Employee Work Scheduling: The Complete Guide for Managers

Improve employee work scheduling to save money and drive success by setting a re...

Learning how to perform a time clock conversion for payroll (a.k.a. converting time card info into payroll hours) is an essential skill that all managers need.

While time clock hardware and software can automate the process from start to finish, it’s extremely helpful if you understand the underlying mechanics of the process so that you can make your payroll as accurate and error-free as possible.

In this article, we take you through the steps for performing a time clock conversion for payroll and then discuss what to do after you have those numbers in hand.

According to the United States Department of Labor (USDOL), payroll hours — also known as work hours — are:

[The] time an employee must be on duty, on the employer premises, or at any other prescribed place of work.

That’s pretty straightforward, right?

The thing about this definition is that, because it comes from a department of the federal government, it makes time cards (in whatever format you have them) legal documents.

As such, the IRS can ask you to produce payroll records going back as far as two years to ensure that you were and are compliant with local, state, and federal labor laws. That’s why it’s important to keep accurate records and retain those records for at least two years.

So, now that you understand what work hours are and why it’s so important to maintain accurate records of those hours, let’s go through how to perform a time clock conversion for payroll.

At the most basic, your employee timecards will come in one of three forms:

In the written system, employees write their start and end times on a sign-in sheet or on a paper timecard. In the printed system, employees insert a paper timecard into a clock that then records the start and end times onto the card.

Lastly, in a digital system, employees input their ID (via PIN, RFID badge, or biometrics) into a computer-based tracking system.

So, you may be dealing with pieces of paper, timecards, numbers on a screen, or some combination of all three. It all depends on the system you have in place for tracking work hours.

With printed and digital tracking, you can usually set the hardware or the software to record time in 24-hour format (e.g., 8:00 and 17:00)

With a written system, you’re more likely to get regular time (e.g., 8:00 and 5:00) unless you train your team to convert to 24-hour time themselves. Regardless, it’s good to know how to make the conversion yourself.

Standard time format is what you see when you look at most clocks: the time from one to twelve. Recording standard time requires the addition of “a.m.” or “p.m.” to differentiate between morning and afternoon.

Twenty-four-hour time counts the morning hours just like the standard format (e.g., 7:24 a.m., 9:11 a.m., 11:47 a.m., etc.). But after 12:59 p.m., 24-hour time begins counting by adding an hour to twelve.

For example, 1:00 p.m. in standard format would be 13:00 in 24-hour time. You’ll notice that you don’t need the “p.m.” to indicate afternoon as you do with standard time format. That’s because the other one o’clock (in the wee hours of the morning) is written 1:00.

From this brief explanation, it may not be obvious, but 24-hour time makes performing a time clock conversion for payroll much easier.

Here’s an example to illustrate the point.

Let’s say Sam clocked in at 9:00 a.m. (standard format) and clocked out at 5:00 p.m. You’re going to have to do some roundabout math to calculate the hours worked since you can’t simply subtract one number from the other and get work hours that make sense.

But, let’s say that Sam clocked in at 9:00 (24-hour format) and clocked out at 17:00. Calculating the hours worked becomes simply a matter of subtracting nine from 17 to get eight.

So, Sam worked eight hours that day.

As we mentioned earlier, 24-hour time shows afternoon and evening hours by adding to 12. That means 1:00 p.m. would be 13:00 (12 + 1), 2:00 p.m. would be 14:00 (12 + 2), and 3:00 p.m. would be 15:00 (12 + 3).

Here’s the full list of conversions for your reference:

1:00 p.m. = 13:00

2:00 p.m. = 14:00

3:00 p.m. = 15:00

4:00 p.m. = 15:00

5:00 p.m. = 17:00

6:00 p.m. = 18:00

7:00 p.m. = 19:00

8:00 p.m. = 20:00

9:00 p.m. = 21:00

10:00 p.m. = 22:00

11:00 p.m. = 23:00

12:00 a.m. = 24:00

After 12:59 a.m., 24-hour time starts over with 1:00 and counts up to 12:00.

Very rarely will all of your employees clock in and out precisely on the hour. There are going to be some people early (e.g., 8:56) and some people late (e.g., 9:02). This is where rounding becomes crucial.

The United States Department of Labor allows businesses to round to the nearest 15-minute increment when making a time clock conversion for payroll. In this system, employee time from one to seven minutes rounds down, while time from eight to fourteen minutes rounds up.

For instance, if Sam clocks in at 08:56 and clocks out at 17:02, he’s worked for eight hours and four minutes. That would round down to a straight eight hours.

If, however, Sam clocks in at 08:58 and clocks out at 17:10, he’s worked for eight hours and twelve minutes. That would round up to eight hours and fifteen minutes.

As with converting from standard to 24-hour format, rounding makes the payroll calculation much easier.

Continuing with the example above, let’s say that Sam worked eight hours and fifteen minutes on Monday. Before you can multiply his work hours by his hourly rate, you’re going to need to convert the minutes to a decimal.

This is because multiplying 15 minutes (or 30 minutes, or 45 minutes) by an hourly rate of $10 gives you 150 (or 300, or 450). That’s an incorrect dollar amount for a fraction of an hour worked. Instead, divide the minutes worked by 60 to get a decimal equivalent.

The nice thing about rounding the minutes to the nearest 15-minute increment is that there are only three options:

15 / 60 = 0.25

30 / 60 = 0.5

45 / 60 = 0.75

Following this calculation through to the end, Sam worked 8.25 hours on Monday. When you multiply that number by his hourly rate, you get $82.50 (8.25 x $10). That’s what your business owes Sam for those hours worked.

If Sam worked one position at one hourly rate all week, you can add up all his time worked for that week and then multiply it by his hourly rate.

For example, let’s say Sam worked 8.25 hours on Monday, 8 hours on Tuesday, 7.75 hours on Wednesday, 7.5 hours on Thursday, and 8.25 hours on Friday, his total for the week would be 39.75 hours.

You can then multiply that number by his hourly rate to get his gross pay for the week (39.75 x $10 = $397.50).

It can be extremely helpful if you understand the underlying mechanics of performing a time clock conversion for payroll, but that doesn’t mean you have to do it manually every time.

With one or two employees, it might not be a problem. But, with any more than that, you’ll need to set aside a large chunk of time to get it all done. Time that could be better spent growing your business.

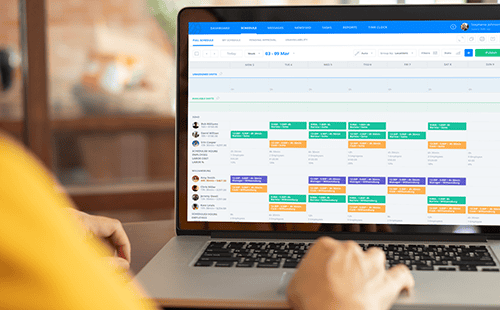

That’s where the Sling software comes in.

With Sling, you set the rules that govern the time clock conversion for payroll (e.g., rounding or no rounding, 24-hour time or regular time), and the app does the rest for you.

As employees record their time using the integrated time clock, Sling crunches the numbers in the blink of an eye. That means less work for you and more accurate data for figuring out the final paycheck.

And, with powerful scheduling tools built in, you’ll be able to see what your business will pay for a shift, a day, a week, or a month or longer as you put it all together.

That’s a valuable time-savings that can help you streamline both the scheduling process at the beginning and the payroll process at the end.

Want to see it for yourself? Try Sling today!

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

See Here For Last Updated Dates: Link

Schedule faster, communicate better, get things done.