost = Direct Material Costs + Direct Labor Costs

With this equation in mind, let’s run through a hypothetical example of a monthly calculation. A food truck owner wants to know how business went last month, so they set out to calculate their restaurant’s prime cost.

First, they go through their inventory records and discover that they accumulated $20,000 in direct material costs.

Second, they go through their labor reports and discover that they accumulated $8,000 in wages, benefits, taxes, and insurance.

Next, they plug those numbers into the equation:

Prime Cost = Direct Material Costs + Direct Labor Costs

Prime Cost = $20,000 + $8000

Prime Cost = $28,000

This calculation, however, isn’t the end of the story. To really see what went on in your restaurant, you need to compare this number to your total sales.

To calculate prime cost compared to sales, plug your restaurant’s data into the following equation:

Prime Cost As A Percentage Of Sales = (Prime Cost / Total Sales) x 100

Continuing with the example from above, our food truck manager goes back through their records and finds that total sales for the previous month were $75,000.

He then works through the equation.

Prime Cost As A Percentage Of Sales = (Prime Cost / Total Sales) x 100

Prime Cost As A Percentage Of Sales = ($28,000 / $75,000) x 100

Prime Cost As A Percentage Of Sales = 0.37 x 100

Prime Cost As A Percentage Of Sales = 37%

From that number, the food truck manager can see that they had 63% of total profits left over to pay for indirect expenses such as rent, utilities, and paying themself.

Prime cost percentage is an extension of the calculation that you can use to see how labor and materials compare to overhead.

Overhead costs are recurring expenses that sustain your business but don’t contribute to income. These expenses are often called indirect costs because they are not part of business activities that generate revenue.

Each business has its own unique overhead costs — we mentioned manager salaries, transport and delivery, and facility utilities earlier — so it’s vital to assemble the figures for your restaurant and not base your calculations on some other business’s numbers.

Here’s the equation for prime cost percentage:

Prime Cost Percentage = (Prime Cost / Overhead) x 100

Let’s plug-and-chug with our prime cost from above and overhead costs of $50,000 to see what we get:

Prime Cost Percentage = (($20,000 + $8000) / $50,000) x 100

Prime Cost Percentage = ($28,000 / $50,000) x 100

Prime Cost Percentage = (0.56) x 100

Prime Cost Percentage = 56%

This tells you that your prime cost (materials + labor) is 56% of your total overhead.

One of the main reasons prime cost matters is because it tells you how much you have left over after paying the bulk of your expenses. In essence, it gives you a quick idea of what your profits might be.

If your cost is too high (upwards of 80%), you’ll only have 20% left for indirect expenses. That means that for every dollar you sell, $0.80 goes toward production, leaving your business with $0.20 for other activities.

Most new restaurant owners run their prime cost as a percentage of total sales in the low-to-mid 70s, but the ideal range of operations is 55-60%.

Another reason that prime cost matters is that your expenses fluctuate all the time. Some things you can nail down and keep consistent, but others change every few months.

Labor costs may go up and down depending on how you schedule full-time and part-time employees and whether or not anyone works overtime.

Factor in the rapidly changing price of food, the addition or subtraction of new menu items, and the relationships you have with your vendors, and you can quickly see how keeping track of your restaurant’s prime cost can become a full-time job.

Payroll (direct labor costs) is one of the largest expenses that your restaurant is likely to face. The wages you pay your servers, food runners, bartenders, and prep staff make up the bulk of your monthly labor expenditures.

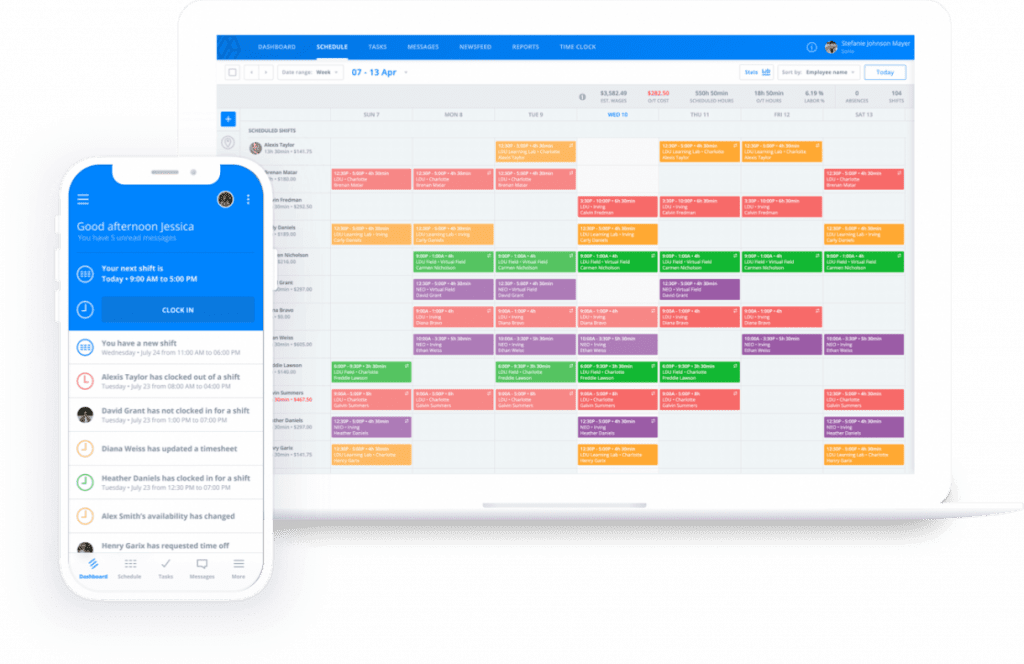

Those numbers, however, are not completely out of your control. You can manage labor costs — and reduce your prime cost in the process — by harnessing the power of the Sling app.

Sling’s labor costs feature gives you the ability to optimize your payroll as you schedule so that your spending doesn’t get out of control. You can set wages per employee or position and see how much each shift is going to cost.

Sling also helps you keep track of your labor budget and will alert you when you’re likely to exceed the numbers you’ve set. Sling will even notify you when you’re about to schedule someone into overtime so that you can make the necessary changes.

And that’s only one of Sling’s many features that will streamline and simplify the way you organize, manage, and optimize your workforce.

Sling truly is the best way to control your restaurant’s prime cost.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.