The 14 Best Mobile Time Clock Apps in 2024

Get an accurate picture of work hours and labor costs with an app. We’ve creat...

Calculating wages and salaries is a time-consuming task. There are so many variables and details that it can quickly become more than one person can handle. Thankfully, there is a simple solution: payroll software.

Apps like Sling provide managers with tools that automate and streamline many of the more difficult and involved tasks associated with maintaining your business’s payroll.

But will just any app do? Not likely. In this article, we discuss why using payroll software is important and which features to look for to make your job easier.

When you incorporate payroll software into your workflow, your business saves time that can be better spent on more important, strategic objectives.

Time, in a very real sense, is money, and that’s never more true than when it comes to running payroll.

If your payroll process is overly complicated, relies too much on manual calculations, or takes too much time to complete, your business is losing valuable time and money that could be spent on more important issues.

Another important reason to use payroll software is compliance. Local, state, and federal laws can be convoluted and complicated and often change from one year to the next.

If your business fails to abide by one or more of the requirements or misses one of the changes, it can face hefty fines and even significant legal trouble later on.

Payroll software helps you keep track of your payroll details so that you can stop worrying about compliance and focus on growing your business.

Accuracy is an essential part of an effective payroll process. Without accuracy, it’s all too easy to slip out of compliance and for friction to develop between your business and your employees.

Human error is the biggest cause of inaccuracies such as miscalculations, missed payments, and incomplete record-keeping. But you can remove this variable from the equation by automating many of the manual payroll processes with software.

Sling, for example, tracks the majority of your team’s necessary data so you can manage payroll without accuracy becoming an issue. Plus, when you have employee time tracking software that syncs with your payroll software, your records are as accurate as they can possibly be.

Complying with local, state, and federal payroll laws also involves submitting necessary reports and maintaining both short-term and long-term records.

Most payroll reports are due on the 15th of the first month after the quarter ends. Some reports, however, may be due more frequently, while others may be due less frequently. It all depends on your industry, location, and filing status.

Similarly, government agencies may have questions from time to time, so it’s good to hold on to timesheets, pay stubs, and other wage-related records for at least three years.

Payroll software helps reduce the complexity of reporting and record-keeping by allowing you to set due-date reminders and store employee information and pay data digitally for easy access and retrieval.

That said, make sure you have all of the reports and records necessary to keep your payroll up to date and compliant by talking to an attorney or accountant who is familiar with your industry and where it operates.

You’ll avoid a lot of headaches if you set up the legal side of your business on the front end. If you don’t know where to start, ask other local businesses for recommendations. They’ll be able to point you in the right direction.

Another reason why payroll software is essential for 21st-century businesses is team happiness and morale.

If your employees can’t depend on receiving a correct paycheck on payday, their job satisfaction, productivity, and efficiency will fall. And if the mistake happens more than once, many employees will choose to take their labor elsewhere.

Apps like Sling automate many of the complex tasks that are required before cutting checks so that, when payday arrives, you’ll have plenty of time to crunch the numbers and get the money into the hands of your employees.

In today’s mobile work environment, accessibility is one of the more important features of payroll software.

You never know where you’re going to be when you or someone on your team will need access to payroll information — especially if you manage multiple locations or teams with on-site, remote, and mobile employees.

That’s why your payroll software should work anywhere and on any device.

The Sling app, for example, operates in the cloud, so you can use it anywhere you have internet access. Sling is also available on desktop, iOS, and Android devices, allowing you and your team to be in sync no matter what phone, tablet, laptop, or desktop you use.

The foundation of easy and accurate payroll is time tracking. Without a comprehensive work-hour record-keeping system, your payroll software would be next to useless.

That’s why the best payroll apps also have robust time tracking features that make clocking in and out easier than ever before.

All of Sling’s features, for example, are available in the cloud so that your team members can use any smartphone, tablet, laptop, or desktop to start and stop their work time — wherever they may be.

Sling even gives you the power to set up restrictions (e.g., how many minutes before and after their shift employees can clock in or out) and geofences so that your team members can’t clock in unless they’re where they should be.

And like we mentioned above, having your employees’ exact time on the clock sync directly with your payroll software means you never have to worry about inaccuracy with payroll reporting again.

Immediate data availability eliminates many of the bottlenecks that slow down and complicate your payroll calculations.

With the right payroll software, from the moment your employees clock in, their data is available and ready for processing and analysis. At the end of the pay period, all it takes is a few clicks or taps to produce the numbers you need.

Apps that offer immediate data availability — coupled with the accessibility mentioned at the start of this list — make the entire payroll process easier and more convenient than ever before.

Compatibility is another must-have feature of modern and effective payroll software. With some payroll apps, you can transfer data in the blink of an eye to integrated payroll tools while maintaining the level of detail and security your business needs to succeed.

You can even sync as much or as little information as necessary, including such variables as employee role, hourly wages, part-time/full-time status, locations, and many others.

Not every business runs its own payroll. Some rely on third-party payroll-processing companies to crunch the numbers for them.

With quality payroll software, you can produce reports — both digital and hard copy — and manually export them in a variety of formats for easy transmission to your accountant or other payroll processing business.

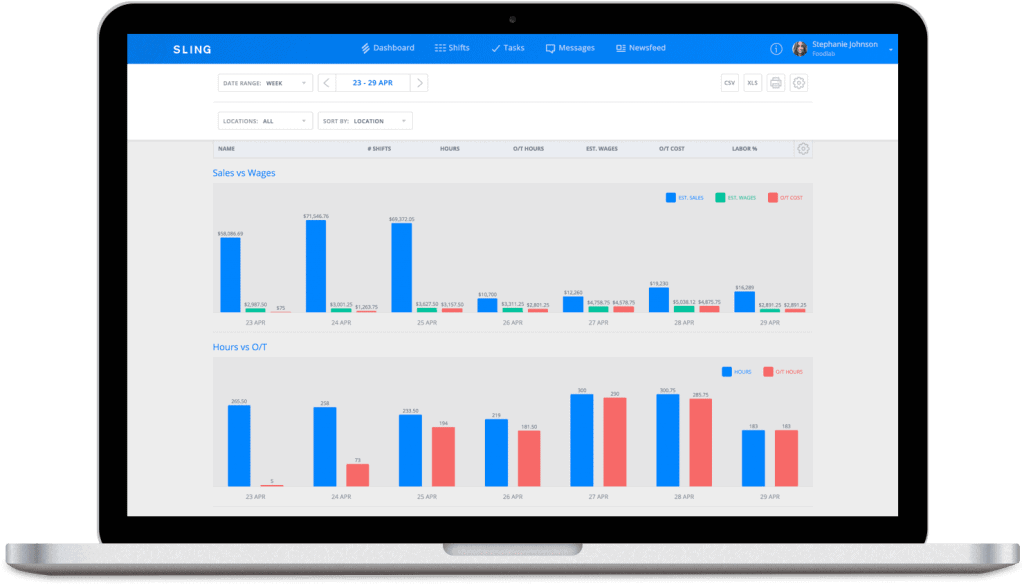

The benefits of advanced payroll software don’t stop once you’ve signed the paychecks. Some even let you use all the data that goes into paying your team to forecast for the future.

For example, Sling makes it easy to import labor cost information from other programs or your payroll processor for easy analysis and integration into future calculations and reporting.

This helps you plan many of the important variables of your business weeks, months, and even years in advance.

Choosing the best payroll software for your business and your team is about more than just crunching the numbers that go on their paychecks.

Granted, the more advanced apps do simplify that aspect of the payday process. But payroll software for the 21st century actually streamlines all the processes that come before handing out checks.

Sling, for example, automates everything from the moment your employees clock in to the moment you sign their paycheck.

With Sling, you can:

You can even export data quickly and easily to integrated tools, such as Toast Payroll, Gusto and ADP Workforce Now, or produce reports in a variety of formats — both digital and hard copy — and manually transfer them to the payroll processor of your choice.

So, whether you need a tool to help you communicate with your team, organize and control necessary tasks, track time, control labor costs, oversee multiple locations, or manage payroll, Sling is the software for you.

To learn more about how Sling can help you manage your business better, organize and schedule your team, and track and calculate work hours, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.