Time Theft: What It Is and How to Prevent It

Time theft is a growing epidemic in businesses from California to New York and a...

Employee theft can happen anywhere, anytime, to any business. In this article, the management experts at Sling help you understand employee theft and what you can do to prevent it from happening in your business.

Employee theft is any stealing, use, or misuse of an employer’s assets without permission.

You’ll notice that the above definition does not mention money. The distinction between “assets” and “money” is vital because employee theft involves more than just cash. Common targets for employee theft include:

Each of these items is an asset to your company in one way or another and is vulnerable to theft through various methods.

Skimming is a type of employee theft that occurs before the incoming money or product is recorded in your point-of-sale system. For example, an employee is guilty of skimming if they accept cash as payment and pocket the funds without recording a transaction.

Put simply, larceny is the theft of personal property. In most businesses, an employee is guilty of larceny if they take assets (money, supplies, merchandise) that rightfully belong to the company. An example of this would be a food runner who pulls money out of an open cash register as they walk by.

Embezzlement is similar to larceny but is differentiated by who has permission to handle cash or supplies and who doesn’t. The example of the food runner described above is considered larceny because the employee isn’t normally allowed access to the cash they are stealing (this applies to other assets as well).

A cashier, on the other hand, has permission to handle money. So if they pull cash out of the register and put it in their own pocket during a transaction, they are guilty of embezzlement.

This type of employee theft involves falsifying charges on an expense report and accepting reimbursement for those items.

Proprietary information theft refers to stealing both tangible and intangible assets, such as:

Often, this type of theft is more damaging than simple larceny or embezzlement.

Check tampering occurs in one of two ways:

This type of employee theft, along with several others on the list, is categorized as fraudulent disbursement.

In billing theft, an employee sets up false vendor accounts and bills your company for fraudulent products or services.

In payroll theft, an employee manipulates the amount on their paycheck (or duplicates it completely) in order to deposit more money than they were supposed to be paid.

Prevent employee theft before it ever occurs by conducting a thorough pre-employment screening. Look for red flags during your phone interview and face-to-face interview that might signal a potential for dishonest behavior.

For employees who will be handling money and other assets on a regular basis, you may also want to ask about their credit history.

All employees — regardless of their position — should be subject to a background check with local, state, and federal law enforcement agencies. If they are not willing to submit to a background check, this may be an indication that they have something to hide.

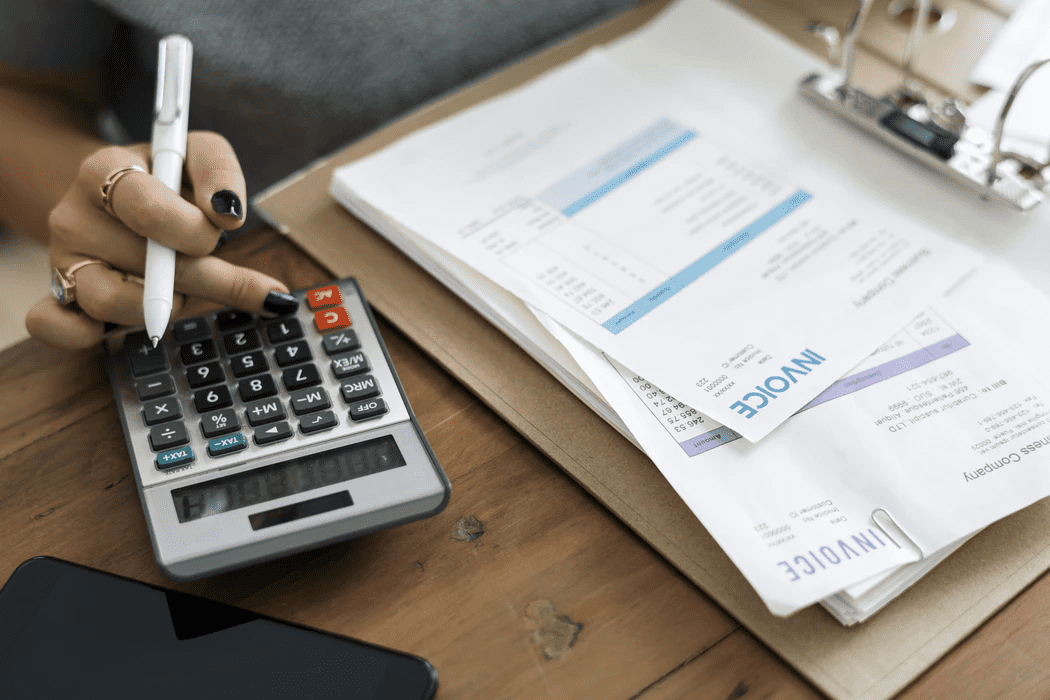

One of the best ways to uncover employee theft before it seriously impacts your bottom line is to hire an outside accountant to review key financial records, such as:

Some businesses conduct an audit like this every day.

Make it clear from day one that you will not tolerate employee theft or unethical behavior in general. A concise code of ethics recorded in your employee handbook is the best place to start. Be prepared to set an example for your employees through your own behavior and conduct.

The easiest way to do this is to ensure that employees work in pairs at all times.

This won’t be possible with every task, but you can implement a second step (e.g., manager approval) into all jobs — such as voiding sales, issuing refunds, maintaining ledgers — so that no one person is responsible for sensitive assets.

One of the best ways to minimize employee theft is through effective workforce management. Workforce management, as the name implies, is everything you do to manage, track, and improve your employees’ productivity.

As we mentioned above, it all starts with the interview and hiring process. From there, workforce management (and minimizing employee theft) extends into all corners of your business to include:

If you want to do everything you can to prevent employee theft, improve your workforce management first.

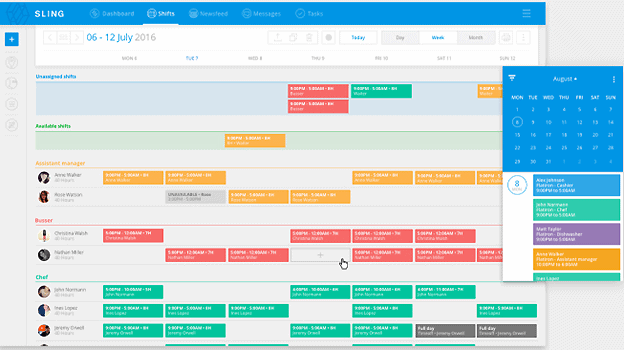

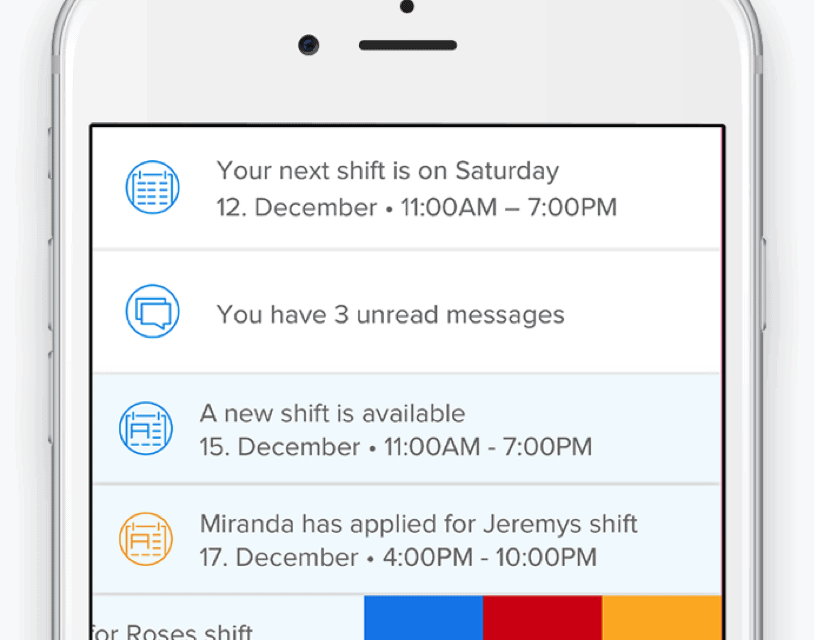

The Sling suite of scheduling and team-management tools is the perfect way to accomplish this. Sling simplifies and streamlines the scheduling, time tracking, labor forecasting, and real-time management processes so that you can focus your energy on more vital parts of your business.

Sling even allows you to:

And that’s only scratching the surface. Try Sling for free to see just how easy it is to better manage your workforce and prevent employee theft.

For more resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.