How To Calculate Profit Margin For Small Business Owners

As a small business owner or manager, you need to speak the language of your ind...

Revenue vs. profit is a difficult — and sometimes confusing — topic, even for the most seasoned business owner. But to manage your company’s finances with any degree of control, you need to understand the differences between the two concepts.

In this article, the management experts at Sling tell you everything you need to know about revenue vs. profit and why they are both crucial for the success of your business.

Revenue (a.k.a. sales or turnover) is the total income your business generates from normal business activity — typically, the sale of goods or services to customers.

More specifically, this type of income is operating revenue because it is money earned from the regular operations of the company.

The formula for calculating operating revenue is very simple:

Price of goods or services sold X Quantity of goods or services sold = Operating Revenue

So, if your business sells 200 items for $10 each, your operating revenue is $2,000 ($10 x 200 = $2,000).

This lies in contrast to non-operating revenue, which is income your business generates from sources other than your primary good or service.

Non-operating revenue often takes the form of dividends from investments or donations from generous benefactors, among other things.

In its most basic form, profit is the money left over after subtracting all of your production expenses (cost of goods sold) from the money you bring in from regular sales (operating revenue).

This is gross profit, the first of the three types of profit. Here’s the equation:

Revenue – Production Expenses = Gross Profit

Depending on how you calculate revenue, this category of income could be from operating revenue, non-operating revenue, or both combined.

The second type of profit you need to understand is operating profit.

While gross profit only takes into account the cost of goods sold as its major expense, operating profit — as the name suggests — includes business operating expenses (e.g., rent, mortgage payments, loan payments, etc.).

Here’s the formula for calculating operating profit:

Gross Profit – Business Operating Expenses = Operating Profit

The third type of profit — and the one that everyone tends to focus on — is net profit. Net profit is the total money left over after subtracting ALL the remaining expenses from your operating profit.

At this point, you’ve already subtracted the cost of goods sold and your operating expenses. But there are probably other expenses that you haven’t factored in yet, such as employee benefits, fuel for the company cars, and donations to local charities.

Here’s the formula for calculating net profit:

Operating Profit – Expenses Not Already Included = Net Profit

Many managers skip right to net profit in an attempt to see how much they’ve made for the year, but calculating operating profit provides insight into other aspects of your business that you can use to reduce costs and better control your workflow.

Now that you understand what each component means, let’s examine the fundamental differences in revenue vs. profit.

Profit is entirely dependent on revenue. Without income from goods or services sold, you will never have any profit.

Similarly, your business can generate revenue but not be profitable because your expenses exceed your income.

It may seem simple, but the fact that you can’t have one without the other — no income, no gain — is the foundation of revenue vs. profit.

Both revenue and profit have their place on your income statement — whether it be an internal report or one for the IRS.

Revenue is at the top of the income statement because it’s the beginning of all calculations — money in from goods or services sold. As we mentioned in point one above, without revenue, you can’t have profit (even with revenue, you’re not guaranteed profit).

Profit (or more accurately, net profit) is at the bottom of the income statement because it’s the end result of all the math.

As such, those with experience calculating these numbers refer to profit by its more common name: the bottom line.

The amount of revenue your business brings in depends on your customer base and their willingness to pay for your product or service.

There are internal decisions you can make to help increase income, but revenue is, more or less, completely dependent on external forces.

Profit, on the other hand, depends on internal forces. Yes, you need enough revenue to cover costs, but those costs are entirely in your control.

Whether you choose to streamline production, slash overhead costs, limit labor expenses, or all three, minimizing the amount you have to subtract from revenue will increase your profit margin.

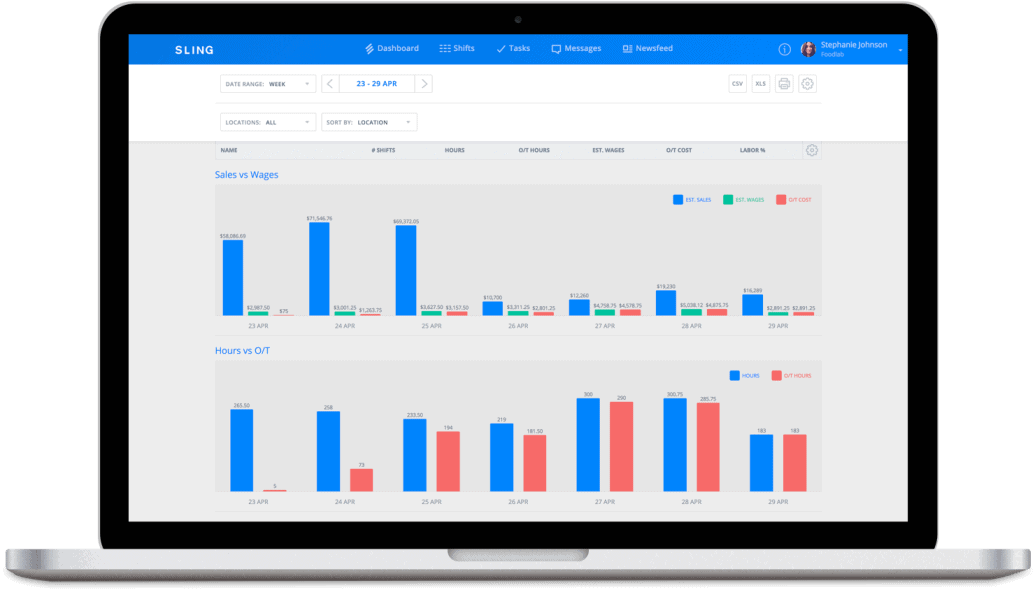

Labor costs are one of the highest expenses that most businesses contend with. Only rent and mortgage payments rank higher.

In fact, in many businesses, labor costs can average 30-35 percent of total revenue. That’s a large sum of money leaving your business each year and seriously cuts into your profits.

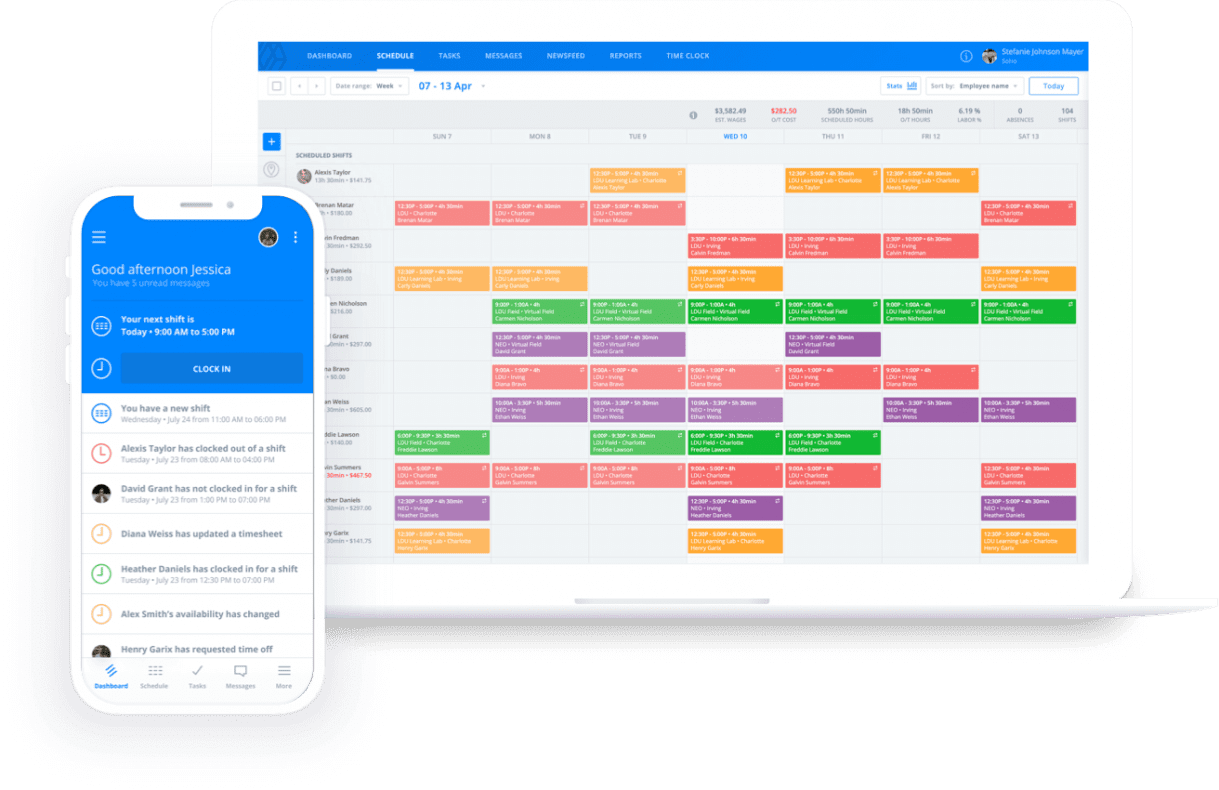

One of the best ways to control those costs throughout your organization — and increase profits along the way — is to incorporate workforce management software like Sling into your workflow.

Sling gives you incredible control over your schedule so you can quickly and easily create rotas one month, two months, even six months or more in advance.

The built-in artificial intelligence even reminds you of requested time off, double bookings, and overtime hours, so there’s less back-and-forth once you’ve completed the schedule.

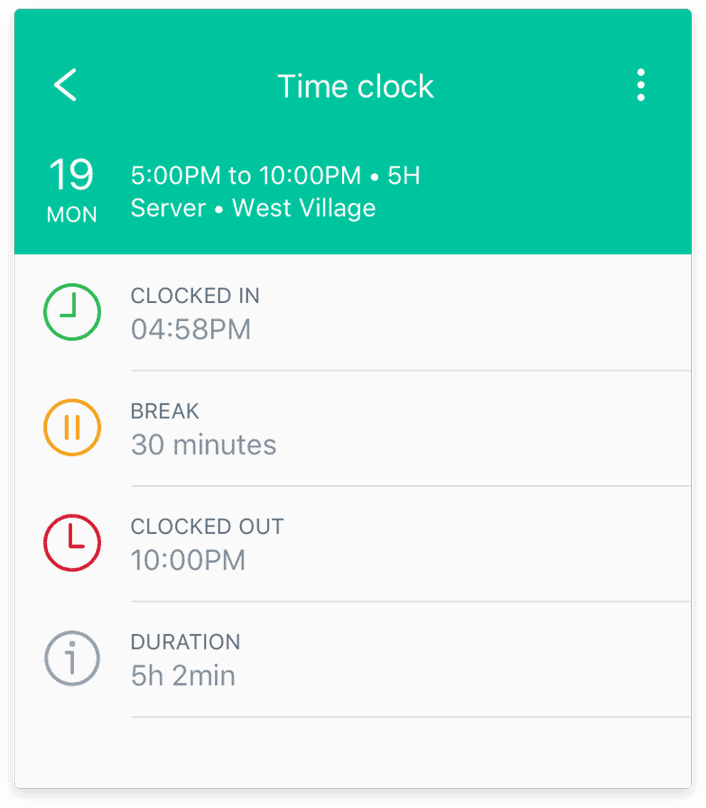

Sling also acts as a time clock for your business. You can set up a central terminal or allow your employees to clock in and out right from their mobile devices.

And with Sling’s powerful geofencing feature, you can prevent early clock-ins and missed clock-outs with the touch of a button to keep tight control of your labor costs.

Sling also lets you optimize labor costs by setting wages per employee or position so you can see how much each shift will cost you. With those settings in place, you can keep track of your labor budget and receive alerts when you’re about to exceed those numbers.

This will help you save money and give you more control over revenue vs. profit.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.