Revenue Vs. Profit: 4 Important Differences You Need To Know

Revenue vs. profit is a difficult — and sometimes confusing — topic, even fo...

As a small business owner or manager, you need to speak the language of your industry. That includes general business terms, such as capital, gross, net, and — perhaps most important — profit margin.

Understanding profit margins is essential to the success of your company because it means the difference between making enough money to pay the bills and keep the doors open, and declaring bankruptcy and shutting everything down.

But what exactly is a profit margin? Why is it important? And how do you go about calculating this crucial metric?

In this article, the experts at Sling will answer those questions and show you how to get control of your margin with some basic math.

The term “profit margin” is made up of two distinct words: “profit” and “margin.” Here’s what they mean individually and what they mean together.

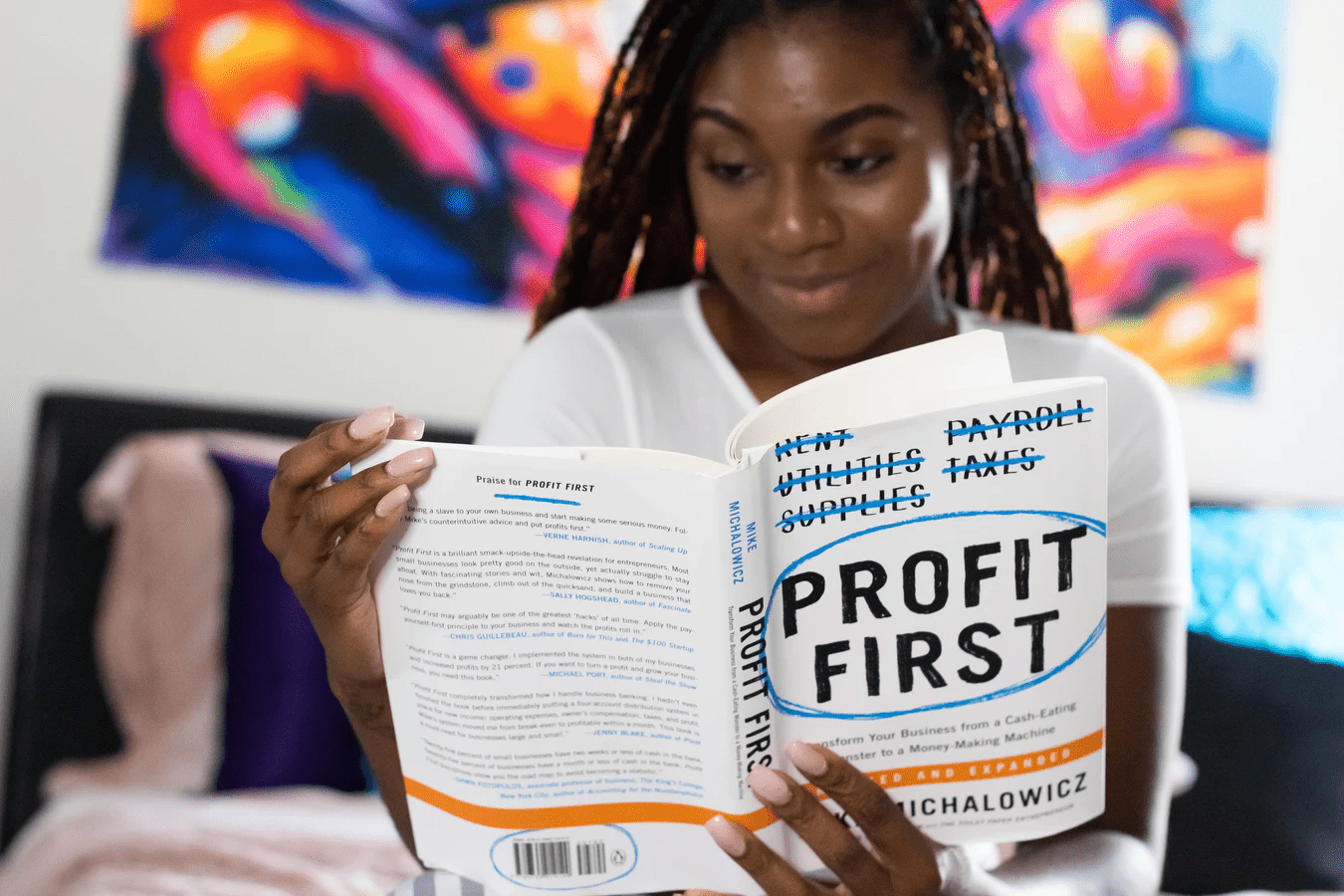

In simple terms, profit is the difference between what you earn for a product or service and what you spend to provide that product or service.

In technical jargon, profit is the income (or revenue) for a product or service minus the cost of goods sold (COGS) for that product or service.

Profit is always expressed as a dollar amount.

For example, if people paid $20,000 for your product in a month (or six months or a year) and you spent $5,000 manufacturing and shipping that product in the same amount of time, your profit would be $15,000 ($20,000 – $5,000).

Unfortunately, this simple equation (income – COGS) doesn’t always yield a positive number. If you only brought in $4,000 for your product but you spent $5,000 getting it to market, the math yields a negative number ($4,000 – $5,000 = $-1,000). That’s called a loss and is the direct opposite of profit.

The dictionary definition of margin is an amount by which something exceeds or falls short. In business, margins are usually expressed as a percentage.

Combining the two words creates a term that means:

The amount by which revenue from sales exceeds costs.

This metric is expressed as a percentage and can be positive or negative.

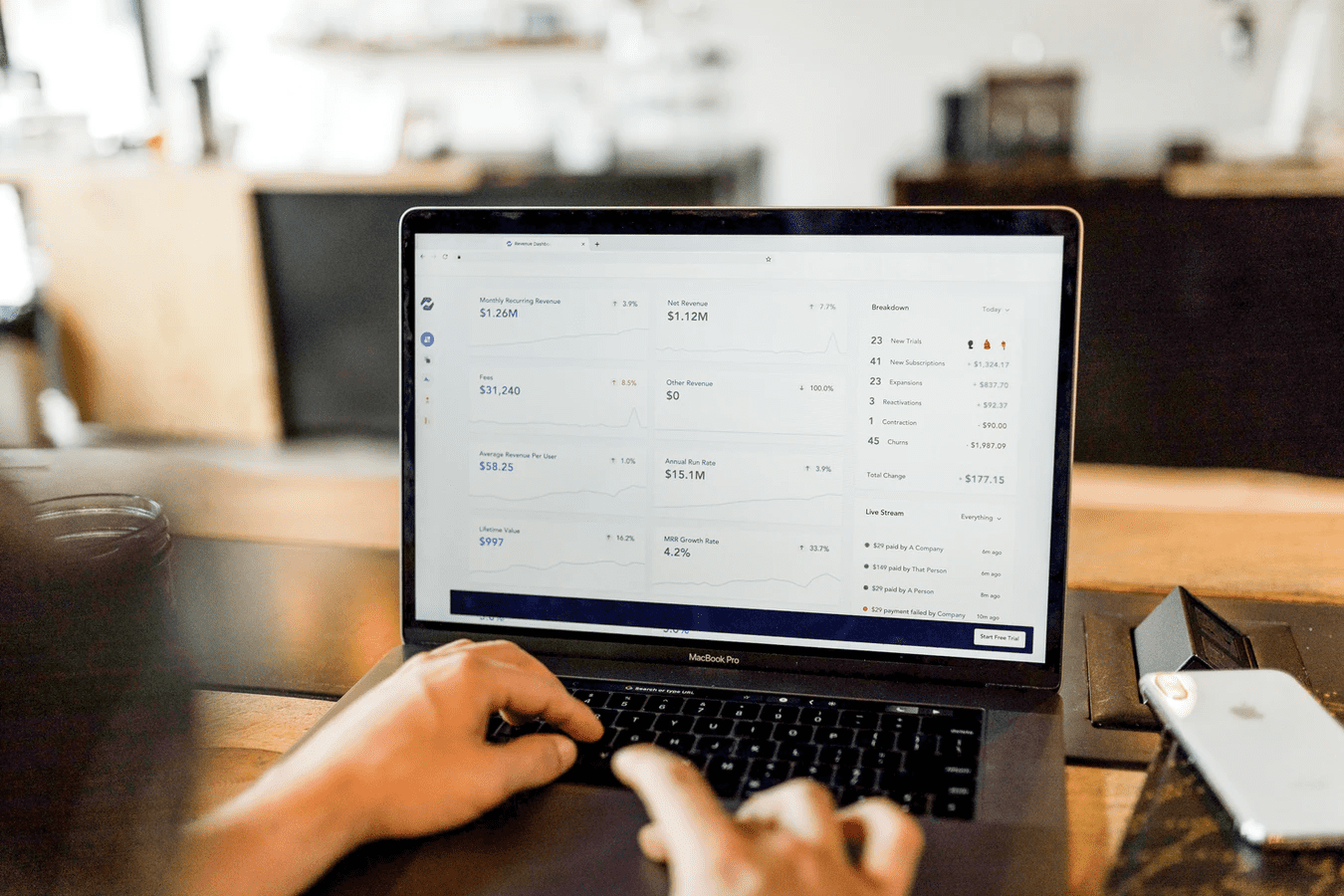

Are profit and revenue the same thing? This is a common question many owners and managers ask in regard to accounting for their business.

The short answer is, no, profit and revenue are not the same thing. Both measure money coming into your company, but that’s where the similarity ends.

Profit is any money left over after you’ve deducted all expenses for a specific period.

Revenue, on the other hand, is the total amount of cash your business takes in during a specific period of time.

Revenue is also called income, though when you start delving deeper into the accounting lexicon, you’ll come across subdivisions of the term income (e.g., net income) that cause the two concepts to diverge.

For now, though, it’s acceptable to define both revenue and income as the total amount of cash your business takes in during a specific period of time.

To help you understand the concept of profit versus revenue, here’s a simple example for the first quarter of the year (January, February, and March).

Profit is your business’s total revenue (or income) for January, February, and March minus all expenses for those months.

Let’s say your business’s total revenue for the first quarter was $20,000 and your expenses for those months totaled $15,000. Your business’s profit for the first quarter would be $5,000 ($20,000 – $15,000).

Keep in mind that this a very simple, basic definition and example of profit.

As we’ll discuss in the How Do You Calculate Profit Margin? section, there are a number of more detailed and complex profit calculations that include and exclude different variables of your business’s income and expense stream.

Armed with that information, you can gain deep insight into your business’s bottom line.

Banks, accountants, and investors use profit margin as a gauge for the profitability of your business. A high profit margin means you’re doing things right. A low margin means you need to make some adjustments.

One such adjustment may be your pricing strategy. If you have a low margin, you may need to increase what you charge for your product or service.

Another such adjustment might be your cost of goods sold (COGS). If you have a low profit margin, try finding ways to decrease what you spend to get your product to market.

All of this is revealed when you calculate one little number.

Your gross profit margin is the money you spent producing your goods subtracted from what you made on those goods (a.k.a. your gross profit). You then divide your income into that gross profit and multiply the whole thing by 100 to produce the gross profit margin percentage.

It sounds complicated, but it’s really not. Here’s the formula:

Gross Profit Margin = ((Income – COGS) / Income) x 100

Now let’s plug in some hypothetical numbers to see how it works. For this example, your business made $55,000 last month while spending $14,000 to produce the goods.

Gross Profit Margin = (($55,000 – $14,000) / $55,000) x 100

Gross Profit Margin = ($41,000 / $55,000) x 100

Gross Profit Margin = (0.745) x 100

Gross Profit Margin = 74.5%

That’s a strong gross profit margin. But remember, it only takes into account the money you spent producing the goods. It doesn’t factor in other expenses like taxes and loan payments, as well as other streams of income. That’s what the next calculation is for.

Net profit margin is basically the same as gross profit margin, but it adds in all the other expenses you incurred doing business.

Costs like rent, advertising, heating and cooling, maintenance on your sales vehicle fleet, and others — all of these are lumped together and added into the net profit margin equation.

Net Profit Margin = ((Income – COGS – All Other Expenses + Other Income) / Income) x 100

Now let’s take the same numbers we used in the gross profit margin calculation to figure your net profit margin. In this example, all the other expenses totaled $8,000. Your business didn’t have any other income.

Net Profit Margin = (($55,000 – $14,000 – $8000) / $55,000) x 100

Net Profit Margin = ($33,000 / $55,000) x 100

Net Profit Margin = (0.6) x 100

Net Profit Margin = 60%

Taken collectively, your net profit (income – COGS – all other expenses) and your net profit margin is your infamous “bottom line.” It’s the primary indicator of the strength of your business.

While gross profit margin and net profit margin are the most common metrics you’ll use in your accounting, operating profit margin is also a useful formula to know.

Operating profit margin is similar to net profit margin in that both take into account all expenses necessary for the day-to-day operation of your business (e.g., overhead, operating, administrative costs), including such numbers as the amortization and depreciation of assets.

Operating profit margin, however, does not include non-operational expenses such as debt, taxes, interest payments, costs from currency exchanges, and others.

Even though it’s not as complete as net profit margin, operating profit margin does provide a nice indicator of the money your business has left over after paying to keep the business running.

Here’s the formula for calculating operating profit margin:

Operating Profit Margin = (Operating Income / Revenue) x 100

The operating income in this equation is a measure of the amount of profit your business realizes from operations after deducting operating expenses such as wages, depreciation, and cost of goods sold.

So, for example, imagine that your business posted an operating income of $10,000 last month with a total revenue of $60,000.

Plugging those numbers into the equation yields:

Operating Profit Margin = ($10,000 / $60,000) x 100

Operating Profit Margin = (0.167) x 100

Operating Profit Margin = 16.7%

Is 16.7% a good profit margin? We’ll discuss that question in the next section.

So, is 16.7% a good operating profit margin? The simple answer is maybe. We can’t give you a definitive yes or no because it varies from industry to industry.

That means that a good margin for a company in one industry may be a bad margin for a company in another industry.

The bottom line is that you can’t compare your business’s profit margin to another business’s unless both businesses are in the same industry (i.e., they’re both fine dining restaurants).

Comparisons between different industries don’t work because, as you learned earlier in this article, profit margins depend on a variety of factors including such processes as:

Businesses in different industries don’t share those same variables, so there’s no basis for comparison.

That said, we can establish a baseline (or “good”) profit margin within specific industries so your business knows how it’s doing.

The information in this section is based on pre-pandemic (2018 and 2019) data. Profit margins in 2020 and 2021 (and beyond) may be drastically reduced until the public health crisis has been resolved.

Here are the standard profit margins (net and gross) by industry:

When you put two different industries side by side — Construction and Tax Services, for example — it’s easy to see why a homebuilder and a tax preparer shouldn’t compare margins.

With a net profit margin of 5% and a gross profit margin of 19%, it would be very easy to get the wrong idea about your construction business if you compared it to the tax preparer next store who boasts 20% net profit and 90% gross profit.

Keep your comparisons to the industry you’re in to really get an idea of whether or not your margins are too low or right on track.

Increasing your prices — even by just a few cents — is an easy way to help boost the margins on certain products or services.

To pick the right price point for your business, adopt the strategy of competitive pricing and then use actual customer data to inform your decision.

Old inventory isn’t doing your business any good just sitting on the shelf — it’s taking up valuable space, and you have to pay taxes on it at the end of the year.

Reducing your inventory brings in more revenue, decreases expenses, and improves the profit margin throughout your entire business.

Upselling (or suggestive selling) is the practice of asking a customer if they would like to include an additional item or service with their primary purchase.

Most often, the additional item is a complementary product to the original purchase and much less expensive — like an extended warranty, batteries, or cables — but the inclusion of those extra items serves to increase the profit margin of your business.

Customer loyalty is the measure of a consumer’s willingness to do repeat business with your company or brand.

The benefits of cultivating customer loyalty are legion and include the fact that:

You may not be able to achieve all those benefits, but even just one or two can increase profit margins across the board.

Vendor management is the process of interacting with — and managing for mutual benefit — the third-party suppliers of goods, materials, and services to your company.

Vendor management is essential to your profit margin and to the overall success of your business because those third-party suppliers have a significant impact on your company’s operations.

Reliable vendors improve your revenue stream and help your business grow at scale.

Unreliable vendors, on the other hand, create bottlenecks in the way your team operates and produce more of a negative impact on your profit than you probably realize at the moment.

For suggestions on how to go about optimizing vendor management, take a moment to read this helpful article from the Sling blog: Vendor Management: The Complete Guide To Working With Suppliers.

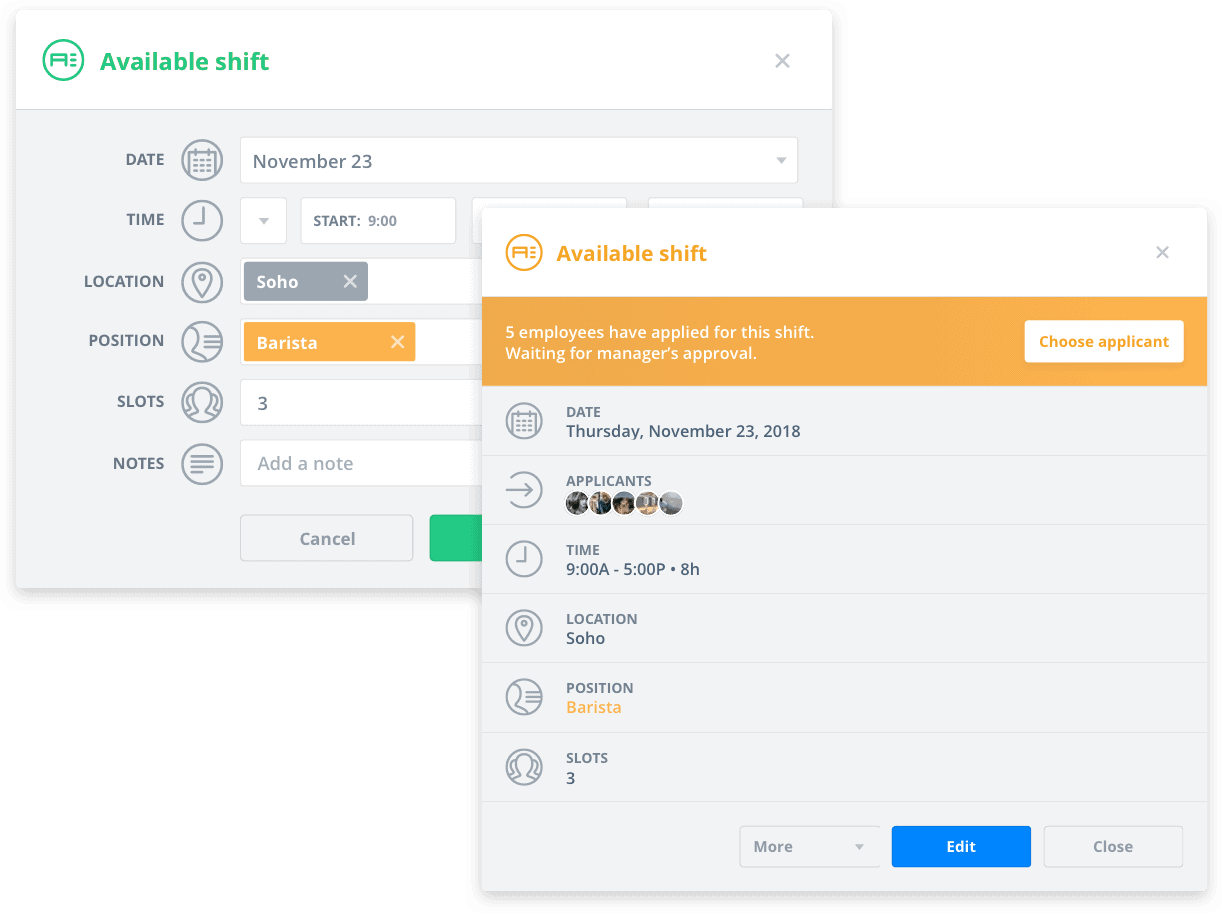

Labor costs are one of the largest expenses your business will have to deal with. Whether you factor them into your costs of goods sold or other expenses, they are going to have a dramatic impact on your profit margin.

You can lower your labor costs by harnessing the power of the Sling app.

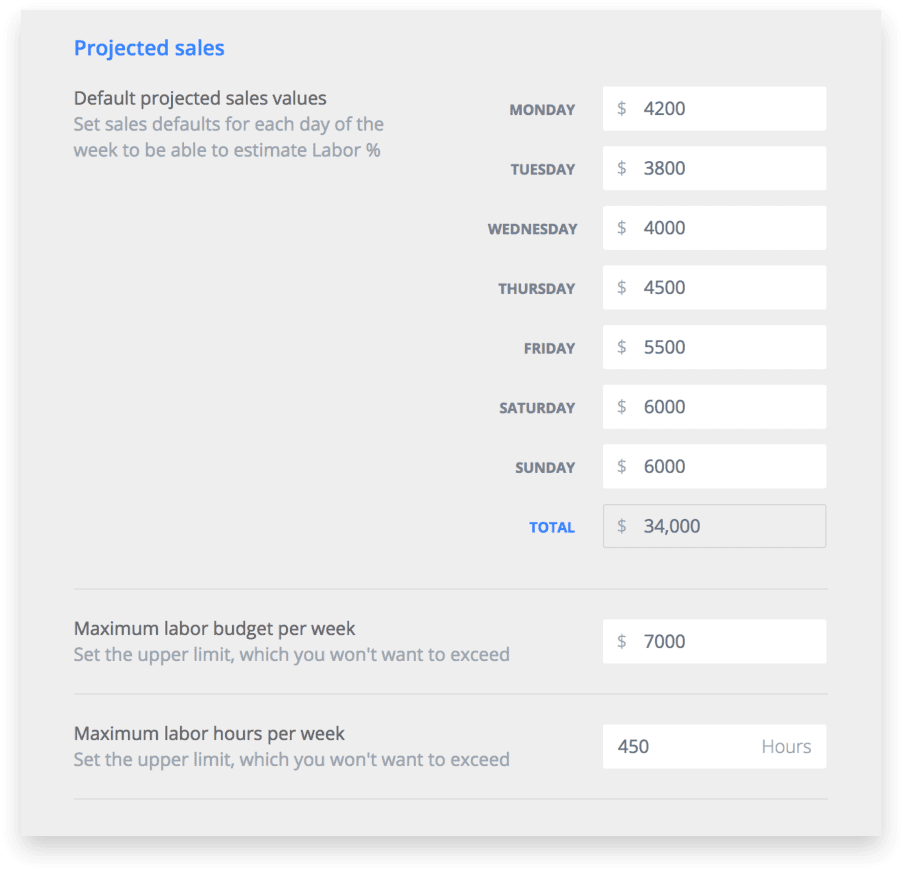

Getting control of your labor costs starts with scheduling. Sling’s labor costs feature gives you the power to optimize your payroll as you schedule so your spending doesn’t get out of control.

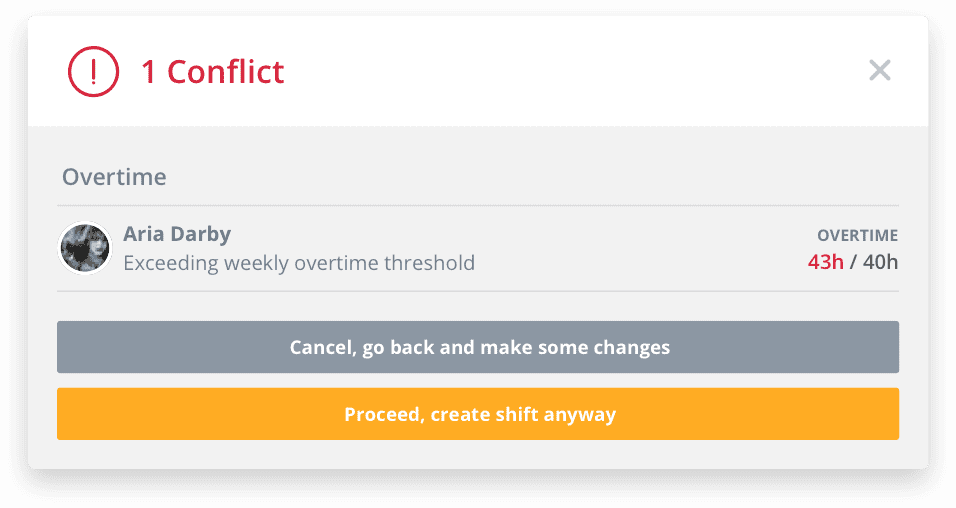

Add to that budget tools and alerts that prevent you from going over the numbers you’ve set and onboard artificial intelligence that notifies you when you’re about to schedule someone into overtime, and you’ve got a powerful ally in the battle against profit and loss.

You can even set wages per employee or position and see how much each shift is going to cost. And that’s only one of Sling’s many features that will streamline and simplify the way you organize and communicate with your employees.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.