Restaurant Bookkeeping: A Comprehensive Guide for Managers

Effective restaurant bookkeeping is essential if you want to ensure your operati...

Preparing a restaurant budget yields many benefits. Chief amongst those benefits is the ability to predict operating expenses, spend less than you make, and use profits to grow the business.

Without a restaurant budget, you’re basically flying blind. Yes, you may have a specific destination in mind, but without a budget, you have no way of knowing how much you need to spend and what you need to earn to cover that spending. It’s that important. A restaurant budget—even a very basic one—can get you pointed in the right direction and on your way to every restaurant owner’s or manager’s goal: a profitable business.

But how, exactly, do you go about creating a restaurant budget that works? This article will show you the best way to get started.

The foundation of your budget is numbers. More specifically, tracking those numbers. So you’re going to need to institute some method of recording and organizing said numbers. This can be something as simple as a piece of paper or as complex as a specialized accounting program.

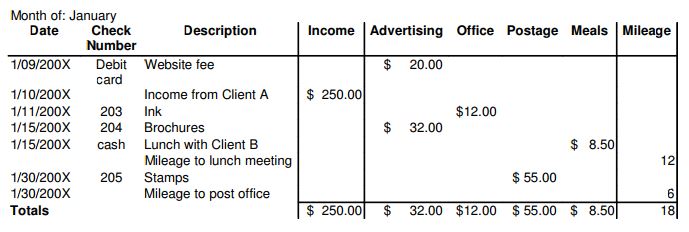

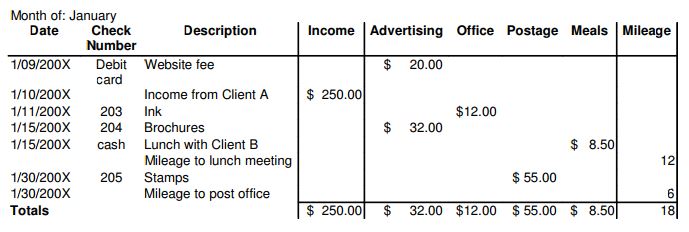

Using your ledger or columnar pad, label the first four columns Date, Payment Method, Description, and Income (see section three for a more in-depth discussion of sales). Those are the absolute basics. If you can get by with just those four sets of numbers, congratulations, your accounting is about as simple as it gets. For the rest of us, we’re going to need a few more columns.

Next to your income, makes columns for all your regular expenses. See the next section for a more in-depth discussion. Common column headings include:

Once you’ve got your columns labeled, you’re ready to go. Income should be recorded in the Income column every time you make a deposit at the bank. For some businesses, that may be every day. For others, that may be every few days, weekly, or even monthly. The frequency with which you make deposits is unimportant. The critical factor is that you record those numbers on your ledger for accurate tracking.

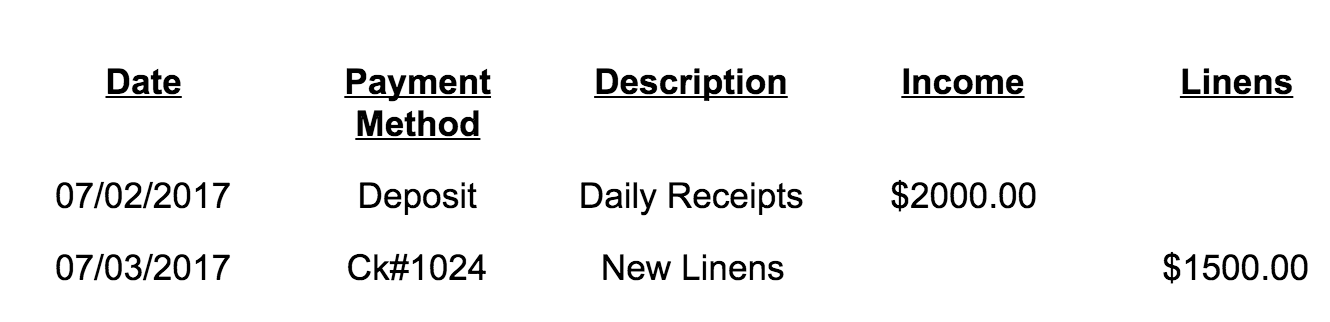

You should also make note of any and all expenses paid out on a daily basis. Whether you pay with cash, check, debit card, or credit card, record the date, payment method and amount in the appropriate column. For example, if your new table linens were delivered on Tuesday and you paid the balance for those items with a check, your ledger entry might look like this:

At the end of every month, add up all your columns to see the total amount you brought in and the total amount for each category of expenses. From these totals, you can see where you need to cut back on expenses in order to operate within your income.

Ledger books and columnar pads are a great way for new managers to gain some exposure to single-entry bookkeeping, but those options can be difficult to reconcile and even more difficult to change should there be mistakes. That’s where computerized record keeping comes in handy.

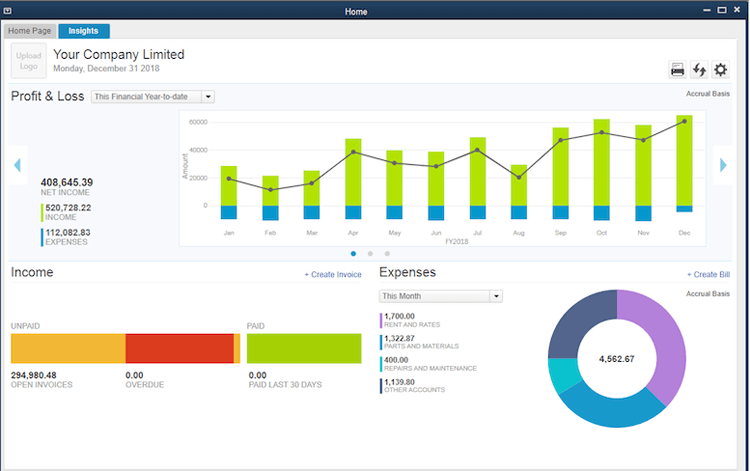

Digital records take the form of a very general spreadsheet program like Microsoft Excel all the way up to a very specific restaurant-focused accounting and budgeting package like QuickBooks For Restaurants. Regardless of the method you choose, you’ll need some way to keep track of things like immediate costs, daily sales, projected expenses, and much more so make sure the software you choose can handle everything.

One of the nice things about computerized bookkeeping is that it is based on the ledgers and columnar pads of yore. The format is the same, as is the process by which you record all your income and expenses. So if you get comfortable with the paper version, the digital version will be a breeze.

The other nice thing about using an app to keep track of your restaurant’s vital numbers is that the app offers a whole host of powerful features that the paper versions do not. Tasks like reporting, tax preparation, and searching are extremely easy with accounting software. As reporting goes, you can transform large columns of numbers that may not mean anything to you at first glance into graphs and tables that reveal the underlying story of your restaurant. In regards to tax preparation, most apps will offer some basic features so you can itemize all your expenses with ease. And if your tax preparer should have some questions about a specific transaction, searching for that entry is only a few keystrokes away. That means no more searching through boxes of receipts to find just the right one.

So if you have very little experience with computers, spreadsheets, and basic accounting software, we recommend starting out with a ledger book or a columnar pad. When you have a bit of experience under your belt, you should transition to a computer-based accounting system as soon as possible. That said, if you’re comfortable with computers, skip the paper and go straight to the software.

Many of the costs (expenses) associated with running a restaurant can be anticipated. You know you’ll have fixed costs that stay pretty much the same from month to month or year to year like insurance and rent or loan payments. You also know you’ll have semi-variable costs that will change from month to month like employee wages and utilities. And you know you’ll have variable costs that will change constantly like supplies and repairs.

Don’t get bogged down in the minutiae of fixed vs. semi-variable vs. variable. Just record what you spend every day, every week, and every month. Then, add up those figures to produce a total costs number for the month. It can also be helpful to take these totals and transfer them to a spreadsheet that lists income and total expenses by month. That way you can see at a glance what happened in any given month, quarter, or year.

Alternatively, you could calculate your totals every two weeks. This works well if you pay your employees bimonthly. Honestly, you can record your costs on whatever timeframe works best for you. Sometimes it’s nice to see what you need to make every day in order to cover your costs. Sometimes you don’t need that amount of precision. It all depends on what you need to get ahold of your restaurant budget.

If you’re just starting out in the restaurant industry, you’ll have to estimate your sales for the week or the month when preparing your restaurant budget. You should have some idea of what that number should be. If you don’t, you’ll need to do some research or look at past numbers if they’re available. In the best of situations, your estimated sales will exceed the costs (expenses) calculated in the step above. If sales don’t exceed costs, that’s the first thing you need to work on.

If you’ve been in business for some time, you likely have some kind of record of sales whether it’s in the form of tax returns, receipts, a ledger, or something else. You can use those numbers as a basis for projecting sales. For example, let’s say you have tax returns for the first two years you were in business. You can take those final numbers (income and expenses) and divide them by twelve to give you a rough idea of what came in and what went out each month. Those monthly numbers can also help you make a “guesstimate” as to what your restaurant might make during the same month next year. That’s a good place to start, but you’re going to need more precision to accurately project sales into the future. For that, you’ll need receipts, a ledger, or a number of years of computerized income-and-expense tracking.

A more accurate sum total of income on a month-by-month basis can show you trends that might not have been apparent with your old method of accounting. For example, when you examine income records for the past three years, you notice that there’s a significant uptick in sales in February and March. A bit of research reveals that this increase in sales is likely driven by the NFL’s big game and the NCAA basketball tournament. Those events aren’t changing anytime soon, so you can pretty confidently predict that February and March of next year will experience that upswing in sales. This allows you to take that expected extra income and plan accordingly. Perhaps you want to schedule some expensive repairs you’ve been putting off or make some updates to the point-of-sale computer system. That predicted extra income will allow you to do that.

Then, regardless of whether you are just starting out or have been in business for awhile, you’re going to need to start tracking sales on a daily, weekly, and monthly basis. This will help you get a handle on inflows versus outflows and show you whether or not you need to cut expenses, whether or not you’re making a profit, what is driving those sales (food or beer or something else), and where you can improve.

One of the many benefits of preparing a restaurant budget is that, if done correctly, it will often tell you specifically where the bulk of your sales are occurring. After examining your numbers, you may notice that you are spending a lot on alcohol. That may reflect that you’re spending too much on this part of your business, but if your income isn’t lagging behind your sales, it may indicate that alcohol is the cornerstone of your income. This insight may reveal ways to push sales even higher. You may decide to expand your beer and hard alcohol offerings. You may decide to include mention of your alcohol offerings in future advertising campaigns, or even to focus on it exclusively. These and many other insights can be revealed when you use the numbers your budget produces to peek under the hood of your restaurant to see what’s really driving sales and costs. That brings us to the next step in the process.

This is where the power of a restaurant budget starts to take shape. When you compare your costs for the month and your sales for the month, it will give you a good idea of the financial condition of your business.

If your goal is profitability (as it should be), you’ll see right away if you’re on target when you put your sales numbers and your cost numbers side by side. Let’s say that your costs for the month are $100,000. Then let’s say that your sales for the month are $90,000. What does that tell you?

It tells you that you may need to make some changes. We say “may” because sometimes large expenses such as a remodel, the purchase of new furniture or an update to your kitchen appliances can push your monthly expenses well past your income. This is okay once in awhile—and, preferably, that extra expense is paid for with savings, but if your regular expenses like food, liquor, wages, and utilities are exceeding your income, it’s time to find ways to make some cuts. That’s where the next step comes in.

When your restaurant budget shows you that there’s a $10,000 difference between your costs and your sales, it’s time to make changes. Those changes could take many different forms and it really depends on what’s right for you.

At the most basic, you have three options:

To increase sales, you may work harder to drive new customers into your restaurant. You may focus on increasing repeat customers. You may even choose to raise your prices slightly or even significantly. This increase in income will help offset the difference between your sales and your cost.

To decrease costs, you may decide to find cheaper alternative sources of food and drink. You may reduce your number of full-time employees and hire more part-time employees. You may decide to change the normal temperature in your restaurant to save on utility bills. You may incorporate all of these changes. You can even get really aggressive and work on both increasing sales AND decreasing costs. Whatever you choose, your goal is to get your sales to cover your costs. That’s the most basic principle of running a business. If you don’t make this a reality fairly quickly, you won’t be in business for very long.

With the work you’ve done so far in getting your restaurant budget together, you’ll be able to quickly see what you need to work on. And once you’ve got your sales covering your costs, your next goal should be to increase profits. Profit is the difference between your sales and your costs. When your costs exceed your sales, you’ve got a deficit (you’re in the red). When your sales exceed your costs, you’ve got a profit (you’re in the black).

When your profits are consistently exceeding your costs, it’s time to start focusing on ways to further separate those numbers. This goes back to many of the same choices you had when you were trying to get sales to cover costs: pull in new customers, drive repeat customers, cut costs, increase prices, the list goes on and on.

Remember that the original purpose of a restaurant—other than great food and great service—is to make a profit. Whatever you can do to make your profits grow while keeping your costs fairly static fulfills that original purpose. One such way to keep your costs under control is to simplify employee scheduling and track how much they work.

Using software is one of the best ways to keep your restaurant budget under control while at the same time working to increase your profits. One of the biggest costs in your budget will likely be wages. Apps like Sling can help with that.

Using Sling serves two primary purposes. First, it helps make scheduling easier. Scheduling employees can be one of the most difficult parts of running a restaurant. It’s extremely time-consuming and can distract you from more important issues that directly affect your employees and customers. In addition, scheduling can be incredibly complex. Even scheduling just five employees can be like trying to wrangle twenty kittens. Employee A can’t work nights because of family commitments. Employee B can’t work before noon because he attends classes in the morning. Employee C can work anytime but she has the next few days off to take her mother to the doctor. And that’s just three employees. Imagine scheduling with ten, twenty, or even fifty employees. Creating a schedule can quickly become a convoluted nightmare.

Thankfully, Sling helps make those parts of the process easier by allowing you to schedule faster using tools like copy and paste, recurring shifts, and color-coded employees. Sling even assists you by notifying you if you’ve overlapped shifts, double-booked someone, or forgot to give them the time off you approved.

Once your schedule is complete, Sling makes it simple to get that schedule into everyone’s hands. Distributing the schedule is as easy as sharing a link with all your employees. That link takes them to a master schedule that reflects any changes you may make. By using this one master document that everyone can view, you cut down on the very real possibility that your employees will get confused as to which version of the schedule is the most recent. The link you supply always takes them to the correct one.

Then, once the schedule has been sent, Sling even sends notifications to employees reminding them when they work or when a shift has become available. This feature helps cut down on no-shows and allows your employees to do their own scheduling of sorts by filling in when some else can’t cover their shift.

The second purpose of the Sling app, is to help you keep wage expenditures under control. Sling does this by helping you monitor over time so that you don’t exceed costs because you accidentally scheduled someone for too much time each week. These apps also help decrease the time it takes for you to get other things done associated with guiding your employees. Sling helps you communicate faster by allowing you to send messages, files, photos, videos, even links to individuals, user-defined groups, of your entire staff with just the push of a button.

That often invisible time savings can add up to significant cost savings and allow you to focus more on keeping your restaurant in the black.

Creating a restaurant budget is an integral part of running a successful business. So too is streamlining the scheduling process and keeping wage expenditures under control. Because these two tasks are crucial for the success of any business, it’s best to make use of both a budgeting/accounting program as well as a scheduling program like Sling.

Used together, these tools can give you detailed insight into the inner workings of your restaurant and powerful control over the costs associated with your employees.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.