Verification of Employment: What Managers Should Know

Getting ready to welcome a new employee to the team? Before you make it official...

Hiring a new employee is an exercise in patience, persistence, and attention to detail. After conducting extensive interviews and settling on the right person, that patience and attention to detail continues during the onboarding process. It’s here that it becomes vital to make sure all applicable new employee forms are complete and filed properly.

But what new employee forms do you need for your business? The management experts at Sling help you sort through the paperwork to decide which forms are essential for your industry.

Before you can begin interviews, you must have job candidates complete an application for the position they’re looking to fill.

This provides with you with information about the potential employee that you can verify (e.g., education and previous employment). The job application is also vital as a new employee form because — once completed and signed — it protects you, the employer, from fraudulent claims made by the employee.

The first new employee form that all new hires should complete before beginning work is the Employment Eligibility Verification (a.k.a. the I-9). Once submitted, the federal government uses this form to verify that the employee you intend to hire is legally eligible to work in the United States.

The second most important new employee form (following the I-9) is the Employee’s Withholding Allowance Certificate (a.k.a. the W-4).

You, the employer, will use the information on the W-4 to withhold the correct federal income tax amount from your employee’s paycheck. If your employee doesn’t complete the W-4 and you fail to withhold taxes from their paycheck, you can both get into serious trouble with the IRS when tax day rolls around.

Next in the line of new employee forms is your state’s income tax withholding form (check your Secretary of State’s website for details).

This form (or forms) is similar to the federal W-4 but applies exclusively to taxes levied on wages at the state and local levels. If you neglect to complete this form, you and your employee can have difficulties come April 15.

If you offer direct deposit to your employees, this new employee form gives you the details necessary to transfer a paycheck into their bank account.

Key pieces of information to include on this form are:

This form also gives you the authorization necessary to transfer payroll money between your bank and the employee’s bank.

This new employee form indicates who you should call on the employee’s behalf in the case of an emergency. It should contain all applicable employee information, such as:

In addition to those details, the form should also ask for the address, contact information, and relationship to the employee of two individuals that you could call in the event of an emergency.

Whether your employee handbook comes in paper or digital form, you should make it available to the new hire.

Then, whether it’s a part of the employee handbook itself or a separate document altogether, verify that the employee has read the handbook by having them sign an employee handbook acknowledgment form.

If you offer health insurance coverage to your employees under the Affordable Care Act, you should include the federal 1094-C as one of your new employee forms.

Even if you provide health benefits as part of a private plan, it’s crucial to have the new hire fill out a form indicating their choice to participate or not.

An essential part of every employee handbook is your business’s policy on harassment and discrimination. The handbook must be specific on those behaviors that are not acceptable while at work and list the repercussions should an incident occur.

Once the new employee has read your anti-harassment and anti-discrimination policy, have them fill out an acknowledgment that they understood what they read.

An orientation, or onboarding, checklist tells the new hire what will happen after they finish filling out all the new employee forms. This checklist gives them a step-by-step guide to how they will be trained and what they can expect after they leave your office on their first day.

If your business has 100 or more employees, the Equal Employment Opportunity Commission (EEOC) requires that you complete the Equal Employment Opportunity (EEO-1) report each year.

Making the EEO-1 a part of your new employee forms reduces the amount of work required when it’s time to send in your report. If you stay up to date on the collection of this information, all you have to do is compile the data on diversity and transmit it to the proper authorities instead of taking time out of your — and your employees’ — busy day to have them fill out the form.

Keep in mind that this specific form is completely voluntary — the new hire may choose to fill it out or not. Whatever they decide, it will not affect their opportunity for employment or the terms and conditions of their job.

It’s essential to schedule enough time for your new hire to complete these forms. Without them, you can both face difficulties when it comes time to pay taxes, complete payroll, make an insurance claim, or deal with workplace issues.

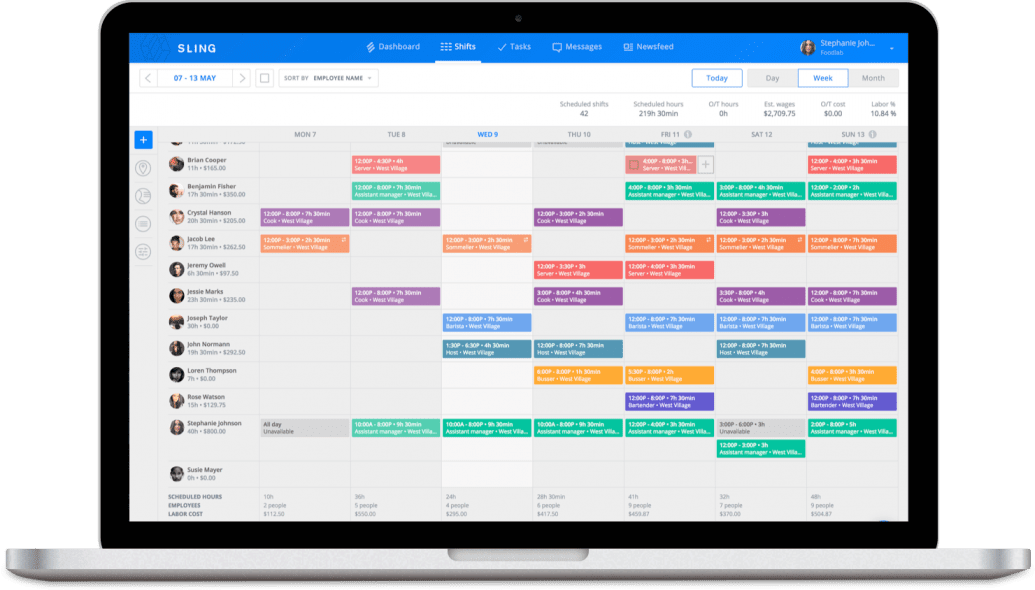

Sling can help you avoid those problems right from the get-go by helping you carve out time in your busy schedule — and in the schedule of your new team member — to make sure all the new employee forms are filled out and filed properly.

Then once the onboarding process is complete, Sling can help you organize every aspect of the way you manage your team. From quickly and easily scheduling even the most complicated shifts to tracking when and where your employees work to controlling labor costs and budgets, Sling is the go-to solution for the busy business manager.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.