Average Vacation/PTO Time: Is Your Business Offering Enough?

As a manager or owner, you may be curious about what the average vacation/PTO ti...

Calculating PTO accrual can be a confusing and labor-intensive task. But every manager should have at least a working knowledge of how to track this important benefit.

In this article, the experts at Sling introduce you to PTO, PTO accrual, and the calculations you’ll need to figure it all out.

Table Of Contents

PTO is the abbreviation for “paid time off” (or, sometimes, “personal time off”).

Paid time off is a benefit given by employers to employees that provides a bank of hours from which the employee can withdraw time off for sick days, vacation days, and personal days as the need arises.

To understand PTO accrual, we need to define that second term.

Accrual is:

The accumulation or increase of something over time.

Putting the two ideas together, we get a clear and concise definition of PTO accrual:

The accumulation or increase of paid time off hours over time.

We’ll examine how this works in more detail in the section How To Calculate PTO. But first, we’ll discuss three key questions that every manager and business owner should answer.

PTO is a fringe benefit that some businesses offer as a way to recruit and retain the best employees. But is it right for your business?

When examining the issue of paid time off, it’s vital to take into account one important fact: PTO is not mandatory. There’s no law that says you have to offer this benefit. It’s entirely up to you.

Some businesses don’t offer PTO at all, while other businesses offer it to their full-time employees but not their part-time employees. It all depends on the unique needs of your organization.

Examine your business’s budget, consider all the angles, and then decide whether or not to offer PTO as a perk.

For more information on PTO, take a few moments to read our helpful article, Paid Time Off: The Complete Business Owner & Managers Guide.

The first step in implementing a paid-time-off policy is to decide how much time you will offer. Remember, PTO is entirely optional, so you decide on the number of hours that works for your business.

Common PTO offerings include:

(Note: These numbers assume an eight-hour workday. Your policy may differ.)

Again, you can choose any number you want — or none at all. It all depends on what makes the most sense for your business.

Another crucial factor to consider when setting up a paid-time-off program is the roll-over policy you’ll apply to any leftover hours.

Some businesses make it mandatory that all employees use their PTO in one calendar year, eliminating the need for a roll-over policy. Any hours remaining at the end of December disappear at the beginning of January.

Other businesses allow their employees to transfer a certain amount of PTO hours from one year to the next.

For example, if you offer 40 hours of PTO per year and an employee only uses 35, they can add those five unused hours to the next year’s total (for a grand total of 45 hours).

Whatever PTO numbers and roll-over policy you choose, be sure to provide all the details in your employee handbook.

Now that you understand the basics of PTO accrual, we’ll turn our attention to the calculations you’ll need to make your policy work.

There are many different ways to calculate PTO accrual — from the simple to the complex. We’ll show you one from either end of the spectrum.

This is the simplest method for calculating PTO and is ideal for long-time employees and full-time employees who have already worked a full year.

In January, each employee starts with a specific number of PTO hours. When an employee takes time away from work, you subtract the time off from their yearly PTO bank.

Here’s an example of this PTO calculation:

If you don’t want your employees to wait until the start of a new year to begin accruing paid time off, you can implement the following method.

This method is more complicated than the yearly PTO bank, but it more accurately reflects the amount of work the employee puts into your business — especially for part-time team members.

For this example, we’ll calculate PTO accrual for a part-time employee using the same metrics you’d use for a full-time employee:

With those numbers in mind, here’s how to calculate PTO accrual based on hours worked:

80 PTO hours / 2000 total hours = 0.04

4 hours worked X 0.04 = 0.16

Continue calculating their PTO accrual for every hour they work.

You can also use this method to calculate PTO for a full-time employee who works less than eight hours a day on certain days.

Just use the same two constants — 80 hours PTO and 2000 hours worked per year — and the employee’s hours worked to figure out how much time off they’ve earned.

Daily PTO accrual is useful for all employees — full-timers and part-timers alike — but it only works if they are on the clock for full eight-hour shifts.

Since the eight-hour shift is the basis for your calculations, if a part-time employee works anything less, they won’t receive the PTO like full-time employees.

Below we’ll talk about how to determine a daily PTO accrual rate. Again, you’ll base all your numbers on what your full-time employees receive, so the numbers might be a bit different from the ones we use here.

That said, the equations remain the same.

In this example, we’re going to use the day (a full eight-hour shift) as the foundation of the calculation.

So, as before, we assume the following standards:

To figure out the amount of PTO an employee will accrue for every day worked, plug those numbers into the following equation:

Daily PTO Rate = Annual PTO Hours / Annual Days Worked

Daily PTO Rate = 80 / 250

Daily PTO Rate = 0.32

For every day an employee works, they will receive 0.32 hours of PTO.

If a part-time employee works an eight-hour shift Monday, Wednesday, and Friday, along with a six-hour shift on Thursday, their PTO accrual is as follows:

Employee PTO = Number Of Full Days Worked x Daily PTO Rate

Employee PTO = 3 x 0.32

Employee PTO = 0.96

In this example, only the full days count, so the six-hour shift is discarded.

Hourly and daily PTO accrual calculations work for both full-time and part-time employees. Even though the daily rate discounts shorter shifts, the part-time employee does receive a portion of the benefit.

The same can’t be said for the weekly calculation. Any accrual method that deals with time periods larger than the day is biased toward full-time employees.

If you choose to use this calculation for your part-time employees, you’ll need to introduce more elaborate tracking and record-keeping that may make it less productive.

That said, once an employee accumulates a week’s worth of hours (e.g., 40), the math is very similar to the daily calculation.

Again, we’ll assume the following metrics:

Weekly PTO Rate = Annual PTO Hours / Total Weeks Worked Annually

Weekly PTO Rate = 80 / 50

Weekly PTO Rate = 1.6 hours

As an example of this method, imagine that an employee asks for a morning off in mid-February. Do they have enough PTO (assuming they don’t have rollover from the previous year)? You can use the weekly accrual calculation to find out.

They’ve worked six weeks so far this year at a weekly PTO rate of 1.6 hours per week. Here’s the math:

PTO Accrued So Far = 6 Weeks Worked x 1.6 Hours Per Week

PTO Accrued So Far = 9.6 hours

The employee has more than a full day (eight hours) of PTO saved up, so granting them the morning (four hours) off is possible from a PTO perspective.

Many businesses pay their employees every two weeks, so basing your PTO accrual on that time period makes great sense.

One of the benefits of the every-two-week calculation is that your employees will always see the same amount on their paycheck.

As with the previous methods, to figure out the accrual rate, take the total amount of PTO you give divided by the number of two-week periods that employees work in a year.

Your numbers may vary — you may give less total PTO and your employees may work more total weeks annually — but for this example, we’ll assume the same numbers we’ve been using throughout this article:

Two-Week PTO Accrual Rate = 80 Hours / 25 Two-Week Periods

Two-Week PTO Accrual Rate = 3.2 hours

Assuming an employee works 40 hours both weeks, they’ll receive 3.2 hours of PTO for that pay period.

To illustrate how you can use this method if an employee asks for time off, consider the following example.

An employee asks for a week off at the end of June. Do they have enough PTO (assuming no rollover from the previous year)? Look back at your records and see that you have issued 12 paychecks so far this year (one every two weeks for six months).

Multiply those 12 pay periods by the accrual rate of 3.2 hours and find that the employee has earned 38.4 hours of PTO.

They haven’t accumulated the full 40 hours necessary to take the whole 40-hour week off, but since they’re close, you might credit them the 1.6 hours as a gesture of goodwill.

During the next two-week pay period, then, they would only receive 1.6 hours of PTO instead of the regular 3.2.

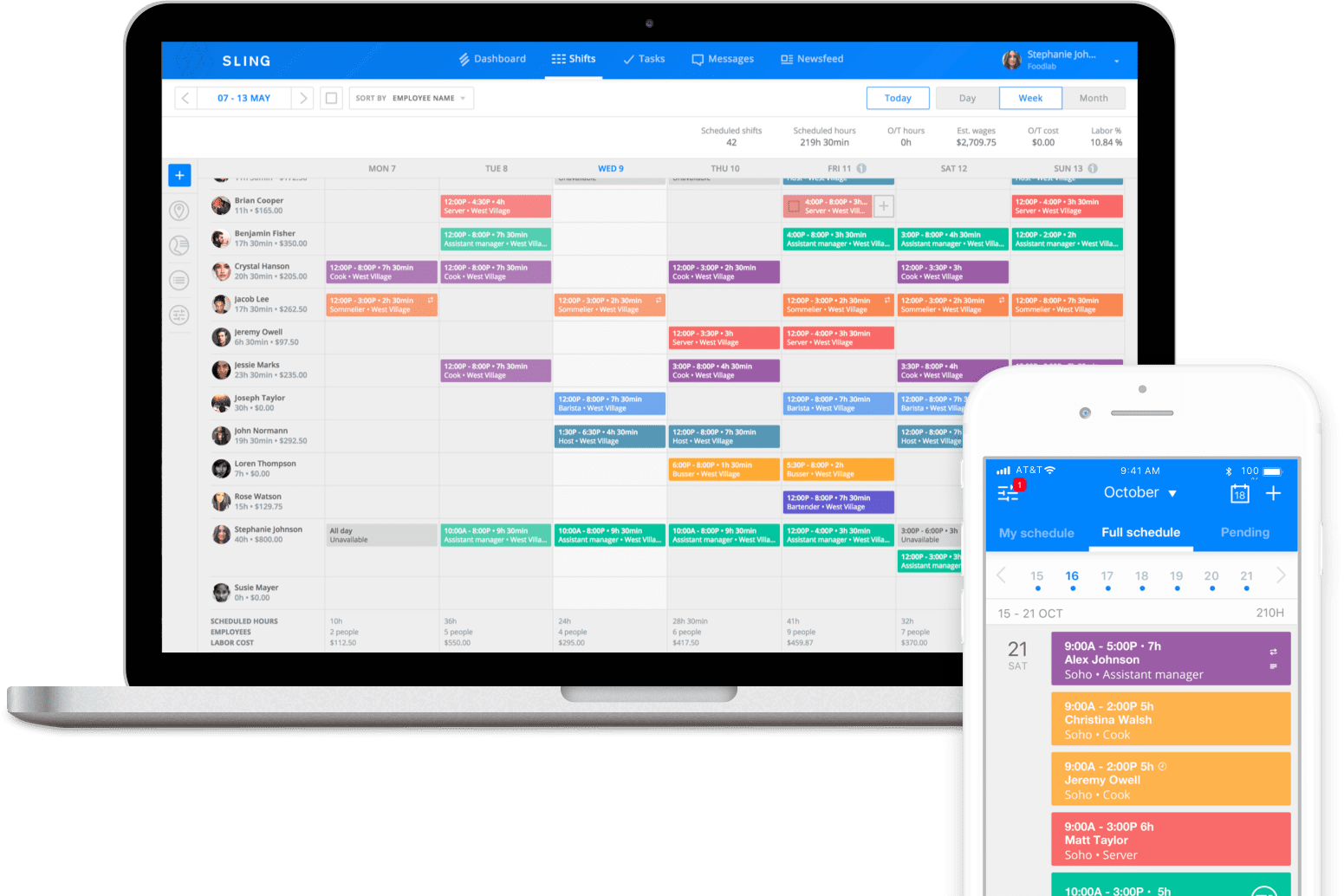

Your to-do list is long and calculating PTO accrual can eat up a big chunk of your day. To make your work life easier, incorporate Sling — the most multifaceted employee scheduling platform available — into your workflow.

With Sling’s employee scheduling features and management tools, you can quickly handle all of your business needs and leverage your time effectively.

Take care of employee scheduling, monitor your labor spend, and communicate with employees all in one platform.

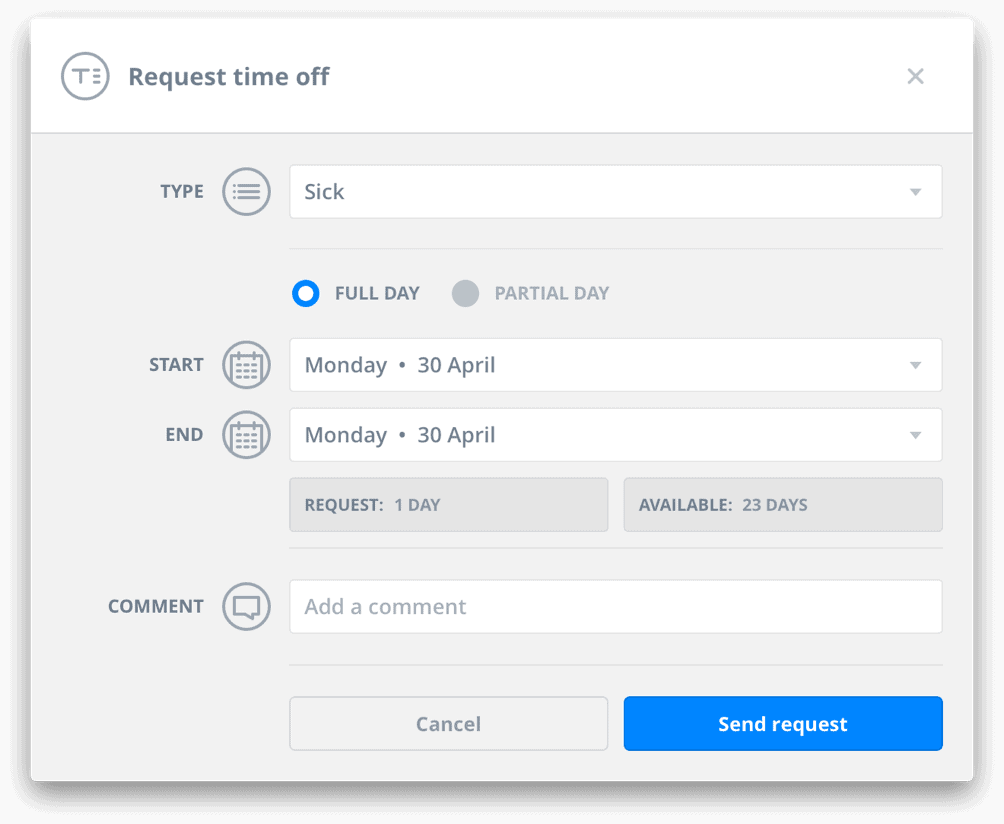

Whether you’re managing a team of 5 or 500, Sling will save you valuable hours. With just a few clicks, you can approve PTO requests, find coverage for shifts, and seamlessly track labor costs while staying on budget.

All of Sling’s cloud-based features — from schedule creation to time clock to payroll calculations — make it easy for you to create the best schedule possible, distribute it with ease, make changes, and juggle time-off requests.

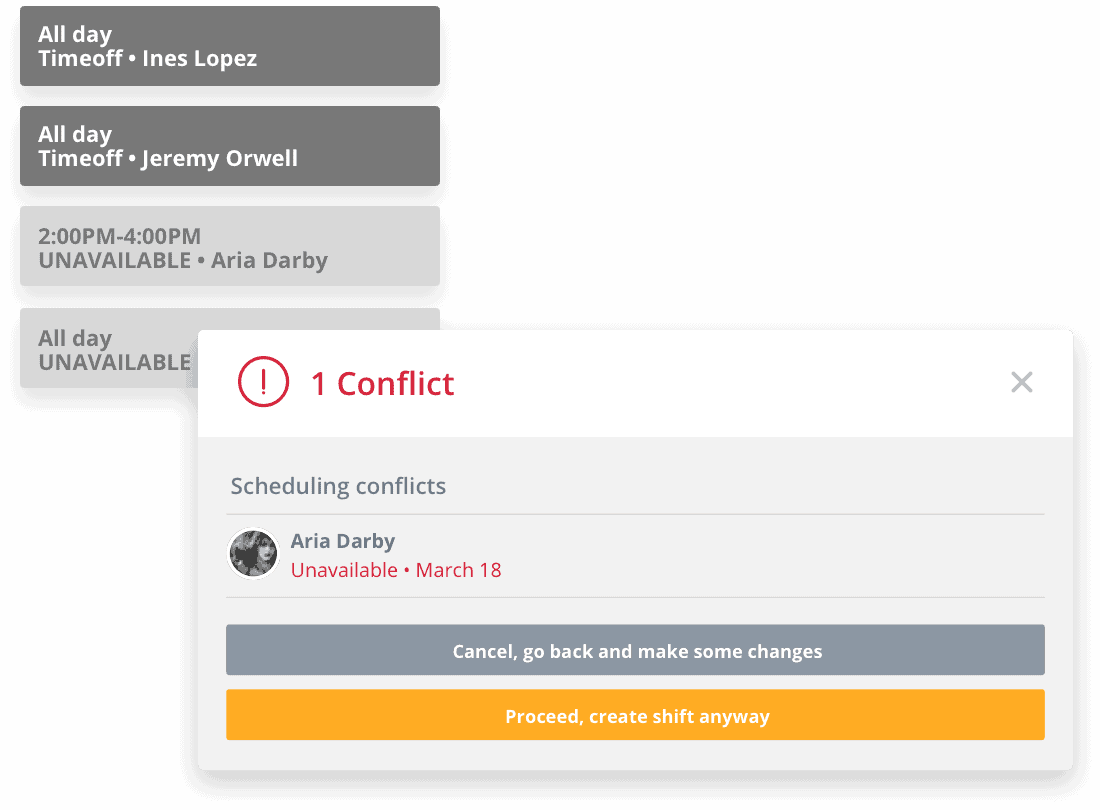

Sling even provides suggestions and warnings when you’ve double-booked a team member or created a conflict in another part of your schedule.

All of this makes Sling the best shift planning software for simplifying your business’s work schedule, tracking PTO accrual, and giving you more time to focus on guiding your business to success.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.